Adipic Acid Market By Production Process (Biotechnological Method, Chemical Synthesis), By Source (Synthetic, Bio-based), By Form (Solid, Liquid), By Application (Nylon 6,6 Production, Polyurethane Production, Food Additives, Coatings & Adhesives), By End-Use Industry (Automotive, Textile & Apparel, Electronics & Electrical, Construction), and By Region; Global Insights & Forecast (2024 – 2030)

As per Intent Market Research, the Adipic Acid Market was valued at USD 6.8 billion in 2023 and will surpass USD 10.3 billion by 2030; growing at a CAGR of 6.2% during 2024 - 2030.

The adipic acid market has witnessed significant expansion driven by its critical role in the production of a variety of industrial materials, most notably nylon 6,6, which is used in textiles, automotive parts, and electronics. As a key chemical intermediate, adipic acid plays a vital role in the manufacture of polyurethane, food additives, coatings, adhesives, and numerous other applications. The growing demand for high-performance materials in industries such as automotive, textile, electronics, and construction is fueling the increased consumption of adipic acid. Additionally, environmental considerations and the drive for sustainable solutions have led to innovations in bio-based production methods, creating a more diverse and environmentally conscious market landscape.

As industries seek to improve product performance while minimizing environmental impact, the adipic acid market is evolving. The market is being driven by the continuous advancement of production technologies, particularly the shift towards bio-based adipic acid. The demand for both solid and liquid forms of adipic acid continues to rise as manufacturers look for versatile and cost-effective chemical solutions. With substantial applications across various end-use industries, the adipic acid market is positioned for long-term growth, with companies working to meet evolving regulatory standards, increase sustainability, and capitalize on new emerging applications.

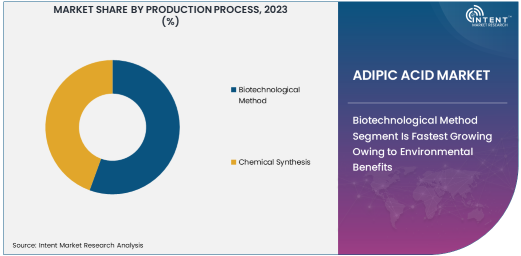

Biotechnological Method Segment Is Fastest Growing Owing to Environmental Benefits

The biotechnological method of adipic acid production is the fastest growing segment in the market, owing to the significant environmental advantages it offers over traditional chemical synthesis. The biotechnological process, which typically involves the use of renewable biomass or microorganisms, results in lower carbon emissions and reduced energy consumption. This method aligns with the growing global emphasis on sustainable and green chemistry solutions, especially as industries strive to meet stricter environmental regulations. As concerns regarding carbon footprints and the environmental impact of traditional production processes grow, the biotechnological method presents a promising alternative for the production of adipic acid.

The shift towards biotechnological methods is not only driven by environmental considerations but also by advancements in microbial fermentation and enzyme engineering, which are making the process more cost-effective and scalable. These innovations are expected to accelerate the adoption of biotechnological adipic acid production, making it the fastest growing segment in the market as manufacturers look to meet the rising demand for sustainable chemicals while addressing environmental challenges.

Synthetic Source Segment Is Largest Owing to Cost-Effectiveness and Established Infrastructure

The synthetic source segment dominates the adipic acid market, owing to the established infrastructure for its production and the cost-effectiveness of the process. Synthetic adipic acid is produced primarily through the chemical synthesis of cyclohexane, a widely available petrochemical. This method has been the traditional approach for producing adipic acid and remains the most common due to its scalability and relatively lower cost compared to bio-based alternatives. The synthetic method also benefits from well-established production facilities and supply chains, making it a reliable source for large-scale industrial use, particularly in the automotive, textile, and electronics industries.

Despite the growing interest in bio-based production, the synthetic method remains the dominant source of adipic acid due to its lower production costs and more mature technological infrastructure. The widespread use of synthetic adipic acid across various applications, from nylon 6,6 to coatings and adhesives, continues to make it the largest segment in the market.

Nylon 6,6 Production Application Is Largest Owing to High Demand from Automotive and Textile Industries

The nylon 6,6 production application is the largest in the adipic acid market, driven by its widespread use in the automotive and textile industries. Nylon 6,6, a high-performance polymer, is essential in the manufacture of automotive parts such as gears, bearings, and under-the-hood components due to its strength, heat resistance, and durability. Additionally, it is a key material in the textile industry, used in the production of clothing, carpets, and industrial fabrics. The growing demand for lightweight, durable, and high-performance materials in automotive manufacturing, coupled with the expanding textile market, has solidified the dominance of nylon 6,6 production as the primary application for adipic acid.

As the automotive industry continues to evolve with the introduction of electric vehicles and advancements in manufacturing processes, the need for high-performance materials like nylon 6,6 will continue to rise, further driving the demand for adipic acid. The diverse applications of nylon 6,6 across various industries ensure that this segment will remain the largest application for adipic acid for the foreseeable future.

Automotive End-Use Industry Is Largest Owing to High Demand for Lightweight and Durable Materials

The automotive industry is the largest end-use industry in the adipic acid market, driven by the increasing demand for lightweight, durable, and high-performance materials. Adipic acid is a key ingredient in the production of nylon 6,6, which is widely used in automotive components such as interior parts, exterior panels, and under-the-hood applications. The automotive sector continues to demand materials that offer a combination of strength, heat resistance, and reduced weight to improve fuel efficiency and performance. The use of adipic acid in the production of nylon 6,6 aligns with these requirements, making it an essential material for the automotive industry.

As the automotive market increasingly focuses on electric vehicles (EVs) and fuel-efficient solutions, the demand for lightweight, high-strength materials will continue to grow, ensuring the automotive industry's dominance as the largest end-use sector for adipic acid. Additionally, the shift towards more sustainable and recyclable materials in automotive manufacturing will further increase the reliance on high-performance polymers such as nylon 6,6, maintaining the automotive industry's leading role in driving market growth.

Asia Pacific Is Fastest Growing Region Owing to Rapid Industrialization and Rising Automotive Demand

The Asia Pacific region is the fastest growing in the adipic acid market, driven by rapid industrialization, increasing automotive production, and a growing textile and electronics sector. Countries such as China, India, and Japan are major consumers of adipic acid, with China being the largest producer and consumer globally. The expanding manufacturing base in the region, particularly in automotive and textile production, is fueling the demand for adipic acid. Additionally, the rise of middle-class populations in countries like India and China is driving the consumption of goods that require adipic acid, such as clothing, automotive parts, and electronics.

The Asia Pacific region's strong economic growth, coupled with its expanding industrial capabilities and increasing demand for high-performance materials, positions it as the fastest growing market for adipic acid. As the region continues to industrialize and invest in manufacturing capabilities, the demand for adipic acid is expected to rise, further cementing Asia Pacific's role in the global market.

Leading Companies and Competitive Landscape

The competitive landscape of the adipic acid market is characterized by a mix of established chemical manufacturers and emerging players focusing on sustainability. Leading companies such as BASF SE, DSM, and Solvay SA dominate the market with large-scale production facilities and extensive distribution networks. These companies are continually investing in research and development to improve production processes, reduce environmental impacts, and meet the growing demand for bio-based adipic acid.

In addition to the traditional chemical giants, smaller companies and startups are making their mark by developing more sustainable and cost-effective production methods, particularly in the bio-based adipic acid sector. These players are focusing on innovations in microbial fermentation and enzymatic processes to make bio-based adipic acid more commercially viable. As the market continues to evolve, competition will intensify as companies strive to meet both environmental standards and consumer demand for high-performance materials at competitive prices.

Recent Developments:

- In December 2024, BASF announced its new bio-based adipic acid plant, aiming to reduce the carbon footprint of its production processes.

- In November 2024, Invista launched a new line of polyamide products made with more sustainable adipic acid sourced from renewable materials.

- In October 2024, DSM expanded its adipic acid production capacity in response to increased demand from the automotive sector.

- In September 2024, Covestro AG developed a new technology to reduce energy consumption in the adipic acid production process.

- In August 2024, Honeywell International introduced an advanced catalytic process for adipic acid production, lowering emissions and improving efficiency.

List of Leading Companies:

- DSM

- Invista

- BASF

- Covestro AG

- Honeywell International

- Mitsui Chemicals

- LyondellBasell Industries

- Ube Industries

- Asahi Kasei Corporation

- Rhodia

- FMC Corporation

- LG Chem

- SABIC

- Shin-Etsu Chemical

- Eastman Chemical Company

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 6.8 billion |

|

Forecasted Value (2030) |

USD 10.3 billion |

|

CAGR (2024 – 2030) |

6.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Adipic Acid Market By Production Process (Biotechnological Method, Chemical Synthesis), By Source (Synthetic, Bio-based), By Form (Solid, Liquid), By Application (Nylon 6,6 Production, Polyurethane Production, Food Additives, Coatings & Adhesives), By End-Use Industry (Automotive, Textile & Apparel, Electronics & Electrical, Construction) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

DSM, Invista, BASF, Covestro AG, Honeywell International, Mitsui Chemicals, LyondellBasell Industries, Ube Industries, Asahi Kasei Corporation, Rhodia, FMC Corporation, LG Chem, SABIC, Shin-Etsu Chemical, Eastman Chemical Company |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Adipic Acid Market, by Production Process (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Biotechnological Method |

|

4.2. Chemical Synthesis |

|

5. Adipic Acid Market, by Source (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Synthetic |

|

5.2. Bio-based |

|

6. Adipic Acid Market, by Form (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Solid |

|

6.2. Liquid |

|

7. Adipic Acid Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Nylon 6,6 Production |

|

7.2. Polyurethane Production |

|

7.3. Food Additives |

|

7.4. Coatings & Adhesives |

|

7.5. Others |

|

8. Adipic Acid Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Automotive |

|

8.2. Textile & Apparel |

|

8.3. Electronics & Electrical |

|

8.4. Construction |

|

8.5. Others |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Adipic Acid Market, by Production Process |

|

9.2.7. North America Adipic Acid Market, by Source |

|

9.2.8. North America Adipic Acid Market, by Form |

|

9.2.9. North America Adipic Acid Market, by Application |

|

9.2.10. North America Adipic Acid Market, by End-Use Industry |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Adipic Acid Market, by Production Process |

|

9.2.11.1.2. US Adipic Acid Market, by Source |

|

9.2.11.1.3. US Adipic Acid Market, by Form |

|

9.2.11.1.4. US Adipic Acid Market, by Application |

|

9.2.11.1.5. US Adipic Acid Market, by End-Use Industry |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. DSM |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Invista |

|

11.3. BASF |

|

11.4. Covestro AG |

|

11.5. Honeywell International |

|

11.6. Mitsui Chemicals |

|

11.7. LyondellBasell Industries |

|

11.8. Ube Industries |

|

11.9. Asahi Kasei Corporation |

|

11.10. Rhodia |

|

11.11. FMC Corporation |

|

11.12. LG Chem |

|

11.13. SABIC |

|

11.14. Shin-Etsu Chemical |

|

11.15. Eastman Chemical Company |

|

12. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Adipic Acid Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Adipic Acid Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Adipic Acid Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats