As per Intent Market Research, the Absorbent Paper Market was valued at USD 134.5 billion in 2023 and will surpass USD 172.2 billion by 2030; growing at a CAGR of 3.6% during 2024 - 2030.

Factors contributing to this growth include the rising awareness of hygiene standards, the increasing prevalence of disposable products, and the growing use of absorbent materials in diverse applications. As consumer preferences shift toward convenience and efficiency, the demand for absorbent paper products is expected to continue its upward trajectory.

Absorbent paper is primarily used in applications requiring high absorbency, such as napkins, medical absorbent pads, and personal care products. Innovations in production technologies are enhancing the quality and functionality of absorbent paper products, enabling manufacturers to cater to a wider range of consumer needs. Additionally, growing environmental concerns are prompting companies to invest in sustainable manufacturing practices, leading to the development of eco-friendly absorbent paper products. As the market evolves, the focus on quality, sustainability, and innovation is expected to drive further growth in the absorbent paper sector.

Hygiene Products Segment is Largest Owing to Rising Demand for Personal Care

The hygiene products segment is the largest within the absorbent paper market, primarily due to the increasing demand for personal care and hygiene items. Products such as sanitary napkins, diapers, and adult incontinence products heavily rely on absorbent paper materials for their effectiveness. The rising awareness of health and hygiene standards, particularly in emerging economies, is significantly boosting the demand for these products.

Furthermore, the hygiene products segment is benefiting from continuous innovation in product design and materials. Manufacturers are focusing on developing thinner, more absorbent, and skin-friendly materials to enhance user comfort and convenience. The growing trend toward disposable products is further propelling this segment, as consumers seek easy-to-use and hygienic solutions. With a steady increase in birth rates in some regions and the aging population in others, the hygiene products segment is anticipated to maintain its dominance in the absorbent paper market.

Medical Absorbent Products Segment is Fastest Growing Owing to Healthcare Advancements

The medical absorbent products segment is the fastest growing within the absorbent paper market, driven by advancements in healthcare and the increasing emphasis on patient safety. Medical absorbent products, including surgical pads, absorbent dressings, and medical wipes, are critical in ensuring effective wound management and infection control in healthcare settings. The rising number of surgical procedures and growing awareness of hospital-acquired infections are contributing to the heightened demand for these products.

As healthcare facilities increasingly prioritize patient care and safety, the need for high-quality absorbent materials is becoming paramount. Innovations in medical absorbent products, such as the incorporation of antimicrobial properties and improved fluid management capabilities, are enhancing their effectiveness. Moreover, the growing trend toward home healthcare and outpatient services is further propelling the demand for medical absorbent products. This segment's rapid growth reflects the broader trends in healthcare and the increasing focus on quality and efficiency in medical practices.

Food Service Segment is Largest Owing to Growing Convenience Demand

The food service segment is one of the largest within the absorbent paper market, primarily due to the increasing demand for convenience and hygiene in food packaging and preparation. Absorbent paper products, such as food napkins, trays, and liners, play a vital role in maintaining cleanliness and absorbing excess moisture in various food applications. The growing trend of takeout and delivery services, particularly in the wake of the COVID-19 pandemic, has significantly boosted the demand for absorbent paper products in the food service industry.

Additionally, the food service sector is increasingly adopting sustainable packaging solutions, further enhancing the appeal of absorbent paper products. With consumers becoming more environmentally conscious, food service providers are seeking eco-friendly packaging options that meet sustainability standards. This shift is driving innovation in the absorbent paper market, with manufacturers developing biodegradable and recyclable options that cater to the evolving preferences of both businesses and consumers. As a result, the food service segment is expected to continue playing a significant role in the overall growth of the absorbent paper market.

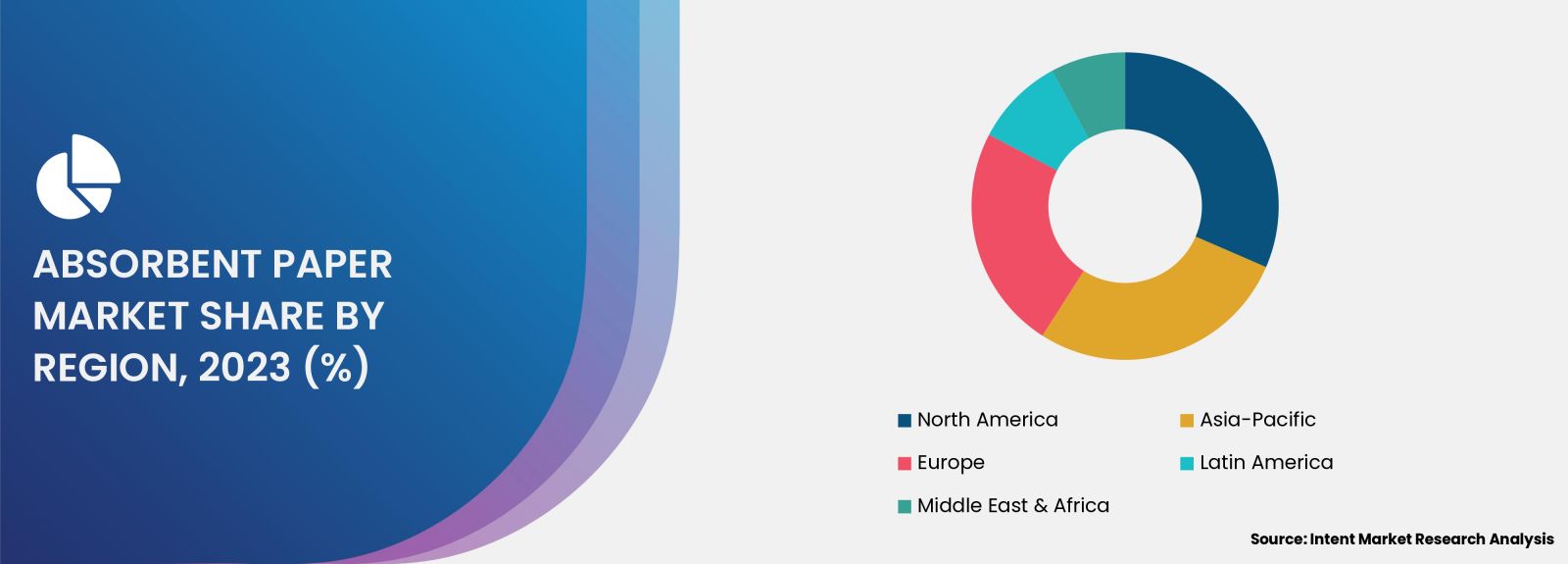

Fastest Growing Region: Asia-Pacific is Fastest Growing Owing to Rapid Urbanization

The Asia-Pacific region is the fastest growing market for absorbent paper, fueled by rapid urbanization, rising disposable incomes, and changing consumer preferences. Countries such as China, India, and Japan are witnessing a surge in demand for absorbent paper products across various sectors, including hygiene, food service, and healthcare. The region's expanding population and growing awareness of health and hygiene are driving significant growth in the hygiene products segment.

Furthermore, the increasing focus on healthcare infrastructure development in emerging economies is contributing to the demand for medical absorbent products. As healthcare facilities expand and modernize, the need for high-quality absorbent materials is becoming more pronounced. Additionally, the food service industry in Asia-Pacific is rapidly evolving, with a growing number of quick-service restaurants and food delivery services, further boosting the demand for absorbent paper products. As the region continues to develop, its dynamic market landscape positions it as a key player in the global absorbent paper market.

Competitive Landscape of Leading Companies

The competitive landscape of the absorbent paper market features several key players actively working to enhance their market presence and product offerings. The top companies in this sector include:

- Procter & Gamble Co.: A leading manufacturer of personal care products, Procter & Gamble offers a range of absorbent paper products, including sanitary napkins and diapers, under various brand names.

- Kimberly-Clark Corporation: Known for its innovative hygiene and personal care products, Kimberly-Clark produces a wide variety of absorbent paper products for both consumer and professional use.

- Georgia-Pacific LLC: A major player in the paper products industry, Georgia-Pacific offers a range of absorbent paper products for the hygiene, food service, and medical sectors.

- Essity AB: Specializing in hygiene and health products, Essity produces a variety of absorbent paper items, including feminine hygiene products and incontinence solutions.

- Hengan International Group Company Limited: A leading manufacturer of personal care products in China, Hengan produces absorbent paper products, including sanitary napkins and adult incontinence items.

- Unicharm Corporation: Known for its innovative personal care solutions, Unicharm manufactures a wide range of absorbent products, including baby diapers and feminine hygiene items.

- Mondi Group: A prominent player in the packaging and paper industry, Mondi offers absorbent paper products for various applications, focusing on sustainability and quality.

- Sappi Group: A global leader in pulp and paper production, Sappi provides absorbent paper solutions for hygiene, food service, and medical applications.

- Cascades Inc.: Known for its sustainable practices, Cascades produces absorbent paper products for various markets, including consumer hygiene and food service.

- Clearwater Paper Corporation: A key manufacturer of absorbent paper products, Clearwater Paper focuses on high-quality solutions for the hygiene and food service sectors.

The competitive landscape in the absorbent paper market is characterized by ongoing innovation, strategic partnerships, and mergers and acquisitions as companies strive to enhance their market presence. With the growing emphasis on sustainability and the need for eco-friendly solutions, leading manufacturers are investing in research and development to create advanced absorbent paper products that meet current market trends. The dynamic nature of this market positions these companies to capitalize on emerging opportunities and drive future growth in the absorbent paper sector.

Report Objectives:

The report will help you answer some of the most critical questions in the Absorbent Paper Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Absorbent Paper Market?

- What is the size of the Absorbent Paper Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 134.5 billion |

|

Forecasted Value (2030) |

USD 172.2 billion |

|

CAGR (2024 – 2030) |

3.6% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

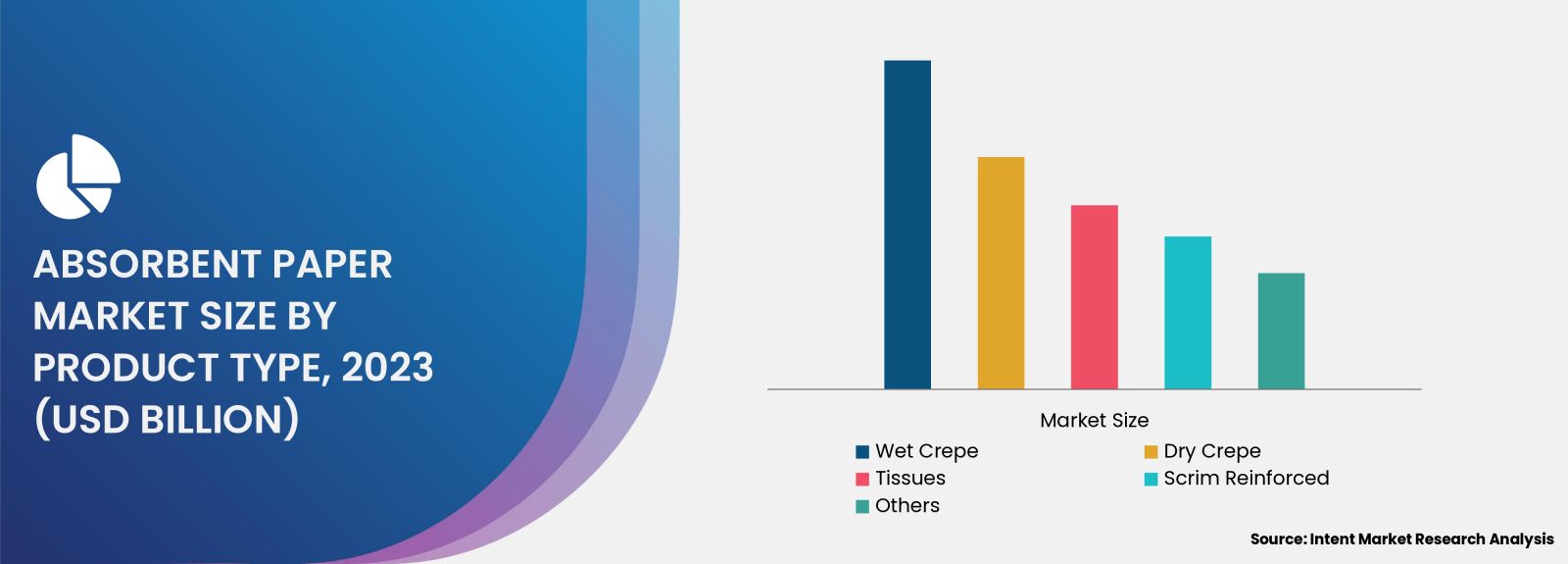

Absorbent Paper Market By Product Type (Wet Crepe, Dry Crepe, Tissues, Scrim Reinforced), By Application (Filter Paper, Table Paper, Towelette, Surgical Drapes & Wipes, Wraps), By End-Use Industry (Packaging, Home Care, Personal Care, Medical, Food & Beverage) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Absorbent Paper Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Wet Crepe |

|

4.2. Dry Crepe |

|

4.3. Tissues |

|

4.4. Scrim Reinforced |

|

4.5. Others |

|

5. Absorbent Paper Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Filter Paper |

|

5.2. Table Paper |

|

5.3. Towelette |

|

5.4. Surgical Drapes & Gowns |

|

5.5. Wipes |

|

5.6. Wraps |

|

5.7. Others |

|

6. Absorbent Paper Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Packaging |

|

6.2. Home Care |

|

6.3. Personal Care |

|

6.4. Medical |

|

6.5. Food & Beverage |

|

6.6. Other |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Absorbent Paper Market, by Product Type |

|

7.2.7. North America Absorbent Paper Market, by Application |

|

7.2.8. North America Absorbent Paper Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Absorbent Paper Market, by Product Type |

|

7.2.9.1.2. US Absorbent Paper Market, by Application |

|

7.2.9.1.3. US Absorbent Paper Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Ahlstrom |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Clearwater Paper Corporation |

|

9.3. Domtar Corporation |

|

9.4. Essity Aktiebolag |

|

9.5. Georgia-Pacific Consumer Products LP |

|

9.6. International Paper Company |

|

9.7. Kimberly-Clark |

|

9.8. Metsä Group |

|

9.9. Robert Wilson Paper |

|

9.10. Twin Rivers Paper Company |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Absorbent Paper Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Absorbent Paper Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Absorbent Paper ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Absorbent Paper Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.