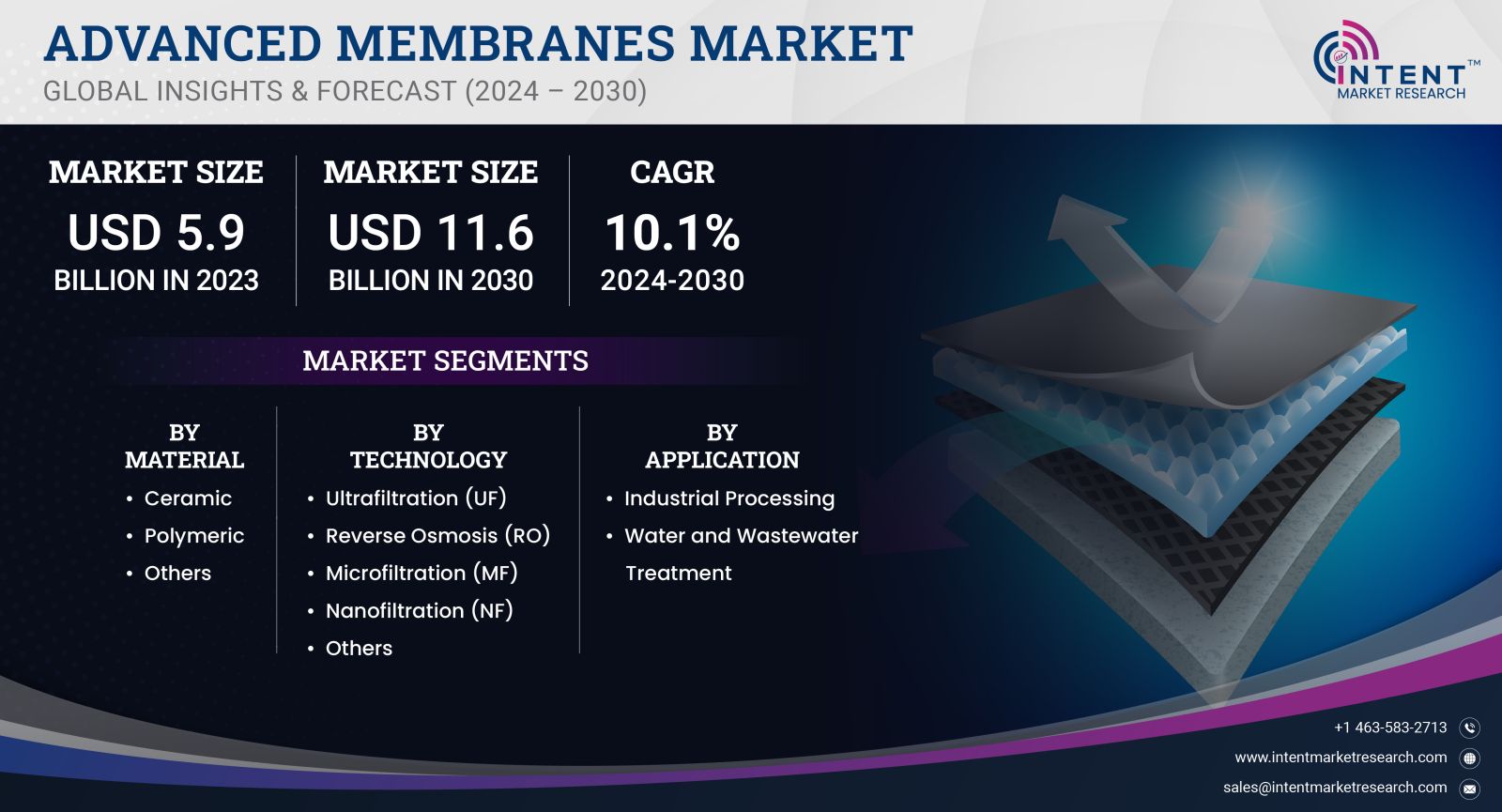

As per Intent Market Research, the Advanced Membranes Market was valued at USD 5.9 billion in 2023-e and will surpass USD 11.6 billion by 2030; growing at a CAGR of 10.1% during 2024 - 2030.

The Advanced Membranes Market has become increasingly significant across various industries, driven by the rising demand for efficient separation, filtration, and purification technologies. Advanced membranes, which are materials designed to selectively separate components of mixtures, play a critical role in sectors such as water treatment, energy production, healthcare, and food processing. These membranes offer superior performance characteristics, such as high permeability, chemical stability, and selectivity, making them ideal for addressing the increasing challenges associated with resource optimization and environmental sustainability.

As of 2024, the market is anticipated to reach a value of USD 6.2 billion and expand to over USD 13 billion by 2030. This robust growth is fueled by increased demand in critical applications such as desalination, wastewater treatment, carbon capture, and biomedical applications. The push for greener technologies and stricter environmental regulations is leading to a rapid adoption of membrane filtration solutions across both emerging and developed markets, driving market momentum globally

Water & Wastewater Treatment Segment is Largest Owing to Expanding Global Water Scarcity Concerns

The Water & Wastewater Treatment segment holds the largest share of the Advanced Membranes market, primarily driven by the increasing global demand for fresh water and the need for effective wastewater treatment solutions. Membranes are used extensively in reverse osmosis (RO), ultrafiltration (UF), and nanofiltration (NF) processes to purify drinking water, treat municipal and industrial wastewater, and desalinate seawater. With the growing scarcity of fresh water, especially in regions such as the Middle East, Asia-Pacific, and Africa, advanced membrane technologies have become integral to ensuring access to clean and safe water for communities and industries.

The demand for advanced membranes in water and wastewater treatment is expected to continue growing as countries increasingly invest in sustainable water management solutions. The rising prevalence of industrial activities, urbanization, and the increasing need for water recycling are pushing utilities to adopt more efficient and cost-effective filtration technologies. As a result, membrane-based systems are becoming the preferred solution due to their ability to offer high performance and relatively lower energy consumption compared to traditional water treatment technologies.

Energy Segment is Fastest Growing Owing to Technological Advancements in Carbon Capture

The Energy segment of the Advanced Membranes market is the fastest growing, fueled by technological advancements in energy production, specifically in carbon capture and storage (CCS) technologies. Membranes are being increasingly used in energy applications, especially for the separation of carbon dioxide (CO2) from flue gas in power plants and industrial processes. This is part of a broader effort to reduce greenhouse gas emissions and meet global climate targets. The energy sector is under immense pressure to minimize its environmental footprint, and membranes offer a cost-effective and energy-efficient solution for CO2 capture compared to traditional methods.

Technological innovations, such as the development of high-performance polymer and inorganic membranes for gas separation, are making these systems more scalable and economically viable for industrial applications. With countries worldwide intensifying their efforts to decarbonize industries and meet the Paris Agreement targets, the adoption of advanced membranes for energy applications is expected to grow rapidly. Additionally, the rising focus on alternative energy sources like hydrogen production is further fueling the demand for membrane technologies in energy applications.

Healthcare & Biomedical Segment is Largest Owing to Expanding Medical Applications

The Healthcare & Biomedical segment is one of the largest in the Advanced Membranes market, driven by the increasing use of membranes in various medical applications, such as dialysis, blood filtration, and drug delivery. Membranes are crucial in medical devices and processes that require selective separation, such as in hemodialysis for kidney patients or in sterile filtration of pharmaceuticals. The growing prevalence of chronic diseases, particularly kidney failure, is contributing to the steady demand for membrane-based medical devices, making this segment one of the most significant in the overall market.

Additionally, advancements in biocompatible materials and improved membrane designs are enabling more efficient and patient-friendly medical treatments. The ongoing aging population worldwide, along with rising healthcare spending, is expected to further boost the demand for membrane technologies in medical applications. As healthcare systems continue to prioritize patient care and safety, the importance of advanced membrane materials in medical diagnostics and therapeutics is expected to increase.

Food & Beverage Segment is Fastest Growing Due to Demand for Cleaner, Safer Production

The Food & Beverage segment is witnessing the fastest growth in the Advanced Membranes market, fueled by the rising demand for high-quality, safe, and efficient food processing solutions. Membranes are widely used in applications such as juice concentration, whey protein filtration, and edible oil refining. Their ability to separate liquids and solids with high precision without using heat is particularly advantageous in preserving the taste, nutritional content, and quality of food products. The growing consumer preference for natural, organic, and minimally processed foods is further driving the adoption of membrane technologies.

The shift towards more sustainable production processes in the food and beverage industry is also a key factor contributing to the rapid growth of this segment. Membranes offer a more energy-efficient alternative to conventional separation processes, which helps reduce waste, improve yield, and lower operational costs. With rising global populations and increasing consumer demands for quality food products, membrane filtration systems are expected to play a pivotal role in shaping the future of the food and beverage processing industry.

Asia-Pacific Region is Fastest Growing Market Owing to Industrialization and Environmental Initiatives

The Asia-Pacific region is the fastest growing market for advanced membranes, driven by rapid industrialization, urbanization, and increasing environmental awareness. Countries such as China, India, Japan, and South Korea are at the forefront of adopting advanced membrane technologies in sectors like water treatment, energy, and manufacturing. The rising levels of air and water pollution, along with growing concerns over resource scarcity, are pushing governments and industries in the region to implement sustainable technologies, such as membrane filtration, to address these challenges.

Additionally, the booming industrial base and expanding middle class in Asia-Pacific are creating a higher demand for consumer goods, healthcare, and clean energy solutions, which further drive the adoption of advanced membranes. The region’s large-scale investments in water desalination projects, energy production, and wastewater treatment are expected to continue fueling market growth in the coming years. With the growing focus on improving environmental sustainability and efficiency, Asia-Pacific is poised to remain the key growth driver for the advanced membranes market.

Competitive Landscape and Leading Companies in the Advanced Membranes Market

The competitive landscape of the Advanced Membranes market is marked by the presence of several established players who are leading the development of innovative membrane technologies. Key companies in the market include DuPont de Nemours, Inc., 3M Company, Toray Industries, Inc., LG Chem Ltd., Hydranautics (A Nitto Denko Company), and Pentair plc. These companies dominate the market by offering a wide range of advanced membrane solutions for applications in water treatment, healthcare, energy, and food processing.

Competition in the market is intensifying as companies focus on technological advancements, strategic partnerships, and expanding their production capabilities to cater to increasing demand. Research and development (R&D) are central to the growth strategies of these companies, with many investing heavily in improving membrane performance, durability, and cost-efficiency. Moreover, the trend towards sustainability is prompting companies to develop membranes made from environmentally friendly materials and pursue circular economy practices, including membrane recycling. The market is expected to see further consolidation as larger players acquire smaller innovators to expand their product portfolios and market reach.

Report Objectives

The report will help you answer some of the most critical questions in the Advanced Membranes Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the advanced membranes market?

- What is the size of the advanced membranes market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa?

- What are the market opportunities for stakeholders after analysing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 5.9 billion |

|

Forecasted Value (2030) |

USD 11.6 billion |

|

CAGR (2024-2030) |

10.1% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Advanced Membranes Market By Technology (Ultrafiltration, Reverse Osmosis, Microfiltration, Nanofiltration), By Material (Ceramic, Polymeric), By Application (Industrial Processing, Water and Wastewater Treatment) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, UAE, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Advanced Membranes Market, by Material (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Ceramic |

|

4.2.Polymeric |

|

4.3.Others |

|

5.Advanced Membranes Market, by Technology (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Ultrafiltration (UF) |

|

5.2.Reverse Osmosis (RO) |

|

5.3.Microfiltration (MF) |

|

5.4.Nanofiltration (NF) |

|

5.5.Others |

|

6.Advanced Membranes Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Industrial Processing |

|

6.2.Water and Wastewater Treatment |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Advanced Membranes Market, by Material |

|

7.2.7.North America Advanced Membranes Market, by Technology |

|

7.2.8.North America Advanced Membranes Market, by Application |

|

*Similar Segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Advanced Membranes Market, by Material |

|

7.3.1.2.US Advanced Membranes Market, by Technology |

|

7.3.1.3.US Advanced Membranes Market, by Application |

|

7.3.2.Canada |

|

7.3.3.Mexico |

|

*Similar Segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8. Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.3M |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Asahi Kasei Corporation |

|

9.3.Cembrane A/S |

|

9.4.DuPont |

|

9.5.Kovalus Separation Solutions |

|

9.6.LG Chem |

|

9.7.Membranium |

|

9.8.Pall Corporation |

|

9.9.Qua Group LLC |

|

9.10.TORAY Industries |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyse data on the Advanced Membranes Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to measure the impact of them on the advanced membranes market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the advanced membranes ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the advanced membranes market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA