As per Intent Market Research, the 5G Chipset Market was valued at USD 35.1 billion in 2023 and will surpass USD 95.9 billion by 2030; growing at a CAGR of 15.4% during 2024 - 2030.

The 5G chipset market is experiencing rapid growth as global telecommunications infrastructure upgrades to support the next generation of wireless networks. As 5G technology enables faster data speeds, lower latency, and the ability to connect millions of devices simultaneously, the demand for 5G chipsets has surged across various industries. With applications in smartphones, IoT devices, autonomous vehicles, and more.

The key drivers for this growth include increased investments in 5G infrastructure, rising demand for connected devices, and the expansion of smart city projects. In this market analysis, we will explore the fastest-growing or largest subsegments within each key segment of the 5G chipset market, covering device types, frequency bands, process nodes, and regions, and provide an overview of the competitive landscape.

Smartphones Segment is the Largest Owing to Increased Consumer Demand

Within the device type segment, smartphones represent the largest subsegment in the 5G chipset market. The adoption of 5G-enabled smartphones has grown exponentially, driven by consumer demand for faster mobile data speeds and enhanced connectivity. With leading smartphone manufacturers, such as Apple, Samsung, and Xiaomi, continuously launching new models equipped with 5G chipsets, this subsegment has become the primary revenue generator in the market.

Smartphones continue to be the dominant use case for 5G technology as users increasingly rely on mobile devices for streaming, gaming, and other data-intensive applications. This trend is expected to sustain the high demand for 5G chipsets in this subsegment through the forecast period. Additionally, emerging markets in Asia-Pacific and Latin America are seeing significant smartphone penetration, further boosting growth.

Sub-6 GHz Segment is the Fastest Growing Owing to Broad Commercial Rollouts

When examining the frequency band segment, the Sub-6 GHz band is the fastest-growing subsegment in the 5G chipset market. This frequency range is ideal for providing widespread 5G coverage, particularly in urban and suburban areas. Telecom operators worldwide have primarily focused on Sub-6 GHz bands for their initial 5G deployments, owing to its balance between coverage area and data transmission speeds.

As more countries expand their 5G networks, the demand for Sub-6 GHz chipsets is expected to rise rapidly. Although millimeter-wave (mmWave) chipsets offer faster speeds, Sub-6 GHz provides a more cost-effective solution for large-scale deployment, making it the preferred choice for telecom operators in many regions. This trend is likely to accelerate as 5G becomes more accessible to the general population, particularly in regions with dense urban populations.

7 nm Process Node is the Largest Owing to Power Efficiency and Performance

In the process node segment, the 7 nm process node holds the largest share of the 5G chipset market. Chipsets manufactured using the 7 nm process offer an optimal balance between performance and power efficiency, making them highly suitable for a wide range of 5G applications. Major chipset manufacturers such as Qualcomm, MediaTek, and Samsung are utilizing the 7 nm process to produce 5G chipsets that can power smartphones, IoT devices, and other connected applications.

The 7 nm process node's dominance is driven by its ability to deliver high processing power while keeping energy consumption relatively low. This is particularly important for battery-operated devices such as smartphones and wearables, where power efficiency is critical. As the demand for high-performance, energy-efficient 5G chipsets continues to grow, the 7 nm process node is expected to maintain its leadership in the market.

Consumer Electronics Segment is the Fastest Growing Owing to IoT and Wearables Expansion

Within the end-user segment, consumer electronics is the fastest-growing subsegment in the 5G chipset market. The proliferation of Internet of Things (IoT) devices and wearables, such as smartwatches, fitness trackers, and augmented reality (AR) glasses, is driving the demand for 5G chipsets. As these devices become more advanced, they require the faster data speeds and low latency that 5G networks provide.

Additionally, the growing popularity of smart home devices, such as smart speakers, security systems, and appliances, is further contributing to the demand for 5G chipsets in the consumer electronics sector. As consumers increasingly adopt connected devices, the 5G chipset market within this subsegment is expected to expand at a rapid pace over the forecast period.

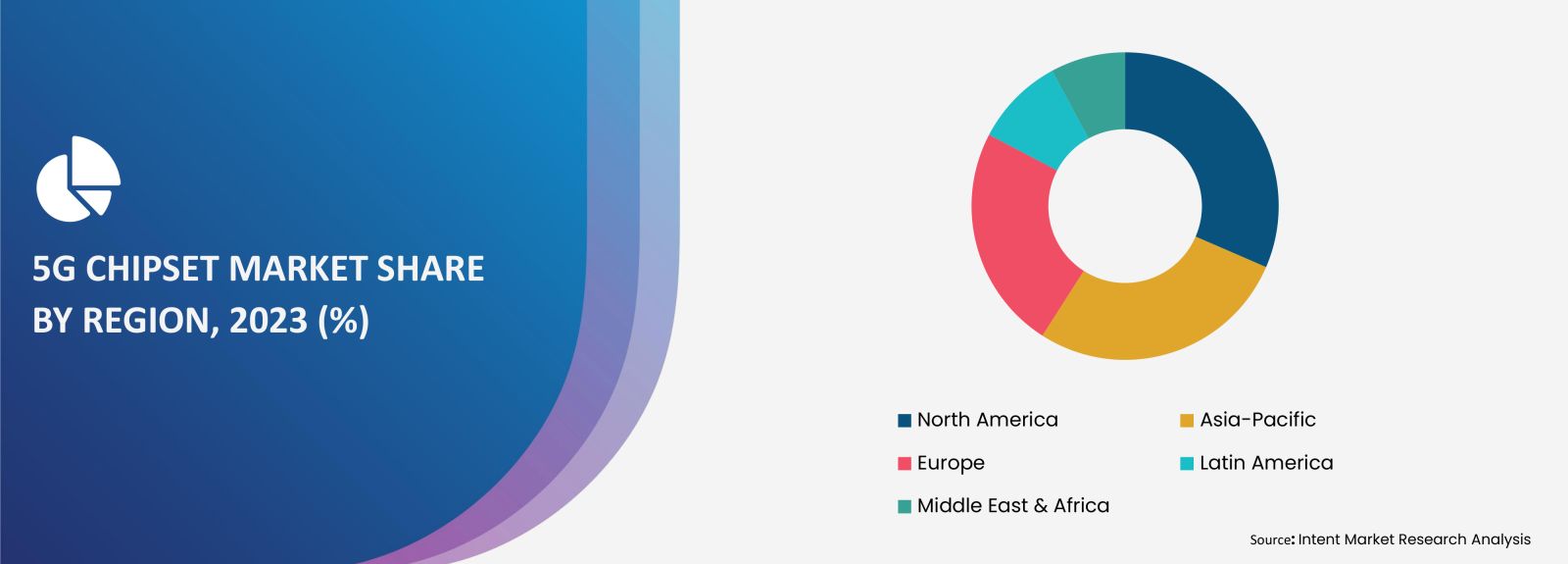

Asia-Pacific is the Largest Region Owing to Massive 5G Infrastructure Investments

Geographically, Asia-Pacific is the largest region in the 5G chipset market, accounting for a significant portion of global revenue. Countries such as China, South Korea, and Japan have been at the forefront of 5G network deployment, with extensive investments in infrastructure and technology. China, in particular, has made substantial progress in rolling out 5G networks across the country, supported by government initiatives and strong partnerships between telecom operators and technology companies.

The high demand for 5G-enabled devices in the region, combined with the rapid development of smart cities and industrial IoT applications, is expected to further drive the growth of the 5G chipset market in Asia-Pacific. The region's leadership in semiconductor manufacturing and consumer electronics production also contributes to its dominant position in the market. As 5G adoption continues to accelerate in the region, Asia-Pacific is expected to maintain its status as the largest market for 5G chipsets.

Competitive Landscape and Leading Companies

The 5G chipset market is highly competitive, with several key players dominating the landscape. Leading companies in the market include Qualcomm Technologies, Inc., MediaTek Inc., Samsung Electronics Co., Ltd., Intel Corporation, and Huawei Technologies Co., Ltd. These companies are continuously innovating to improve the performance, efficiency, and capabilities of their 5G chipsets, driving competition in the market.

The competitive landscape is characterized by partnerships and collaborations between telecom operators and chipset manufacturers, as well as strategic acquisitions to enhance 5G technology offerings. Companies are also investing heavily in research and development to advance chip technology and stay ahead in this fast-evolving market. As the demand for 5G technology grows, competition is expected to intensify, with companies striving to differentiate their products through innovations in performance, power efficiency, and application-specific features.

Report Objectives:

The report will help you answer some of the most critical questions in the 5G Chipset Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the 5G Chipset Market?

- What is the size of the 5G Chipset Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 35.1 billion |

|

Forecasted Value (2030) |

USD 95.9 billion |

|

CAGR (2024 – 2030) |

15.4% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

5G Chipset Market By Type (MODEMs, RFICs {RF Transceiver, RF FE}, By Frequency (Sub–6 GHz, 24–39 GHz, Above 39 GHz), By Process Node (Less Than 10 nm, 10–28 nm, Above 28 nm) By End-Use (Telecommunication Infrastructure, Non-Mobile Devices, Mobile Devices, Automobile) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. 5G Chipset Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. MODEMs |

|

4.2. RFICs |

|

4.2.1. RF TRANSCEIVER |

|

4.2.2. RF FE |

|

5. 5G Chipset Market, by Frequency (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Sub–6 GHz |

|

5.2. 24–39 GHz |

|

5.3. Above 39 GHz |

|

6. 5G Chipset Market, by Process Node (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Less Than 10 nm |

|

6.2. 10–28 nm |

|

6.3. Above 28 nm |

|

7. 5G Chipset Market, by End-Use (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Telecommunication Infrastructure |

|

7.1.1. Macro Cells |

|

7.1.2. Small Cell |

|

7.1.3. Customer Premises Equipment (CPE) |

|

7.2. Non-Mobile Devices |

|

7.2.1. IoT Gateways |

|

7.2.2. Surveillance Cameras |

|

7.3. Mobile Devices |

|

7.3.1. Smartphones |

|

7.3.2. Tablets & Laptops |

|

7.3.3. Mobile Hubs |

|

7.3.4. Robots / Drones |

|

7.3.5. Wearables |

|

7.3.6. AR / VR Devices |

|

7.4. Automobile |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America 5G Chipset Market, by Type |

|

8.2.7. North America 5G Chipset Market, by Frequency |

|

8.2.8. North America 5G Chipset Market, by Process Node |

|

8.2.9. North America 5G Chipset Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US 5G Chipset Market, by Type |

|

8.2.10.1.2. US 5G Chipset Market, by Frequency |

|

8.2.10.1.3. US 5G Chipset Market, by Process Node |

|

8.2.10.1.4. US 5G Chipset Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Analog Devices, Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Anokiwave, Inc |

|

10.3. Broadcom Inc. |

|

10.4. Huawei Technologies Co., Ltd. |

|

10.5. Marvell |

|

10.6. MediaTek |

|

10.7. NXP Semiconductors |

|

10.8. Qorvo, Inc. |

|

10.9. Qualcomm Technologies, Inc. |

|

10.10. Samsung |

|

10.11. Skyworks Solutions, Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the 5G Chipset Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the 5G Chipset Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the 5G Chipset ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the 5G Chipset Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA