As per Intent Market Research, the Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market was valued at USD 1.1 Billion in 2024-e and will surpass USD 2.4 Billion by 2030; growing at a CAGR of 11.4% during 2025-2030.

The market for anterior cruciate ligament (ACL) and posterior cruciate ligament (PCL) reconstruction devices is witnessing substantial growth, driven by rising sports injuries and advancements in orthopedic surgical techniques. These devices play a critical role in stabilizing the knee joint post-injury, enabling athletes and individuals to regain functionality. ACL and PCL injuries are among the most common knee injuries, particularly in sports, leading to high demand for reconstruction surgeries and related devices. With growing healthcare expenditure, improved surgical technologies, and increased awareness of knee health, the market is expected to grow significantly in the coming years.

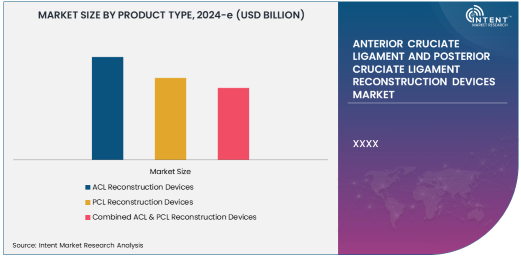

ACL Reconstruction Devices Segment Is Largest Owing To Rising Sports Injuries

Among the various product types in this market, ACL reconstruction devices hold the largest market share. ACL injuries are most common in athletes who participate in high-impact sports such as soccer, basketball, and skiing. The high prevalence of ACL injuries in active individuals is driving the demand for ACL reconstruction devices. As these injuries often require surgical intervention, the devices used for ACL reconstruction have become crucial for the success of these procedures. Furthermore, advancements in device technology, including more effective graft fixation systems and biocompatible materials, have enhanced the recovery rates, further fueling market growth.

The ACL reconstruction market benefits from a combination of technological innovations and a large patient pool needing intervention. More people are undergoing surgeries for ACL injuries, as these injuries are not only limited to athletes but also common in recreational activities. With the integration of minimally invasive surgical techniques like arthroscopy, the demand for ACL reconstruction devices is expected to continue growing, especially in regions with high levels of sports engagement and active lifestyles.

Arthroscopic Surgery Segment Is Fastest Growing Owing To Minimally Invasive Nature

Arthroscopic surgery has emerged as the fastest-growing surgical approach for both ACL and PCL reconstruction procedures. This minimally invasive technique involves smaller incisions, less tissue damage, and faster recovery times compared to traditional open surgery. As the adoption of arthroscopic surgery increases due to its benefits, the demand for arthroscopic surgical devices, including reconstruction devices, has surged. This trend is supported by the growing preference for outpatient procedures and reduced hospital stays, making it a popular choice among patients and healthcare providers.

The ability to view the internal structures of the knee joint in real-time with minimal disruption to surrounding tissues makes arthroscopic surgery ideal for reconstruction. Additionally, improvements in arthroscopic equipment, such as cameras, scopes, and surgical instruments, have further driven the adoption of this method. This growing preference for minimally invasive procedures is set to fuel the market for ACL and PCL reconstruction devices, especially in regions with advanced healthcare facilities and a higher number of knee surgeries.

Hospitals Segment Is Largest End-User Industry Owing To High Patient Volume

The largest end-user industry for ACL and PCL reconstruction devices is hospitals. These institutions handle the majority of orthopedic surgeries, particularly in trauma cases involving knee ligament injuries. Hospitals are equipped with specialized facilities and medical professionals to perform complex surgeries like ACL and PCL reconstruction. The higher number of patients seeking surgical interventions for knee injuries in hospitals is a key factor in the large share of this segment. Furthermore, hospitals typically have more access to advanced technology, which facilitates the use of sophisticated surgical devices for knee reconstruction.

The hospital sector’s dominance is further supported by the presence of surgical experts and a higher level of patient care, including postoperative rehabilitation. As the number of surgical procedures increases due to the growing prevalence of ACL and PCL injuries, hospitals remain the primary end-users of these devices. With more patients requiring inpatient care and postoperative rehabilitation, hospitals are expected to continue to dominate this segment in the coming years.

Autograft Implants Segment Is Largest Implant Type Due to Superior Healing Outcomes

The autograft implants segment is the largest within the implant category for ACL and PCL reconstruction surgeries. Autografts involve using the patient's own tissue for reconstruction, which reduces the risk of rejection and provides superior healing outcomes. As patients and surgeons favor this approach for its biological compatibility and quicker healing time, autografts are widely used in ACL and PCL reconstructions. This segment is expected to retain its dominance due to the established clinical outcomes and long-term success associated with autograft implants.

While allografts and synthetic implants are also used, autografts remain the preferred choice for many orthopedic surgeons. This is particularly true for younger, active patients who are looking for durable and long-lasting results from their knee reconstruction surgeries. Autograft implants are well-suited for patients with higher activity levels, making this subsegment a critical part of the overall ACL and PCL reconstruction devices market.

Direct Sales Segment Is Largest Distribution Channel Owing To Strong Healthcare Relationships

The direct sales distribution channel is the largest in the ACL and PCL reconstruction devices market. This channel enables manufacturers to establish direct relationships with healthcare providers, hospitals, and clinics, ensuring that they have access to the latest devices and innovations. Direct sales offer manufacturers greater control over product delivery, support services, and customer relationships. Hospitals and orthopedic clinics typically prefer direct purchases from trusted suppliers to ensure consistent quality and timely availability of devices.

Moreover, direct sales facilitate ongoing technical support, which is critical for complex surgical procedures. As healthcare providers prefer to maintain strong partnerships with device manufacturers for product support and education, the direct sales model will continue to dominate the distribution of ACL and PCL reconstruction devices.

North America Is Largest Region Due To High Healthcare Spending and Sports Participation

North America remains the largest market for ACL and PCL reconstruction devices. The region boasts a high prevalence of knee injuries, particularly in athletes, leading to an increased demand for orthopedic surgeries. The healthcare infrastructure in North America is well-developed, and advanced medical technology is readily available, which contributes to the high adoption of ACL and PCL reconstruction devices. Furthermore, the sports culture in North America, coupled with an aging population, results in a steady stream of patients requiring knee surgeries.

The large number of hospitals and orthopedic clinics in North America, combined with the region’s high healthcare expenditure, positions it as the largest market for these devices. Moreover, increasing awareness of joint health and rehabilitation options drives further demand in this region.

Competitive Landscape

The competitive landscape of the ACL and PCL reconstruction devices market is dominated by leading players such as Smith & Nephew, Stryker Corporation, and Zimmer Biomet. These companies hold a significant market share due to their strong brand presence, extensive product portfolios, and innovations in surgical technologies. Other notable players, including Arthrex Inc. and Medtronic, continue to enhance their offerings with advanced materials and minimally invasive techniques to improve patient outcomes.

The market is competitive, with companies focusing on research and development to offer more durable, cost-effective, and innovative products. Strategic collaborations, acquisitions, and partnerships are also common in this industry as companies aim to expand their market reach and capabilities. With the rising demand for effective ACL and PCL reconstruction solutions, the competitive dynamics are expected to intensify in the coming years.

Recent Developments:

- Smith & Nephew announced the launch of a new all-in-one solution for ACL reconstruction that offers enhanced stability and quicker recovery times.

- Stryker Corporation acquired a leading arthroscopic surgery device company to strengthen its position in the ligament reconstruction market.

- Zimmer Biomet recently unveiled an advanced ACL reconstruction device that incorporates 3D-printed bone anchors for better fixation and integration with natural bone.

- Arthrex Inc. received regulatory approval for its new PCL reconstruction system, featuring improved graft fixation technology.

- Medtronic PLC partnered with a leading research institution to develop next-generation implantable devices for joint reconstruction and repair, targeting faster healing and increased durability.

List of Leading Companies:

- Smith & Nephew

- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet

- Arthrex Inc.

- Medtronic PLC

- Conmed Corporation

- DJO Global

- Wright Medical Group

- NuVasive Inc.

- Orthofix International N.V.

- B. Braun Melsungen AG

- Intuitive Surgical, Inc.

- KCI Medical

- Healthcare Products, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 Billion |

|

Forecasted Value (2030) |

USD 2.4 Billion |

|

CAGR (2025 – 2030) |

11.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

ACL and PCL Reconstruction Devices Market By Product Type (ACL Reconstruction Devices, PCL Reconstruction Devices, Combined ACL & PCL Reconstruction Devices), By Surgical Approach (Open Surgery, Arthroscopic Surgery), By End-User Industry (Hospitals, Orthopedic Clinics, Sports Rehabilitation Centers), By Implant Type (Autograft Implants, Allograft Implants, Synthetic Implants), and By Distribution Channel (Direct Sales, Retail Sales, Online Retailers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Smith & Nephew, Stryker Corporation, Johnson & Johnson (DePuy Synthes), Zimmer Biomet, Arthrex Inc., Medtronic PLC, Conmed Corporation, DJO Global, Wright Medical Group, NuVasive Inc., Orthofix International N.V., B. Braun Melsungen AG, Intuitive Surgical, Inc., KCI Medical, Healthcare Products, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. ACL Reconstruction Devices |

|

4.2. PCL Reconstruction Devices |

|

4.3. Combined ACL & PCL Reconstruction Devices |

|

5. Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by Surgical Approach (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Open Surgery |

|

5.2. Arthroscopic Surgery |

|

6. Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Orthopedic Clinics |

|

6.3. Sports Rehabilitation Centers |

|

7. Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by Implant Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Autograft Implants |

|

7.2. Allograft Implants |

|

7.3. Synthetic Implants |

|

8. Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Direct Sales |

|

8.2. Retail Sales |

|

8.3. Online Retailers |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by Product Type |

|

9.2.7. North America Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by Surgical Approach |

|

9.2.8. North America Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by End-User Industry |

|

9.2.9. North America Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by Implant Type |

|

9.2.10. North America Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by Distribution Channel |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by Product Type |

|

9.2.11.1.2. US Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by Surgical Approach |

|

9.2.11.1.3. US Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by End-User Industry |

|

9.2.11.1.4. US Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by Implant Type |

|

9.2.11.1.5. US Anterior Cruciate Ligament and Posterior Cruciate Ligament Reconstruction Devices Market, by Distribution Channel |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Smith & Nephew |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Stryker Corporation |

|

11.3. Johnson & Johnson (DePuy Synthes) |

|

11.4. Zimmer Biomet |

|

11.5. Arthrex Inc. |

|

11.6. Medtronic PLC |

|

11.7. Conmed Corporation |

|

11.8. DJO Global |

|

11.9. Wright Medical Group |

|

11.10. NuVasive Inc. |

|

11.11. Orthofix International N.V. |

|

11.12. B. Braun Melsungen AG |

|

11.13. Intuitive Surgical, Inc. |

|

11.14. KCI Medical |

|

11.15. Healthcare Products, Inc. |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the ACL and PCL Reconstruction Devices Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the ACL and PCL Reconstruction Devices Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the ACL and PCL Reconstruction Devices Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA