As per Intent Market Research, the 5G Edge Computing Market was valued at USD 03.4 billion in 2024-e and will surpass USD 15.9 billion by 2030; growing at a CAGR of 29.4% during 2024 - 2030.

The 5G edge computing market is poised for significant growth, fueled by the rapid deployment of 5G networks and the increasing demand for low-latency, high-speed computing at the edge of the network. Edge computing enables data processing closer to where it is generated, reducing the reliance on centralized cloud servers and minimizing latency. This is particularly critical for applications that require real-time data processing, such as autonomous vehicles, industrial IoT, and smart cities. The integration of edge computing with 5G technology is creating new opportunities for businesses to optimize performance, improve user experiences, and enable innovative services across various industries. As 5G networks expand globally, the demand for edge computing solutions is expected to grow, driving the market forward.

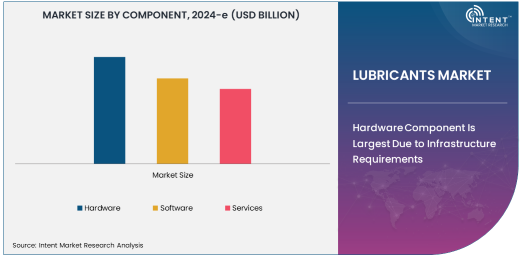

Hardware Component Is Largest Due to Infrastructure Requirements

The hardware component is the largest segment in the 5G edge computing market, primarily driven by the need for physical infrastructure to support edge computing environments. This includes edge servers, routers, gateways, and network equipment designed to handle high volumes of data processing at the network edge. As 5G networks are rolled out globally, the demand for hardware that can support the low-latency, high-speed requirements of 5G applications is increasing. The need for robust, scalable, and secure hardware solutions to ensure seamless data processing at the edge is crucial to the success of 5G edge computing deployments.

Moreover, edge computing hardware plays a key role in ensuring that devices and sensors in IoT ecosystems can operate efficiently by processing data locally. This minimizes the need for round-trip communication to centralized data centers, reducing delays and optimizing performance. The growth of 5G networks and the expanding IoT ecosystem are expected to drive continued demand for edge computing hardware in the coming years.

Cloud-Based Deployment Mode Is Fastest Growing Due to Flexibility and Scalability

The cloud-based deployment mode is the fastest growing in the 5G edge computing market, driven by its flexibility and scalability. In this model, edge computing services are hosted on cloud infrastructure, allowing businesses to scale their operations easily and access advanced computing resources without the need for significant upfront investments in on-premise hardware. Cloud-based edge computing enables organizations to leverage the power of 5G networks while benefiting from the cost-efficiency and scalability of cloud platforms.

As businesses continue to move toward digital transformation and cloud-first strategies, the demand for cloud-based solutions in edge computing is increasing. This deployment mode is particularly appealing to enterprises in industries such as healthcare, manufacturing, and retail, which require the ability to scale quickly and manage large volumes of real-time data. The cloud-based model also offers enhanced collaboration capabilities and centralized management, making it a preferred choice for organizations seeking to optimize their edge computing infrastructure.

Telecommunications End-Use Industry Is Largest Due to 5G Network Rollouts

The telecommunications industry is the largest end-use segment in the 5G edge computing market, driven by the widespread rollout of 5G networks. Telecommunication service providers are at the forefront of 5G edge computing deployments, as they are responsible for building and managing the 5G network infrastructure. The need for faster, more reliable connectivity and the demand for low-latency applications such as autonomous vehicles, industrial automation, and real-time communications are pushing telecom operators to implement edge computing solutions at the network edge.

Telecommunications companies are leveraging edge computing to enhance their service offerings and improve network performance. By processing data closer to the source, telecom providers can reduce network congestion, optimize bandwidth usage, and ensure more efficient delivery of services to end users. As the global demand for 5G services continues to rise, the telecommunications industry will remain a key driver of the 5G edge computing market.

Smart Cities Application Is Largest Due to Real-Time Data Requirements

The smart cities application is the largest segment in the 5G edge computing market, driven by the growing need for real-time data processing and decision-making in urban environments. Smart cities rely on edge computing to process vast amounts of data generated by sensors, cameras, and other IoT devices deployed throughout the city. These data streams are used to manage traffic, monitor air quality, optimize energy consumption, and enhance public safety, among other critical functions. The low latency and high-speed capabilities of 5G networks, combined with the distributed nature of edge computing, enable smart cities to operate more efficiently and respond to challenges in real-time.

As cities around the world invest in digital infrastructure to improve the quality of life for their citizens, the demand for 5G-enabled smart city solutions is growing. Edge computing enables the seamless integration of data from various sources, allowing city planners and administrators to make informed decisions quickly and effectively. The smart cities application is expected to continue driving the adoption of 5G edge computing solutions, particularly as more cities adopt IoT technologies and smart infrastructure.

North America Region Is Largest Due to Advanced Technological Adoption

North America is the largest region in the 5G edge computing market, largely due to the region’s advanced technological infrastructure and early adoption of 5G networks. The U.S. and Canada are at the forefront of 5G deployments, with telecom providers and enterprises actively investing in edge computing solutions to meet the demands of emerging applications such as autonomous vehicles, industrial IoT, and smart cities. North America’s well-established technology ecosystem, along with its focus on innovation and digital transformation, makes it the largest market for 5G edge computing solutions.

In addition, the region benefits from significant investments in research and development, particularly in the telecommunications and technology sectors, which are accelerating the rollout of 5G and edge computing capabilities. North America’s leadership in cloud services, coupled with the rapid deployment of 5G infrastructure, ensures that the region will continue to dominate the 5G edge computing market in the foreseeable future.

Leading Companies and Competitive Landscape

The 5G edge computing market is highly competitive, with several key players leading the way in the development and deployment of edge computing solutions. Major companies in the market include Microsoft, Amazon Web Services (AWS), Google, Intel, and Ericsson, all of which are actively investing in edge computing technologies and partnerships to expand their offerings. These companies are focusing on providing robust cloud platforms, networking equipment, and computing hardware that support 5G edge computing applications across various industries.

The competitive landscape is also shaped by telecommunications giants such as AT&T, Verizon, and China Mobile, who are integrating edge computing into their 5G networks to improve service delivery and optimize network performance. Companies in the 5G edge computing space are working on innovations such as AI-powered edge processing, low-latency communication solutions, and IoT integrations to differentiate their offerings. As the market continues to evolve, companies will focus on strategic partnerships, acquisitions, and technological advancements to capture market share and address the growing demand for 5G-enabled edge computing solutions.

Recent Developments:

- Nokia Corporation launched a new 5G Edge Computing solution to enhance network performance and enable next-gen applications across industries like automotive and healthcare.

- Cisco Systems, Inc. introduced an edge computing platform optimized for 5G networks to support real-time data processing and lower latency.

- IBM Corporation partnered with a leading telecommunications provider to deliver a 5G-enabled edge computing solution for industrial IoT applications.

- Qualcomm Technologies, Inc. announced a new 5G chip designed to enhance edge computing capabilities for autonomous vehicles and smart city applications.

- Microsoft Corporation expanded its Azure Edge platform to support 5G networks, enabling real-time analytics and improved security for various industries.

List of Leading Companies:

- Nokia Corporation

- Ericsson AB

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- IBM Corporation

- Microsoft Corporation

- Intel Corporation

- Qualcomm Technologies, Inc.

- Dell Technologies, Inc.

- Hewlett Packard Enterprise (HPE)

- VMware, Inc.

- Amazon Web Services (AWS)

- Oracle Corporation

- Fujitsu Limited

- ZTE Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.4 billion |

|

Forecasted Value (2030) |

USD 15.9 billion |

|

CAGR (2025 – 2030) |

29.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

5G Edge Computing Market By Component (Hardware, Software, Services), By Deployment Mode (On-Premise, Cloud-Based, Hybrid), By End-Use Industry (Telecommunications, Automotive, Healthcare, Energy & Utilities, Manufacturing, Retail), By Application (Smart Cities, Autonomous Vehicles, Industrial IoT, Augmented Reality/Virtual Reality, Real-Time Data Processing) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Nokia Corporation, Ericsson AB, Huawei Technologies Co., Ltd., Cisco Systems, Inc., IBM Corporation, Microsoft Corporation, Intel Corporation, Qualcomm Technologies, Inc., Dell Technologies, Inc., Hewlett Packard Enterprise (HPE), VMware, Inc., Amazon Web Services (AWS), Oracle Corporation, Fujitsu Limited, ZTE Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. 5G Edge Computing Market, by Component (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Hardware |

|

4.2. Software |

|

4.3. Services |

|

5. 5G Edge Computing Market, by Deployment Mode (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. On-Premise |

|

5.2. Cloud-Based |

|

5.3. Hybrid |

|

6. 5G Edge Computing Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Telecommunications |

|

6.2. Automotive |

|

6.3. Healthcare |

|

6.4. Energy & Utilities |

|

6.5. Manufacturing |

|

6.6. Retail |

|

6.7. Others |

|

7. 5G Edge Computing Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Smart Cities |

|

7.2. Autonomous Vehicles |

|

7.3. Industrial IoT |

|

7.4. Augmented Reality/Virtual Reality |

|

7.5. Real-Time Data Processing |

|

7.6. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America 5G Edge Computing Market, by Component |

|

8.2.7. North America 5G Edge Computing Market, by Deployment Mode |

|

8.2.8. North America 5G Edge Computing Market, by End-Use Industry |

|

8.2.9. North America 5G Edge Computing Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US 5G Edge Computing Market, by Component |

|

8.2.10.1.2. US 5G Edge Computing Market, by Deployment Mode |

|

8.2.10.1.3. US 5G Edge Computing Market, by End-Use Industry |

|

8.2.10.1.4. US 5G Edge Computing Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Nokia Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Ericsson AB |

|

10.3. Huawei Technologies Co., Ltd. |

|

10.4. Cisco Systems, Inc. |

|

10.5. IBM Corporation |

|

10.6. Microsoft Corporation |

|

10.7. Intel Corporation |

|

10.8. Qualcomm Technologies, Inc. |

|

10.9. Dell Technologies, Inc. |

|

10.10. Hewlett Packard Enterprise (HPE) |

|

10.11. VMware, Inc. |

|

10.12. Amazon Web Services (AWS) |

|

10.13. Oracle Corporation |

|

10.14. Fujitsu Limited |

|

10.15. ZTE Corporation |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the 5G Edge Computing Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the 5G Edge Computing Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the 5G Edge Computing Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA