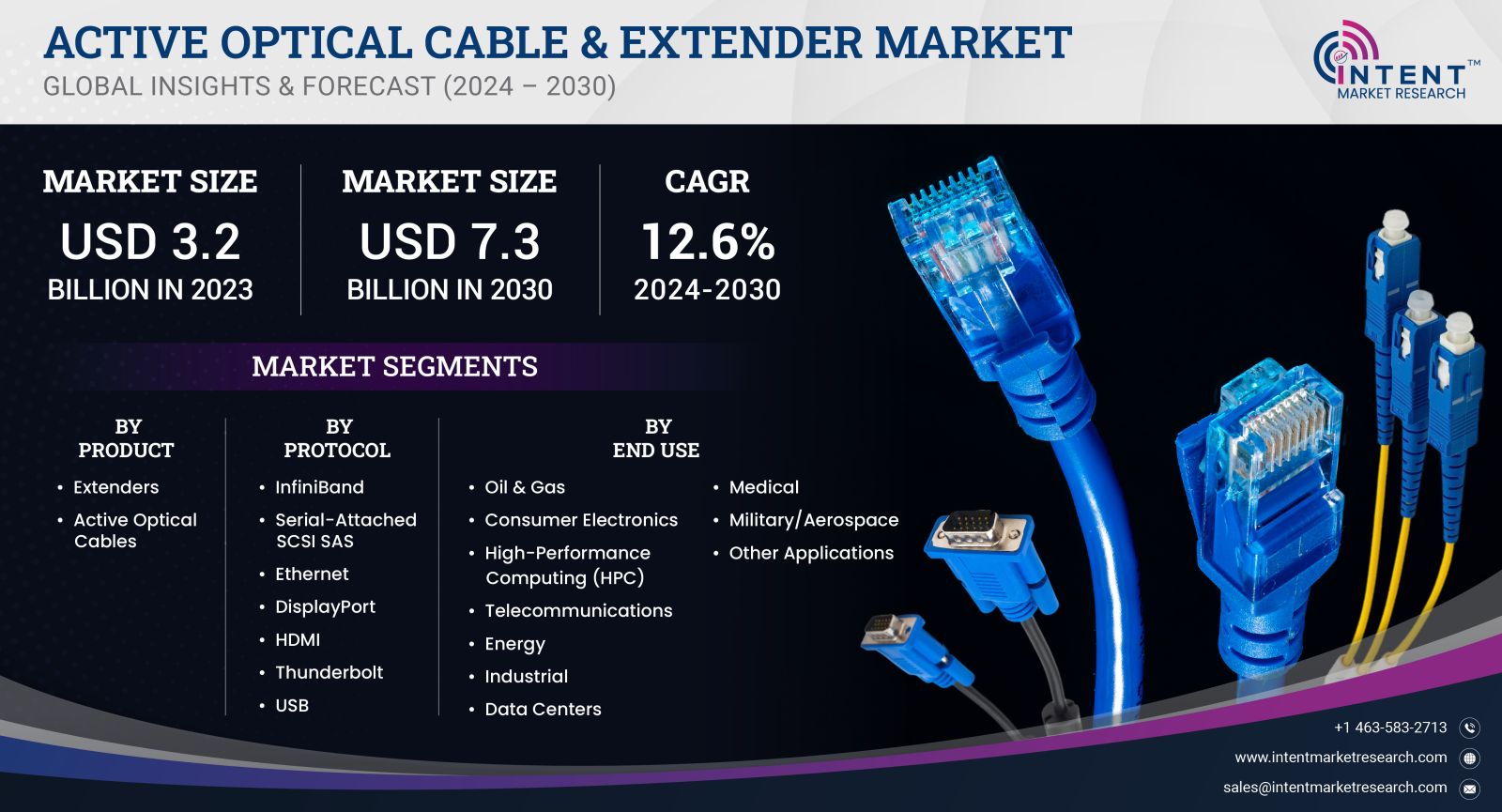

As per Intent Market Research, the Active Optical Cable & Extender Market was valued at USD 3.2 billion in 2023-e and will surpass USD 7.3 billion by 2030; growing at a CAGR of 12.6% during 2024 - 2030.

The Active Optical Cable (AOC) and Extender market is an innovative segment within the broader telecommunications and data transmission industry. As the demand for high-speed data transfer continues to escalate, driven by the proliferation of cloud computing, 5G technologies, and Internet of Things (IoT) applications, AOCs have emerged as a preferred solution due to their lightweight design and exceptional performance. These cables utilize optical fibers and active components to enhance the transmission of data over longer distances, offering significant advantages over traditional copper cables, including reduced power consumption and immunity to electromagnetic interference. This market is poised for substantial growth, driven by the increasing need for high bandwidth and low latency solutions across various sectors, including data centers, consumer electronics, and enterprise networking.

As organizations continue to invest in upgrading their infrastructure to support next-generation technologies, the demand for AOCs is expected to rise, presenting lucrative opportunities for manufacturers and stakeholders in this dynamic landscape.

Data Center Segment is Largest Owing to Growing Demand for High-Speed Connectivity

The data center segment represents the largest share of the Active Optical Cable and Extender market, primarily driven by the exponential growth in data traffic and the increasing demand for high-speed connectivity. As enterprises move towards cloud computing and rely heavily on data centers for their operations, the need for robust and efficient data transfer solutions has never been greater. Active Optical Cables provide a cost-effective and high-performance alternative to traditional copper cables, facilitating the seamless transfer of data across vast distances within data center environments.

Moreover, the shift towards virtualization and the adoption of high-performance computing (HPC) applications are further fueling the demand for AOCs within data centers. With the ability to support higher bandwidths and longer distances, AOCs enhance overall operational efficiency, reduce latency, and improve system reliability. As data centers increasingly implement advanced technologies such as 5G and AI, the reliance on Active Optical Cables will only intensify, solidifying the data center segment's status as the largest within the market.

Consumer Electronics Segment is Fastest Growing Owing to Rising Adoption of 8K Displays

The consumer electronics segment is experiencing rapid growth within the Active Optical Cable and Extender market, primarily due to the rising adoption of 8K displays and high-definition multimedia content. As consumers increasingly seek enhanced viewing experiences, the demand for high-quality video and audio transmission solutions is surging. Active Optical Cables, with their ability to transmit large amounts of data without signal degradation, are becoming indispensable for connecting advanced consumer electronics, such as smart TVs, gaming consoles, and home theater systems.

Furthermore, the growing trend of home automation and smart homes is contributing to the expansion of this segment. As households integrate more smart devices, the need for high-speed, reliable data transfer solutions becomes critical. Active Optical Cables not only meet these demands but also offer improved flexibility and ease of installation compared to traditional cables. With the ongoing advancements in consumer technology and increasing consumer expectations for quality, the consumer electronics segment is poised to become the fastest-growing sub-segment in the Active Optical Cable and Extender market.

Enterprise Networking Segment is Largest Owing to Increasing Demand for Enhanced Connectivity

Within the enterprise networking segment, Active Optical Cables have established themselves as the largest sub-segment, primarily driven by the increasing demand for enhanced connectivity and high-speed communication in corporate environments. As businesses undergo digital transformations and adopt cloud-based solutions, the need for efficient data transfer between various network devices has grown significantly. AOCs facilitate this requirement by providing high-bandwidth capabilities and reduced latency, making them ideal for enterprise applications that rely on swift data exchange.

The rise of remote work and hybrid work models further propels the demand for robust enterprise networking solutions. Companies are investing in advanced networking infrastructure to ensure seamless connectivity for employees, regardless of location. Active Optical Cables, with their compact design and lightweight properties, are particularly suited for modern office setups, enabling organizations to optimize their network configurations while minimizing clutter. As enterprises continue to enhance their networking capabilities to accommodate evolving business needs, the enterprise networking segment will maintain its position as the largest within the AOC and extender market.

Broadcast Segment is Fastest Growing Owing to Surge in Live Streaming

The broadcast segment is witnessing rapid growth within the Active Optical Cable and Extender market, fueled by the surge in live streaming and content creation across various platforms. The demand for high-quality video transmission has escalated as media companies and content creators seek to deliver seamless streaming experiences to their audiences. Active Optical Cables, known for their ability to transmit high-definition video signals over long distances without signal loss, have become essential tools in the broadcast industry.

Additionally, advancements in broadcasting technologies, such as 4K and 8K resolution, require robust connectivity solutions to handle large data streams. AOCs provide the necessary bandwidth to support these high-resolution formats, making them increasingly attractive to broadcasters looking to enhance their production quality. As the landscape of digital media continues to evolve, with more emphasis on live and on-demand content, the broadcast segment is positioned to be the fastest-growing sub-segment in the AOC and extender market.

Fastest Growing Region in the Active Optical Cable and Extender Market

The Asia-Pacific region is projected to be the fastest-growing market for Active Optical Cables and Extenders during the forecast period of 2024 to 2030. Several factors contribute to this growth, including rapid urbanization, increasing investments in telecommunications infrastructure, and the proliferation of digital technologies across countries like China, India, and Japan. The region's growing population and expanding middle class are driving demand for high-speed internet and advanced consumer electronics, which in turn propels the need for efficient data transmission solutions.

Moreover, the Asia-Pacific region is home to numerous data centers and tech companies that are actively adopting advanced networking technologies to enhance operational efficiency and performance. The rising trend of cloud computing and the development of smart cities further amplify the demand for Active Optical Cables as a means to support robust communication networks. As businesses and governments in this region prioritize the digital economy, the Asia-Pacific market is expected to witness significant growth in the Active Optical Cable and Extender segment.

Competitive Landscape and Leading Companies

The competitive landscape of the Active Optical Cable and Extender market is characterized by the presence of several key players striving to innovate and capture market share. Leading companies such as Cisco Systems, Inc., Corning Incorporated, Amphenol Corporation, and Molex LLC are at the forefront of the market, leveraging advanced technologies to develop high-quality AOCs and extenders that cater to diverse industry needs. These companies are engaged in continuous research and development to enhance product performance, improve manufacturing processes, and expand their product portfolios to meet the growing demands of customers.

Additionally, the market is witnessing increasing collaboration and strategic partnerships among companies to enhance their competitive positioning and capitalize on emerging opportunities. As the demand for high-speed data transfer solutions continues to rise, manufacturers are also focusing on sustainability and eco-friendly practices, responding to growing environmental concerns. The Active Optical Cable and Extender market is set to evolve rapidly, with innovation and strategic initiatives driving growth and fostering a competitive environment.

Report Objectives:

The report will help you answer some of the most critical questions in the Active Optical Cable & Extender Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the active optical cable & extender market?

- What is the size of the active optical cable & extender market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Middle East, and Rest of the World?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 3.2 billion |

|

Forecasted Value (2030) |

USD 7.3 billion |

|

CAGR (2024-2030) |

12.6% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Active Optical Cable & Extender Market By Product (Ethernet, Serial-Attached SCSI SAS, DisplayPort, Thunderbolt, USB), By Protocol (InfiniBand, Serial-Attached SCSI SAS, Ethernet, DisplayPort), By End-use (Oil & Gas, Consumer Electronics, High-performance Computing (HPC), Telecommunications, Energy, Industrial) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Active Optical Cable & Extender Market, by Product (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Extenders |

|

4.2.Active Optical Cables |

|

5.Active Optical Cable & Extender Market, by Protocol (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.InfiniBand |

|

5.2.Serial-Attached SCSI SAS |

|

5.3.Ethernet |

|

5.4.DisplayPort |

|

5.5.HDMI |

|

5.6.Thunderbolt |

|

5.7.USB |

|

6.Active Optical Cable & Extender Market, by End Use (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Oil & Gas |

|

6.2.Consumer Electronics |

|

6.3.High-Performance Computing (HPC) |

|

6.4.Telecommunications |

|

6.5.Energy |

|

6.6.Industrial |

|

6.7.Data Centers |

|

6.8.Medical |

|

6.9.Military/Aerospace |

|

6.10.Other Applications |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Active Optical Cable & Extender Market, by Product |

|

7.2.7.North America Active Optical Cable & Extender Market, by Protocol |

|

7.2.8.North America Active Optical Cable & Extender Market, by Application |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Active Optical Cable & Extender Market, by Product |

|

7.3.1.2.US Active Optical Cable & Extender Market, by Protocol |

|

7.3.1.3.US Active Optical Cable & Extender Market, by Application |

|

7.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.7.Latin America |

|

7.8.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.Coherent Corp. |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Broadcom |

|

9.3.Amphenol Communications |

|

9.4.Corning Incorporated |

|

9.5.TE Connectivity |

|

9.6.3M |

|

9.7.Molex |

|

9.8.Dell |

|

9.9.Eaton |

|

9.10.Sumitiom Electric |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Active Optical Cable & Extender Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the active optical cable & extender Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the active optical cable & extender ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the active optical cable & extender market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA