As per Intent Market Research, the Abdominal Surgical Robots Market was valued at USD 3.6 billion in 2023 and will surpass USD 20.2 billion by 2030; growing at a CAGR of 28.2% during 2024 - 2030.

The global Abdominal Surgical Robots Market is poised for significant growth between 2024 and 2030, driven by the increasing demand for minimally invasive surgeries, technological advancements, and a growing preference for robotic-assisted procedures. These robots enable greater precision, control, and flexibility for surgeons, reducing complications and enhancing patient outcomes.The surge in healthcare spending and the rise in complex surgical cases, particularly in aging populations, are key factors shaping the market.

Robot Systems Segment is the Largest Owing to Precision and Efficiency

Among the key components of the abdominal surgical robots market, robotic systems represent the largest subsegment. These systems are highly favored due to their ability to offer enhanced accuracy during complex procedures, reduced trauma, and improved recovery times for patients. As healthcare providers increasingly adopt robotic systems, demand is rising, particularly in developed markets.

Robotic systems are designed with features such as high-definition 3D vision and motion scaling, which provide surgeons with better control and precision compared to traditional methods. By reducing human error, these systems minimize the risks associated with delicate abdominal surgeries, making them a vital part of modern surgical suites. As a result, hospitals are investing heavily in robotic platforms, making this the most lucrative subsegment within the abdominal surgical robots market.

Instrument and Accessories Segment Growing Rapidly Due to Recurrent Usage

The instrument and accessories segment is expected to witness the fastest growth during the forecast period. This growth can be attributed to the recurrent need for instruments and accessories used during each robotic surgery. Unlike the robotic systems themselves, which are typically one-time investments, the instruments used in each surgery need to be regularly replaced and maintained, creating a consistent demand.

These accessories include items such as robotic arms, staplers, graspers, and suturing devices that are specifically designed for use with robotic systems. As the volume of abdominal surgeries performed with robotic assistance increases, so too does the need for reliable, high-quality instruments that can handle delicate tissue and minimize the risk of complications. The high cost of these instruments and their essential role in ensuring successful outcomes are expected to fuel this segment's rapid growth through 2030.

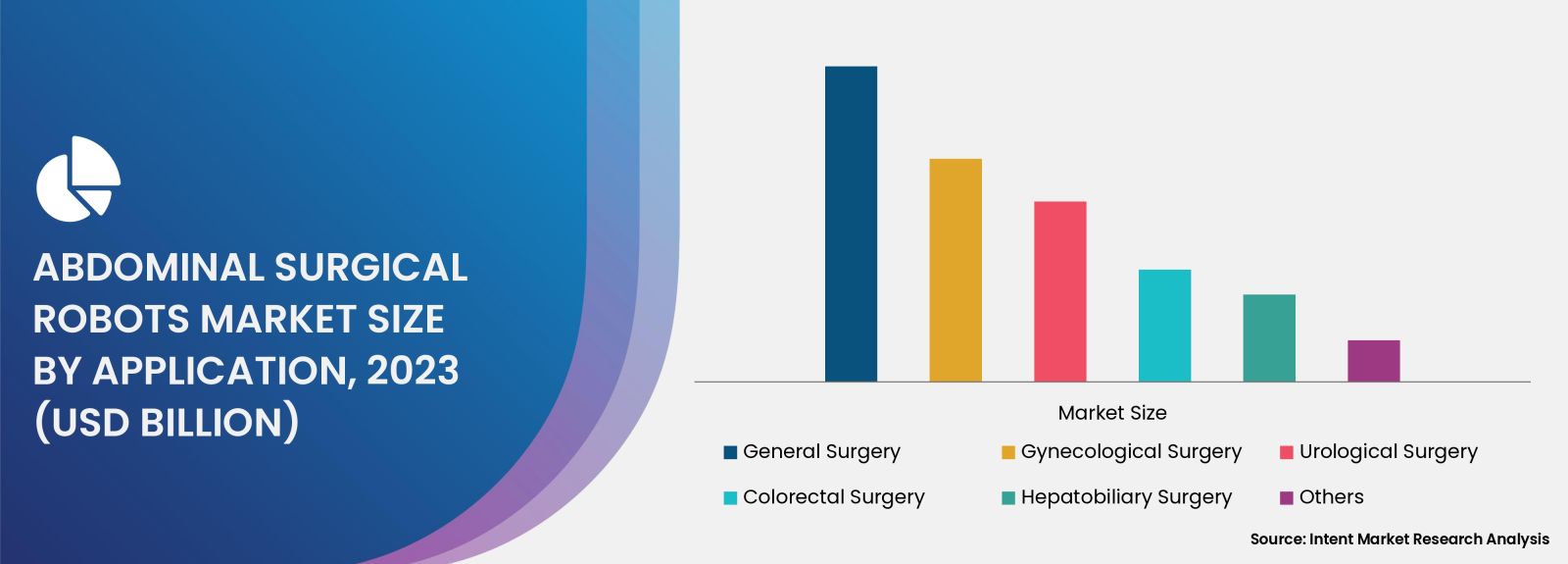

General Surgery Application Segment is the Largest Owing to Widespread Adoption

In terms of application, general surgery is the largest segment within the abdominal surgical robots market, accounting for a significant share. The versatility of robotic systems in performing a wide range of general surgeries, such as gallbladder removal, hernia repair, and appendectomies, has led to widespread adoption. Surgeons are increasingly relying on these systems to conduct routine abdominal procedures with greater precision and control, improving patient outcomes.

The growing number of patients suffering from obesity, gastrointestinal disorders, and other chronic conditions is also contributing to the demand for robotic-assisted general surgeries. Hospitals and surgical centers are embracing robotic solutions to enhance efficiency, reduce operating times, and limit post-operative recovery periods, which has established general surgery as the dominant application segment within the market.

Urology Surgery Segment Witnessing Fastest Growth Due to High Accuracy Requirements

The urology surgery segment is expected to experience the fastest growth during the forecast period. Urological procedures, such as prostatectomies and kidney surgeries, require a high degree of accuracy and precision, which makes robotic systems particularly valuable. These surgeries are often intricate and require delicate handling of organs and tissues, and the use of robotic systems can greatly enhance surgical outcomes.

Robotic systems have become a crucial tool for urologists, as they allow for minimally invasive surgeries with improved visualization and dexterity, leading to fewer complications and faster recovery times. As a result, the demand for abdominal surgical robots in urological surgeries is expected to increase significantly, especially in developed countries with advanced healthcare infrastructures.

Hospitals Segment is the Largest Owing to High Adoption Rates

When examining end-users, hospitals are the largest segment in the abdominal surgical robots market. Hospitals, particularly large medical centers and tertiary care institutions, have been the primary adopters of robotic systems due to their ability to manage high patient volumes and invest in advanced medical technologies. These facilities often have the resources to purchase, maintain, and operate complex robotic systems, enabling them to perform a wide array of abdominal surgeries.

The integration of robotic-assisted surgery into hospitals is also driven by the need to stay competitive in the healthcare sector. With patients increasingly seeking minimally invasive options, hospitals are investing in robotic systems to offer the latest surgical technologies, attracting both patients and skilled surgeons. The high initial cost of these systems is often offset by the long-term benefits, including improved patient outcomes and shorter hospital stays.

Ambulatory Surgical Centers Segment Growing Fastest Due to Cost-Effectiveness

The ambulatory surgical centers (ASCs) segment is forecast to grow at the fastest rate during the forecast period. ASCs offer a more cost-effective solution for outpatient surgeries compared to traditional hospital settings, making them an attractive option for patients and healthcare providers alike. The growing preference for minimally invasive surgeries, which typically require less recovery time, has contributed to the rise of ASCs as a significant user of robotic surgical systems.

ASCs can perform a variety of abdominal surgeries, and their lower operational costs make them an ideal setting for robotic-assisted procedures. Additionally, the convenience of same-day surgeries and quicker recovery times aligns with patient preferences, driving the demand for robotic solutions in these facilities.

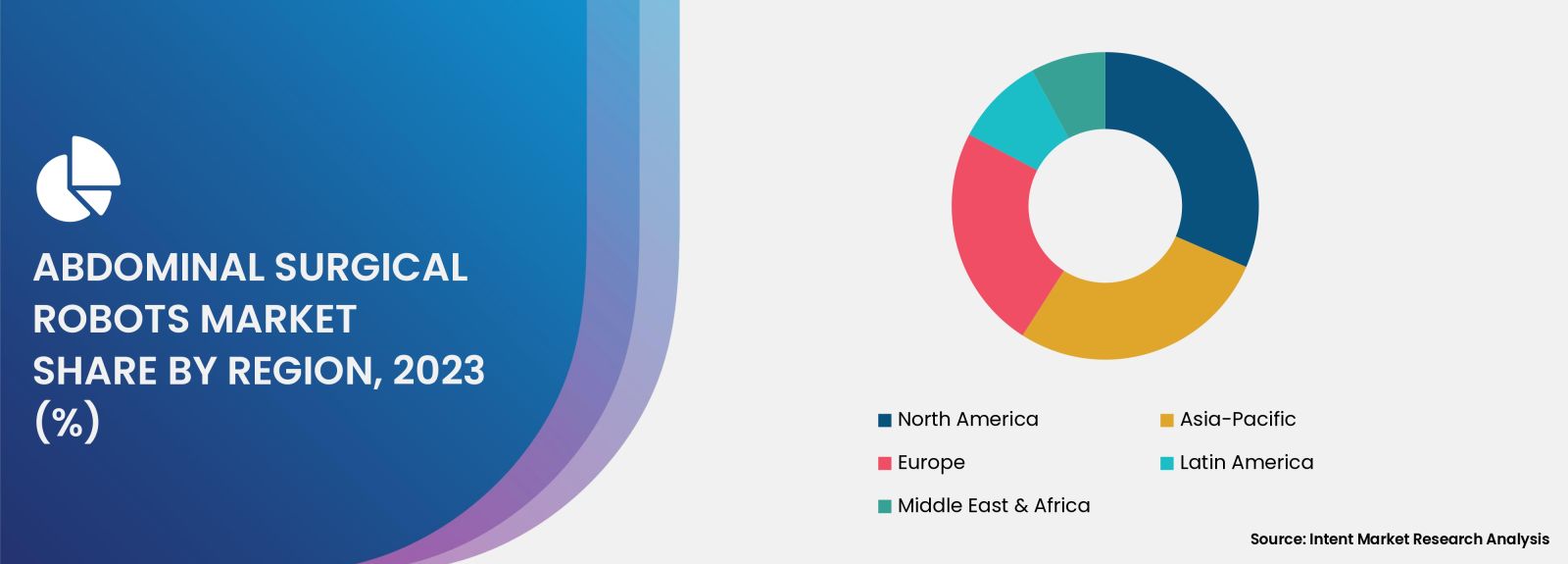

North America Region Leads Due to Advanced Healthcare Infrastructure

North America holds the largest share of the global abdominal surgical robots market, primarily due to its advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and the presence of key market players. The U.S., in particular, is a hub for innovation in robotic surgery, with a growing number of hospitals and surgical centers implementing robotic systems to improve surgical outcomes.

The region’s well-established reimbursement policies, increasing healthcare spending, and the rising prevalence of chronic diseases further bolster the market’s growth. Additionally, North America has a strong focus on research and development, with numerous clinical trials and innovations in robotic surgery technology being pioneered here. These factors combine to make North America the dominant regional market for abdominal surgical robots.

Competitive Landscape

The abdominal surgical robots market is highly competitive, with several major companies dominating the space. Leading players such as Intuitive Surgical, Medtronic, and Johnson & Johnson are at the forefront of technological advancements, continuously investing in research and development to enhance their robotic systems. These companies are expanding their product portfolios, forming strategic partnerships, and focusing on mergers and acquisitions to maintain their market position.

Intuitive Surgical’s da Vinci Surgical System remains the most widely used platform, but competitors are introducing innovative solutions to capture market share. The competitive landscape is characterized by a mix of established companies and emerging players, all vying to provide more cost-effective, efficient, and versatile robotic solutions for abdominal surgeries. As the market continues to evolve, companies that focus on innovation and collaboration are likely to maintain their competitive edge.

Report Objectives:

The report will help you answer some of the most critical questions in the Abdominal Surgical Robots Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Abdominal Surgical Robots Market?

- What is the size of the Abdominal Surgical Robots Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 3.6 billion |

|

Forecasted Value (2030) |

USD 20.2 billion |

|

CAGR (2024 – 2030) |

28.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Abdominal Surgical Robots Market By Component (Robotic Arms, Surgical Instruments, Imaging Systems, Software), By Application (General Surgery, Gynecological Surgery, Urological Surgery, Colorectal Surgery, Hepatobiliary Surgery), By End-User (Hospitals, Ambulatory Surgical Centers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Abdominal Surgical Robots Market, by Component (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Robotic Arms |

|

4.2. Surgical Instruments |

|

4.3. Imaging Systems |

|

4.4. Software |

|

4.5. Others |

|

5. Abdominal Surgical Robots Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. General Surgery |

|

5.2. Gynecological Surgery |

|

5.3. Urological Surgery |

|

5.4. Colorectal Surgery |

|

5.5. Hepatobiliary Surgery |

|

5.6. Others |

|

6. Abdominal Surgical Robots Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Hospitals |

|

6.2. Ambulatory Surgical Centers |

|

6.3. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Abdominal Surgical Robots Market, by Component |

|

7.2.7. North America Abdominal Surgical Robots Market, by Application |

|

7.2.8. North America Abdominal Surgical Robots Market, by End User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Abdominal Surgical Robots Market, by Component |

|

7.2.9.1.2. US Abdominal Surgical Robots Market, by Application |

|

7.2.9.1.3. US Abdominal Surgical Robots Market, by End User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Abbott Laboratories |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Asensus Surgical US, Inc. |

|

9.3. CONMED Corporation |

|

9.4. Ethicon US, LLC. |

|

9.5. Intuitive Surgical |

|

9.6. Medtronic |

|

9.7. Olympus America |

|

9.8. Siemens Medical Solutions USA, Inc. |

|

9.9. Stryker |

|

9.10. TransEnterix, Inc. |

|

9.11. Zimmer Biomet |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Abdominal Surgical Robots Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Abdominal Surgical Robots Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Abdominal Surgical Robots ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Abdominal Surgical Robots Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA