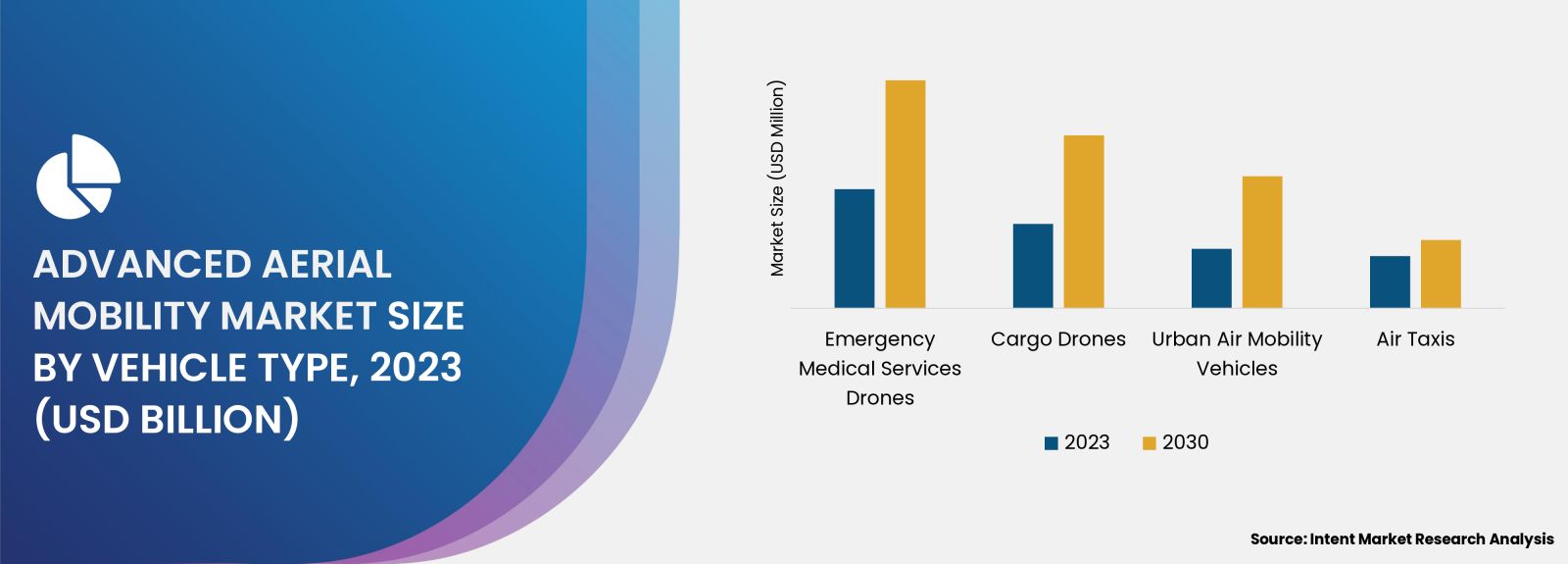

As per Intent Market Research, the Advanced Aerial Mobility (AAM) Market was valued at USD 13.3 billion in 2023 and will surpass USD 52.1 billion by 2030; growing at a CAGR of 21.6% during 2024 - 2030.

The Advanced Aerial Mobility (AAM) market is rapidly evolving, driven by technological innovations, regulatory advancements, and increasing urbanization. AAM encompasses a range of aerial transportation solutions, including urban air mobility (UAM), cargo drones, and electric vertical takeoff and landing (eVTOL) aircraft. As cities become increasingly congested, the need for efficient, sustainable transportation solutions has never been more critical.

Urban Air Mobility Segment is Fastest Growing Owing to Increased Demand for Efficient Transportation

Among the various segments within the Advanced Aerial Mobility market, Urban Air Mobility (UAM) stands out as the fastest-growing subsegment. UAM involves the use of air transportation systems designed to transport passengers and cargo within urban areas. The demand for UAM solutions is surging due to rising urbanization, traffic congestion, and the need for quick, reliable transportation options. Cities worldwide are investing in UAM infrastructure, such as vertiports and air traffic management systems, to facilitate the seamless integration of aerial vehicles into urban settings. The rapid advancements in electric aircraft technology further support UAM growth, promising to provide eco-friendly alternatives to traditional ground transportation.

Moreover, the anticipated launch of various eVTOL aircraft by leading manufacturers has generated considerable excitement in the UAM sector. Companies are focused on developing vehicles that are not only efficient and cost-effective but also meet stringent safety standards. The regulatory frameworks are evolving to accommodate these innovations, allowing for the gradual rollout of UAM services in select urban markets. With the potential to revolutionize the way people navigate cities, UAM is poised for explosive growth, attracting investments and interest from both public and private sectors.

Cargo Drones Segment is Largest Owing to Rising E-commerce Demand

In the Advanced Aerial Mobility market, the Cargo Drones segment emerges as the largest owing to the increasing demand for efficient and timely delivery solutions driven by the burgeoning e-commerce sector. As online shopping continues to gain traction, businesses are seeking innovative ways to meet customer expectations for faster deliveries. Cargo drones offer a promising solution by enabling rapid transportation of goods over short to medium distances, significantly reducing delivery times and operational costs.

Additionally, various industries are exploring the potential of cargo drones for logistical purposes, including healthcare, agriculture, and retail. For instance, the use of drones for medical supply delivery in remote areas has garnered attention, highlighting their versatility and impact on public health initiatives. Companies are investing heavily in drone technology to enhance payload capacities and operational ranges, further solidifying the position of cargo drones as a key player in the AAM market. This growth trajectory is supported by favorable regulatory developments, paving the way for more widespread commercial applications.

Electric Vertical Takeoff and Landing Aircraft Segment is Fastest Growing Owing to Technological Advancements

The Electric Vertical Takeoff and Landing (eVTOL) Aircraft segment is the fastest-growing subsegment within the Advanced Aerial Mobility market, primarily due to rapid advancements in electric propulsion technology and battery systems. eVTOL aircraft are designed to operate in urban environments, offering a flexible and efficient mode of transportation for both passengers and cargo. The development of advanced battery technologies has significantly enhanced the range and performance of eVTOL aircraft, making them increasingly viable for commercial applications.

Moreover, the growing focus on sustainability in transportation has propelled interest in eVTOL solutions. With their potential to reduce greenhouse gas emissions compared to traditional combustion-engine aircraft, eVTOLs align well with global sustainability goals. Leading aerospace manufacturers are heavily investing in eVTOL projects, aiming to bring these aircraft to market in the coming years. The anticipated introduction of eVTOL services for urban commuting and air taxi operations is expected to reshape the aviation landscape, driving significant growth in this subsegment.

Autonomous Aerial Vehicles Segment is Largest Owing to Technological Integration

The Autonomous Aerial Vehicles (AAV) segment within the Advanced Aerial Mobility market is recognized as the largest, owing to the integration of artificial intelligence (AI) and machine learning (ML) technologies in vehicle operations. AAVs are capable of operating without human intervention, enabling a range of applications from passenger transport to cargo delivery. The growing emphasis on automation and efficiency is propelling the demand for autonomous solutions across various sectors, including logistics, agriculture, and surveillance.

The ongoing advancements in sensor technology and data analytics have significantly enhanced the safety and reliability of AAVs. This has led to increased adoption in commercial applications, where companies are leveraging autonomous systems to optimize operational efficiency and reduce labor costs. Furthermore, regulatory bodies are beginning to establish frameworks to facilitate the integration of AAVs into existing airspace, which is expected to drive further growth in this segment. The convergence of technological innovations and regulatory support positions the AAV segment as a cornerstone of the Advanced Aerial Mobility market.

Asia-Pacific Region is Fastest Growing Owing to Increasing Urbanization and Investment

The Asia-Pacific region is poised to become the fastest-growing market for Advanced Aerial Mobility, driven by rapid urbanization, increasing investments in infrastructure, and a burgeoning technology ecosystem. Countries such as China, Japan, and India are at the forefront of exploring AAM solutions to address urban congestion and enhance transportation efficiency. The region's governments are actively investing in developing the necessary infrastructure, including vertiports and air traffic management systems, to support the implementation of aerial mobility solutions.

Moreover, the Asia-Pacific region is home to a vibrant startup ecosystem that is innovating in the AAM space, particularly in the development of eVTOL aircraft and autonomous delivery drones. The strong emphasis on technological advancements, coupled with supportive government policies, is creating a conducive environment for the growth of the AAM market in this region. As cities in Asia-Pacific continue to expand, the demand for efficient aerial mobility solutions is expected to increase significantly, making this region a focal point for industry stakeholders.

.jpg)

Competitive Landscape and Leading Companies

The competitive landscape of the Advanced Aerial Mobility market is characterized by a mix of established aerospace companies and emerging startups. Key players include industry giants such as Boeing, Airbus, and Bell Helicopter, which are leveraging their extensive experience in aviation to develop innovative AAM solutions. Additionally, companies like Joby Aviation, Archer Aviation, and Lilium are at the forefront of developing eVTOL aircraft, showcasing the potential of new entrants in this rapidly evolving market.

The market is also witnessing strategic partnerships and collaborations aimed at accelerating technological advancements and enhancing operational capabilities. Companies are focusing on research and development to refine their product offerings and meet the growing demand for aerial mobility solutions. As the market evolves, competition is expected to intensify, driven by the need for innovation, efficiency, and sustainability in aerial transportation. The diverse array of players highlights the dynamic nature of the AAM market, positioning it for continued growth and transformation in the coming years.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 13.3 billion |

|

Forecasted Value (2030) |

USD 52.1 billion |

|

CAGR (2024 – 2030) |

21.6% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Advanced Aerial Mobility Market By Vehicle Type (Air Taxis, Cargo Drones, Urban Air Mobility Vehicles, Emergency Medical Services Drones), By Technology (Electric Vertical Take-Off and Landing (eVTOL), Hybrid VTOL, Traditional Aviation), By Application (Passenger Transportation, Cargo Transportation, Emergency Services, Military & Defense, Surveillance & Monitoring) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Advanced Aerial Mobility Market, by Vehicle Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Air Taxis |

|

4.2. Cargo Drones |

|

4.3. Urban Air Mobility (UAM) Vehicles |

|

4.4. Emergency Medical Services (EMS) Drones |

|

5. Advanced Aerial Mobility Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Electric Vertical Take-Off and Landing (eVTOL) |

|

5.2. Hybrid VTOL |

|

5.3. Traditional Aviation |

|

6. Advanced Aerial Mobility Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Passenger Transportation |

|

6.2. Cargo Transportation |

|

6.3. Emergency Services |

|

6.4. Military & Defense |

|

6.5. Surveillance & Monitoring |

|

6.6. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Advanced Aerial Mobility Market, by Vehicle Type |

|

7.2.7. North America Advanced Aerial Mobility Market, by Technology |

|

7.2.8. North America Advanced Aerial Mobility Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Advanced Aerial Mobility Market, by Vehicle Type |

|

7.2.9.1.2. US Advanced Aerial Mobility Market, by Technology |

|

7.2.9.1.3. US Advanced Aerial Mobility Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. AIRBUS |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. AURORA FLIGHT SCIENCES |

|

9.3. Bell Textron Inc. |

|

9.4. The Boeing Company |

|

9.5. EHang |

|

9.6. Embraer |

|

9.7. Joby Aviation |

|

9.8. Lilium GmbH |

|

9.9. Opener, Inc. |

|

9.10. Terrafugia |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Advanced Aerial Mobility Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Advanced Aerial Mobility Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Advanced Aerial Mobility ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Advanced Aerial Mobility Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

.jpg)