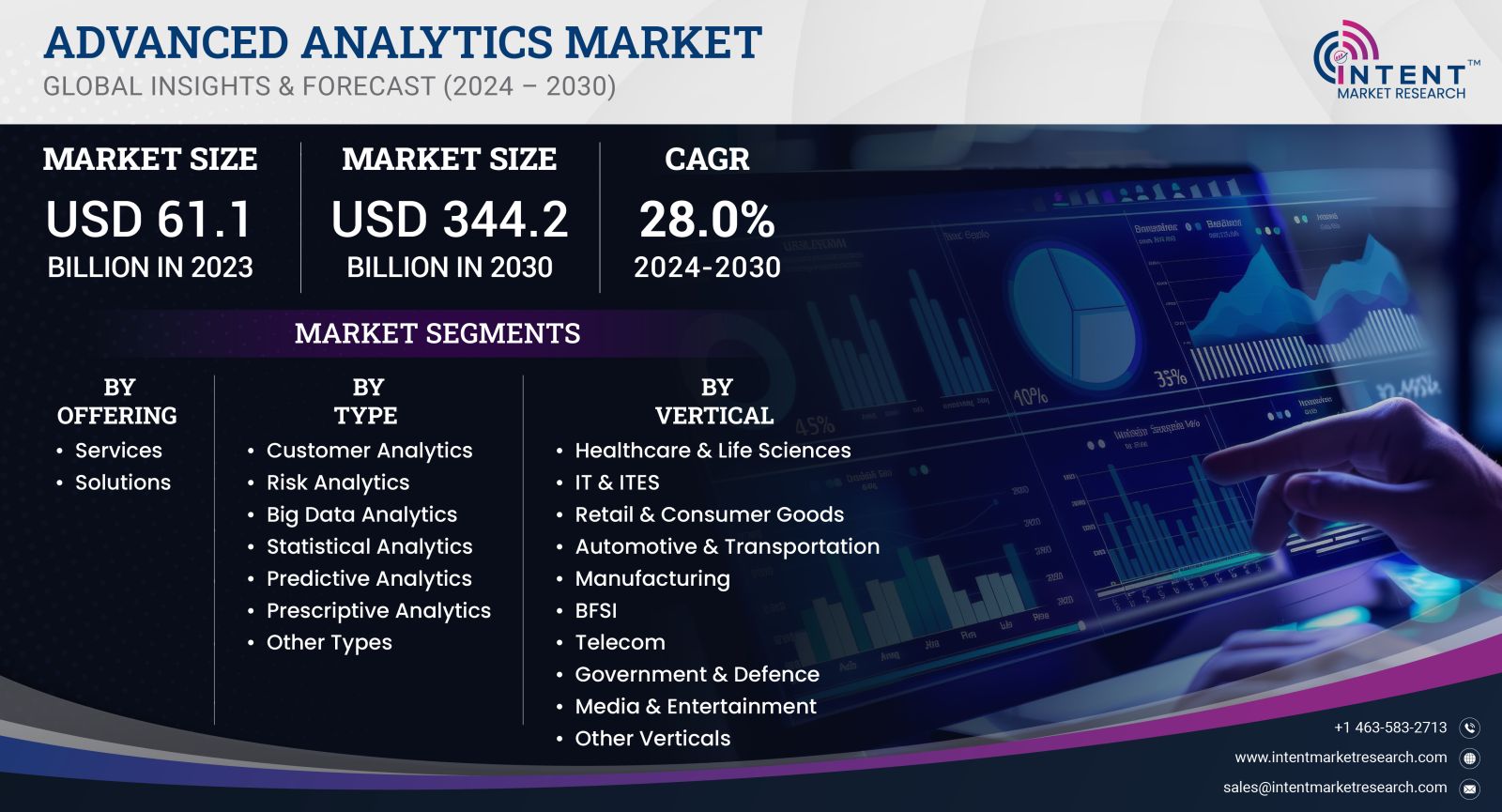

As per Intent Market Research, the Advanced Analytics Market was valued at USD 61.1 billion in 2023-e and will surpass USD 344.2 billion by 2030; growing at a CAGR of 28.0% during 2024 - 2030.

The Advanced Analytics Market has emerged as a critical component of the global business intelligence landscape, facilitating data-driven decision-making across various industries. Leveraging advanced techniques such as machine learning, predictive analytics, and big data technologies, organizations are increasingly adopting these analytics solutions to gain deeper insights into their operations, customer behaviors, and market trends. With the exponential growth of data generated by businesses and consumers alike, the need for sophisticated analytics tools that can process vast amounts of information efficiently is paramount.

Descriptive Analytics Segment is Largest Owing to Its Proven Applications

Among the various segments within the advanced analytics market, the Descriptive Analytics segment stands out as the largest. Descriptive analytics focuses on historical data analysis to provide insights into past performance, helping businesses understand what has happened in their operations. This segment has proven applications in industries such as retail, finance, and healthcare, where organizations utilize descriptive analytics to track key performance indicators (KPIs), analyze sales trends, and monitor customer engagement metrics. The ability to summarize large datasets into understandable reports makes descriptive analytics a preferred choice for organizations seeking to enhance operational efficiency and drive strategic initiatives.

As more businesses recognize the value of data-driven insights, the demand for descriptive analytics tools is on the rise. Companies are investing in technologies that offer intuitive dashboards, data visualization capabilities, and real-time reporting features. This growing demand is further fueled by the increasing adoption of cloud-based solutions, allowing organizations to access advanced analytics tools without the need for significant upfront investments in infrastructure. Consequently, the Descriptive Analytics segment is expected to maintain its dominant position in the advanced analytics market through 2030, with continued advancements in technology driving further growth.

Predictive Analytics Segment is Fastest Growing Owing to Its Actionable Insights

The Predictive Analytics segment is recognized as the fastest-growing area within the advanced analytics market, largely due to its ability to provide actionable insights for future decision-making. By leveraging historical data and statistical algorithms, predictive analytics enables organizations to forecast trends, identify potential risks, and uncover hidden patterns in consumer behavior. This segment is particularly valuable in sectors such as finance, healthcare, and marketing, where accurate predictions can lead to better strategic planning and resource allocation.

As organizations strive for competitive advantages, the adoption of predictive analytics is becoming increasingly prevalent. Companies are implementing machine learning algorithms and data mining techniques to enhance their predictive capabilities, resulting in improved customer targeting, optimized supply chain management, and effective risk assessment. This surge in interest is evidenced by a projected CAGR of approximately 28% for the Predictive Analytics segment during the forecast period. With continuous advancements in AI and machine learning technologies, predictive analytics is set to transform how businesses operate, making it a vital investment for organizations aiming to stay ahead in an increasingly data-driven landscape.

Prescriptive Analytics Segment is Largest Owing to its Strategic Value

The Prescriptive Analytics segment is characterized by its strategic value, enabling organizations to make data-informed decisions based on predictive insights. This segment utilizes advanced techniques such as optimization algorithms and simulation models to recommend actions that can lead to desired outcomes. Businesses in sectors like logistics, healthcare, and finance are increasingly leveraging prescriptive analytics to enhance operational efficiency, reduce costs, and improve customer satisfaction.

The demand for prescriptive analytics solutions is rising due to their ability to address complex business challenges. Companies are harnessing these tools to optimize supply chain operations, streamline resource allocation, and enhance risk management strategies. The ability to evaluate multiple scenarios and recommend optimal courses of action makes prescriptive analytics indispensable for organizations looking to achieve operational excellence. As the need for data-driven decision-making intensifies, the Prescriptive Analytics segment is expected to continue its growth trajectory, solidifying its position as a key player in the advanced analytics market.

Text Analytics Segment is Fastest Growing Owing to Its Growing Demand for Unstructured Data Analysis

Text Analytics is rapidly emerging as the fastest-growing segment within the advanced analytics market, primarily driven by the increasing demand for analyzing unstructured data. With the proliferation of social media, customer reviews, and digital communications, organizations are inundated with vast amounts of text data. Text analytics employs natural language processing (NLP) and machine learning techniques to extract valuable insights from this unstructured information, helping businesses understand customer sentiments, preferences, and trends.

The ability to derive actionable insights from text data is becoming crucial for organizations across industries. Businesses are increasingly utilizing text analytics to enhance customer engagement, improve brand reputation, and drive marketing strategies. As companies recognize the strategic importance of customer feedback and sentiment analysis, the Text Analytics segment is projected to witness a remarkable CAGR of around 30% through 2030. This growth is indicative of the growing reliance on advanced analytics to navigate complex consumer landscapes and make informed business decisions.

Visual Analytics Segment is Largest Owing to Its Impact on Data Interpretation

The Visual Analytics segment holds a prominent position in the advanced analytics market due to its impact on data interpretation and storytelling. Visual analytics transforms complex data sets into visually compelling representations, enabling stakeholders to grasp insights quickly and effectively. This segment is widely adopted across industries, including finance, retail, and healthcare, where decision-makers require intuitive visualizations to drive strategic initiatives.

Organizations are increasingly recognizing the importance of data visualization tools that allow for interactive dashboards and real-time data exploration. These capabilities empower users to delve into the data, uncover trends, and make informed decisions based on visual cues rather than extensive reports. As the demand for visually engaging analytics tools grows, the Visual Analytics segment is expected to continue flourishing, reinforcing its status as a key driver of innovation within the advanced analytics market.

The North America Region is Largest Owing to Its Technological Advancements

The North America region is the largest market for advanced analytics, primarily owing to its technological advancements and strong presence of key players. The region boasts a robust ecosystem of technology providers, data-driven organizations, and research institutions that are continually pushing the boundaries of analytics capabilities. The adoption of advanced analytics solutions is widespread across various industries, including healthcare, finance, and retail, where organizations seek to leverage data for improved decision-making.

Additionally, the increasing focus on digital transformation initiatives among businesses in North America has further propelled the growth of the advanced analytics market. Organizations are investing in cloud-based analytics platforms and AI-driven tools to enhance their analytical capabilities. The region is also home to several leading companies specializing in advanced analytics solutions, contributing to its position as a market leader. As organizations continue to prioritize data-driven strategies, North America is expected to maintain its dominance in the advanced analytics market throughout the forecast period.

Competitive Landscape of the Advanced Analytics Market

The competitive landscape of the advanced analytics market is characterized by the presence of several key players striving to innovate and enhance their offerings. Major companies such as IBM, SAS Institute, Microsoft, and Oracle dominate the market, each providing a range of advanced analytics solutions tailored to various industry needs. These companies are focusing on strategic partnerships, mergers, and acquisitions to expand their product portfolios and strengthen their market positions.

Additionally, the rise of startups and niche players specializing in advanced analytics tools is contributing to a dynamic competitive environment. These emerging companies are often agile and focused on specific industry verticals, allowing them to address unique challenges faced by businesses. As the advanced analytics market continues to evolve, organizations will need to stay vigilant in adapting to technological advancements and competitive pressures to maintain their edge in this rapidly changing landscape.

Report Objectives:

The report will help you answer some of the most critical questions in the Advanced Analytics Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the advanced analytics market?

- What is the size of the advanced analytics market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Middle East, and Rest of the World?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 61.1 billion |

|

Forecasted Value (2030) |

USD 344.2 billion |

|

CAGR (2024-2030) |

28.0% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Advanced Analytics Market By Offering (Solutions, Services), By Type (Big Data Analytics, Predictive Analytics, Customer Analytics, Statistical Analytics), By Vertical (Healthcare & Life Sciences, IT & ITES, Automotive & Transportation, Manufacturing, BFSI, Telecom, Government & Defense) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Advanced Analytics Market, by Offering (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Services |

|

4.2.Solutions |

|

5.Advanced Analytics Market, by Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Customer Analytics |

|

5.2.Risk Analytics |

|

5.3.Big Data Analytics |

|

5.4.Statistical Analytics |

|

5.5.Predictive Analytics |

|

5.6.Prescriptive Analytics |

|

5.7.Other Types |

|

6.Advanced Analytics Market, by Vertical (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Healthcare & Life Sciences |

|

6.2.IT & ITES |

|

6.3.Retail & Consumer Goods |

|

6.4.Automotive & Transportation |

|

6.5.Manufacturing |

|

6.6.BFSI |

|

6.7.Telecom |

|

6.8.Government & Defence |

|

6.9.Media & Entertainment |

|

6.10.Other Verticals |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Advanced Analytics Market, by Offering |

|

7.2.7.North America Advanced Analytics Market, by Type |

|

7.2.8.North America Advanced Analytics Market, by Vertical |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Advanced Analytics Market, by Offering |

|

7.3.1.2.US Advanced Analytics Market, by Type |

|

7.3.1.3.US Advanced Analytics Market, by Vertical |

|

7.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.7.Latin America |

|

7.8.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.IBM |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Alphabet |

|

9.3.Oracle |

|

9.4.Microsoft |

|

9.5.SAP |

|

9.6.Fico |

|

9.7.Knime |

|

9.8.Altair |

|

9.9.AWS |

|

9.10.SAS Institute |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Advanced Analytics Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the advanced analytics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the advanced analytics ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the advanced analytics market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA