sales@intentmarketresearch.com

+1 463-583-2713

Active Packaging Market By Type (Oxygen Scavengers, Moisture Absorbers, Ethylene Absorbers, Antimicrobial Agents), By Material (Plastic, Glass, Metal, Paper & Paperboard), and By Application (Food & Beverages, Pharmaceuticals, Personal Care Products, Electronics) and By Region; Global Insights & Forecast (2024 – 2030)

As per Intent Market Research, the Active Packaging Market was valued at USD 6.5 billion in 2023 and will surpass USD 10.2 billion by 2030; growing at a CAGR of 6.8% during 2024 - 2030.

The global Active Packaging Market is on a notable growth trajectory, driven by increasing consumer demand for extended shelf life, enhanced product safety, and improved quality. Active packaging refers to materials that actively interact with the packaged product or its environment to maintain or extend freshness, quality, and safety. This market encompasses various technologies, including oxygen scavengers, moisture absorbers, and antimicrobial agents, which are widely used in food, pharmaceuticals, and consumer goods.

The growth of this market is further propelled by the rising awareness regarding food safety and waste reduction, alongside stringent regulatory measures favoring the adoption of active packaging technologies. Innovations in materials science and packaging design have led to the development of multifunctional active packaging solutions that cater to diverse consumer needs. As sustainability becomes a key focus for businesses and consumers alike, the active packaging industry is poised to play a pivotal role in transforming the packaging landscape, ensuring that products remain fresh and safe throughout their shelf life.

Oxygen Scavengers Segment is Fastest Growing Owing to Food Preservation Needs

The oxygen scavengers segment is emerging as the fastest-growing sub-segment in the Active Packaging Market, primarily driven by the increasing need for food preservation. Oxygen scavengers are materials that absorb oxygen from the packaging environment, thereby extending the shelf life of food products and preventing spoilage. With consumers becoming more health-conscious and seeking fresher, minimally processed food options, the demand for effective preservation techniques is on the rise. This is particularly relevant in the context of ready-to-eat meals, snacks, and perishable goods, where maintaining freshness is paramount.

Moreover, the expanding food and beverage industry, coupled with the growing trend of e-commerce food delivery, has heightened the need for packaging solutions that ensure product integrity during transportation and storage. As companies continue to innovate in this area, the integration of oxygen scavengers into packaging will likely become a standard practice, further enhancing the segment's growth potential.

Antimicrobial Packaging Segment is Largest Owing to Safety Concerns

The antimicrobial packaging segment holds the largest share in the Active Packaging Market, driven by growing safety concerns related to foodborne illnesses and contamination. Antimicrobial packaging incorporates agents that inhibit the growth of microorganisms, thereby extending the shelf life of food products and ensuring consumer safety. This technology is particularly crucial in the meat, poultry, dairy, and seafood industries, where the risk of spoilage and contamination is high. The increased awareness among consumers regarding food safety has prompted manufacturers to invest in antimicrobial solutions as a means to enhance product quality and safety.

The rise in demand for convenience foods and ready-to-eat meals further fuels the growth of the antimicrobial packaging segment.The incorporation of antimicrobial agents not only enhances product safety but also aligns with the broader industry trend of sustainability, as companies strive to reduce food waste and improve shelf life.

Moisture Control Packaging Segment is Largest Owing to Versatility

The moisture control packaging segment is one of the largest in the Active Packaging Market, owing to its versatility across various industries. Moisture control packaging involves the use of desiccants or humidity regulators that maintain optimal moisture levels within the packaging environment. This technology is essential in sectors such as food, pharmaceuticals, electronics, and cosmetics, where moisture can adversely affect product quality and shelf life. For instance, in the food industry, excess moisture can lead to mold growth, spoilage, and degradation of texture and flavor.

The growing trend of online shopping and home delivery services has further amplified the demand for moisture control packaging solutions. With consumers increasingly relying on e-commerce for their shopping needs, ensuring that products arrive in optimal condition is vital for maintaining brand reputation and customer satisfaction. As companies continue to invest in moisture control solutions, this segment will remain integral to the overall growth of the Active Packaging Market.

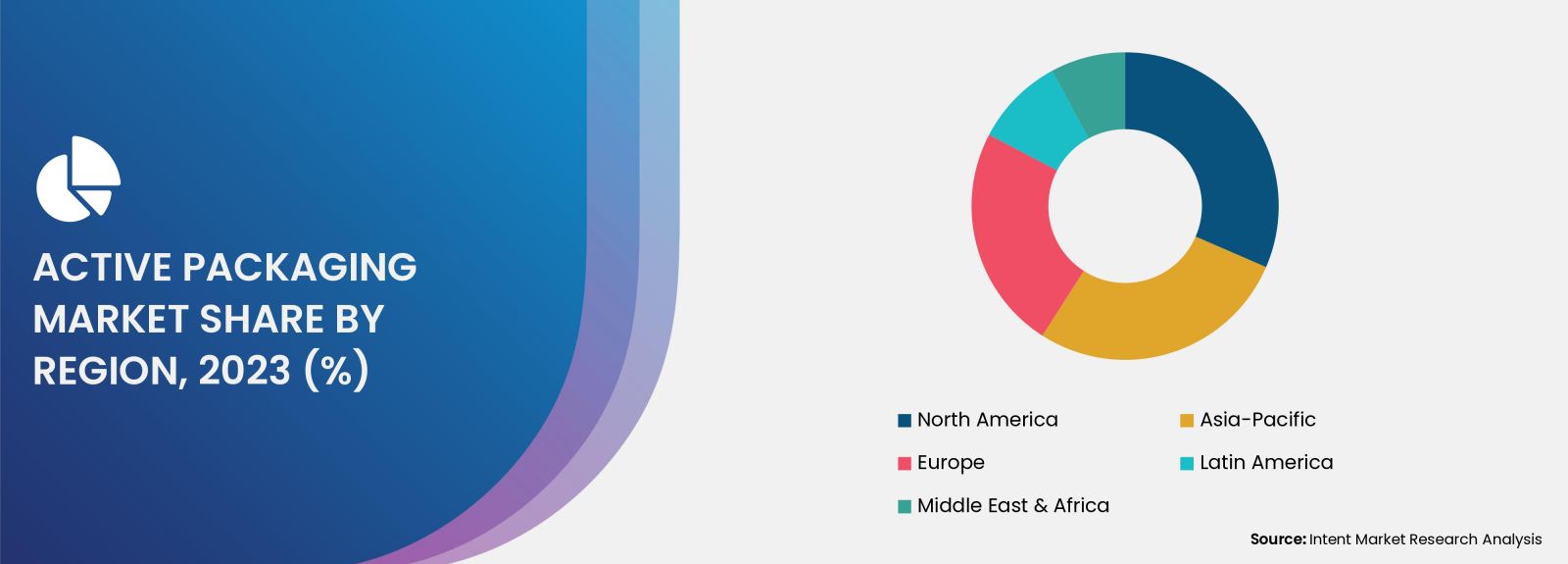

Fastest Growing Region is Asia-Pacific Due to Rising Demand for Packaged Foods

The Asia-Pacific region is expected to be the fastest-growing market for active packaging, driven by the rising demand for packaged foods and beverages in emerging economies. Countries such as China, India, and Japan are experiencing rapid urbanization, changing lifestyles, and increasing disposable incomes, leading to a surge in demand for convenient and safe food products. The region's growing population and evolving consumer preferences are prompting manufacturers to adopt innovative active packaging solutions to enhance product safety and shelf life.

Furthermore, the Asia-Pacific region is witnessing significant investments in the food processing and packaging industries, as governments and private companies strive to improve food safety standards and reduce food waste. The implementation of stringent regulations regarding food safety and packaging is also encouraging the adoption of active packaging technologies.

Competitive Landscape and Leading Companies

The competitive landscape of the Active Packaging Market is characterized by the presence of several key players focused on innovation, sustainability, and customer-centric solutions. Leading companies in this space include:

- Sealed Air Corporation: A global leader in protective packaging solutions, Sealed Air focuses on innovative active packaging technologies to enhance product safety and extend shelf life.

- Amcor plc: Renowned for its sustainable packaging solutions, Amcor invests heavily in research and development to create advanced active packaging materials.

- Mondi Group: A major player in the packaging sector, Mondi emphasizes sustainability and innovation in its active packaging offerings.

- Tetra Pak: Known for its carton packaging solutions, Tetra Pak integrates active packaging technologies to ensure food safety and quality.

- Ball Corporation: Specializing in metal packaging, Ball Corporation is committed to sustainability and enhancing the performance of its packaging solutions.

- WestRock Company: A leader in paper and packaging solutions, WestRock focuses on active packaging technologies that improve product preservation and safety.

- Sappi Group: Sappi is a prominent player in the paper industry, offering active packaging solutions that enhance product freshness and extend shelf life.

- Kraft Heinz Company: As a major food manufacturer, Kraft Heinz invests in active packaging technologies to maintain product quality and reduce waste.

- Dow Chemical Company: A leading materials science company, Dow focuses on developing advanced active packaging solutions that meet industry demands.

- DuPont: Renowned for its innovations in materials science, DuPont offers a range of active packaging technologies that enhance product safety and longevity.

These companies are actively engaged in strategic partnerships, acquisitions, and investments in research and development to strengthen their market position. The competitive landscape is expected to evolve as companies seek to differentiate themselves through technological advancements and sustainable practices, positioning the Active Packaging Market for continued growth in the coming years.

Report Objectives:

The report will help you answer some of the most critical questions in the Active Packaging Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Active Packaging Market?

- What is the size of the Active Packaging Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 6.5 billion |

|

Forecasted Value (2030) |

USD 10.2 billion |

|

CAGR (2024 – 2030) |

6.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Active Packaging Market By Type (Oxygen Scavengers, Moisture Absorbers, Ethylene Absorbers, Antimicrobial Agents), By Material (Plastic, Glass, Metal, Paper & Paperboard), and By Application (Food & Beverages, Pharmaceuticals, Personal Care Products, Electronics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Active Packaging Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Oxygen Scavengers |

|

4.2. Moisture Absorbers |

|

4.3. Ethylene Absorbers |

|

4.4. Antimicrobial Agents |

|

4.5. Others |

|

5. Active Packaging Market, by Material (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Plastic |

|

5.2. Glass |

|

5.3. Metal |

|

5.4. Paper & Paperboard |

|

5.5. Others |

|

6. Active Packaging Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Food & Beverages |

|

6.2. Pharmaceuticals |

|

6.3. Personal Care Products |

|

6.4. Electronics |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Active Packaging Market, by Type |

|

7.2.7. North America Active Packaging Market, by Material |

|

7.2.8. North America Active Packaging Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Active Packaging Market, by Type |

|

7.2.9.1.2. US Active Packaging Market, by Material |

|

7.2.9.1.3. US Active Packaging Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Amcor plc |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. AVERY DENNISON CORPORATION |

|

9.3. BASF |

|

9.4. DuPont |

|

9.5. Kraton Corporation |

|

9.6. MicrobeGuard Corporation |

|

9.7. Mitsubishi Gas Chemical Company, Inc. |

|

9.8. Mondi |

|

9.9. Sealed Air Corporation |

|

9.10. Tetra Pak International S.A. |

|

10. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Active Packaging Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Active Packaging Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Active Packaging ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Active Packaging Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats