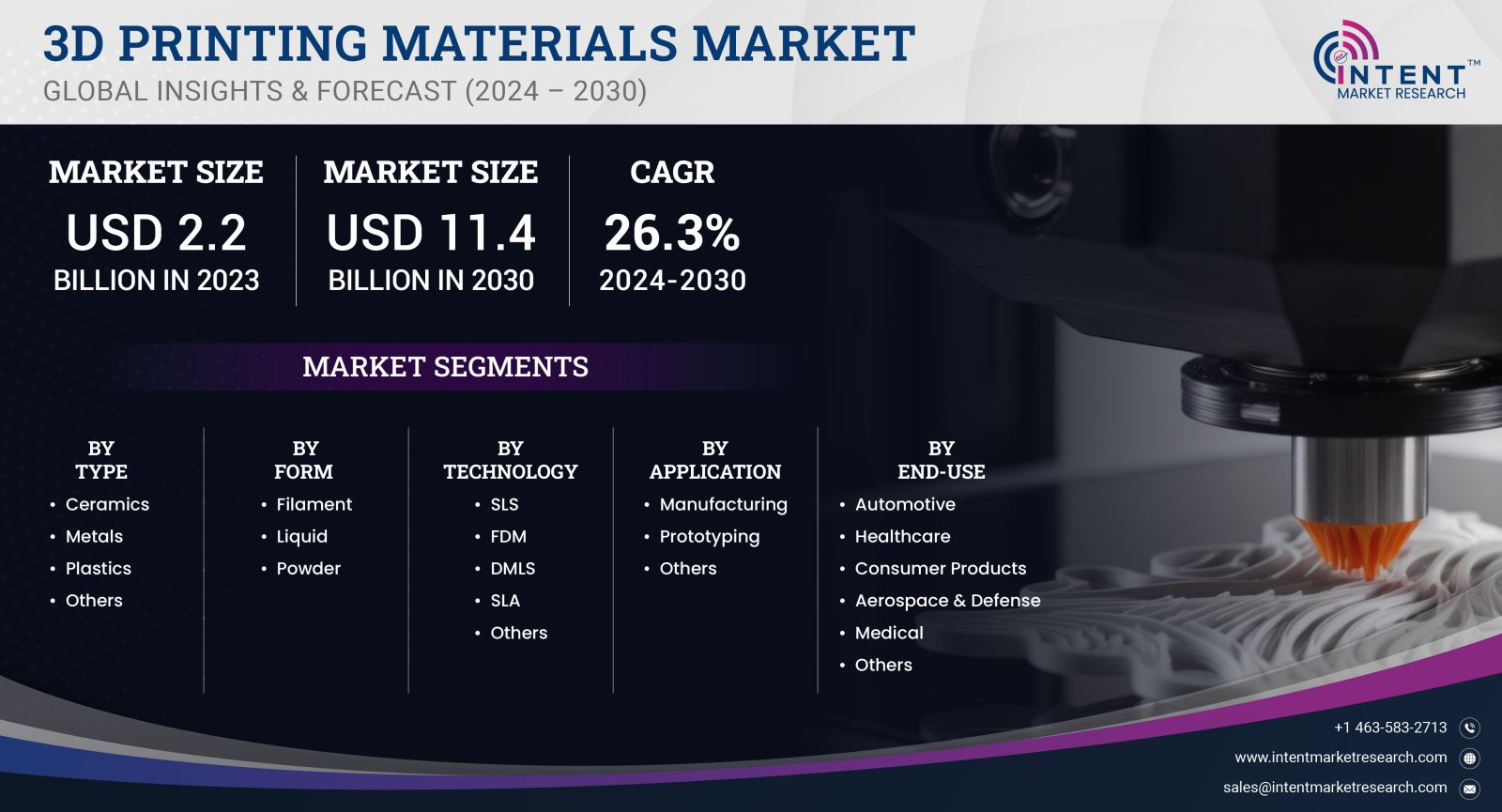

As per Intent Market Research, the 3D Printing Materials Market was valued at USD 2.2 billion in 2023-e and will surpass USD 11.4 billion by 2030; growing at a CAGR of 26.3% during 2024 - 2030.

The 3D printing materials market is expected to grow significantly between 2024 and 2030, driven by the increasing adoption of additive manufacturing (AM) technologies across various industries, including automotive, healthcare, aerospace, and consumer goods. As 3D printing technology continues to evolve, the demand for high-quality, cost-effective, and versatile materials is on the rise. These materials, ranging from plastics and metals to ceramics and composites, are used in diverse applications, such as rapid prototyping, end-use part production, and customized manufacturing. The growth of the market is also supported by advancements in material science, which are enabling the development of innovative materials with enhanced properties such as strength, flexibility, and heat resistance .With the expanding adoption of 3D printing in both industrial and consumer applications, the market for 3D printing materials is projected to witness a strong compound annual growth rate (CAGR) over the forecast period. Key factors contributing to this growth include the increasing demand for customized products, the rise of smart manufacturing processes, and advancements in research and development of specialized materials for 3D printing. The market will also benefit from ongoing innovations in printing technologies and materials that cater to specific industry needs, offering further opportunities for market players

Plastics Segment is Largest Owing to Versatility and Cost-Effectiveness

The plastics segment is the largest subsegment within the 3D printing materials market, owing to its versatility, wide availability, and cost-effectiveness. Plastics are used in a variety of 3D printing applications, ranging from rapid prototyping and model making to the production of functional parts and end-use products. Common plastic materials used in 3D printing include Acrylonitrile Butadiene Styrene (ABS), Polylactic Acid (PLA), Nylon, and Thermoplastic Polyurethane (TPU). These materials are particularly popular in industries such as automotive, consumer goods, and electronics, where lightweight, durable, and customizable parts are required.

The dominance of plastics in the 3D printing materials market is largely due to their ease of processing, wide range of mechanical properties, and relatively low cost compared to other materials like metals or ceramics. The versatility of plastics allows for a wide range of applications, from simple prototypes to functional components with intricate geometries. As the demand for customized products continues to rise, the plastics segment is expected to maintain its leadership position in the market throughout the forecast period. Moreover, ongoing advancements in biodegradable and bio-based plastics are further expanding the scope of their applications, driving growth in this segment.

Metal Segment is Fastest Growing Owing to Industrial Applications and Advanced Properties

The metals segment is the fastest-growing subsegment in the 3D printing materials market, primarily driven by the increasing adoption of metal 3D printing in industrial applications. Metals such as titanium, stainless steel, aluminum, and cobalt chrome are widely used in the aerospace, automotive, and healthcare sectors, where high-performance parts with superior strength, heat resistance, and durability are required. Metal 3D printing, also known as additive manufacturing of metals, allows manufacturers to produce complex and lightweight parts with reduced waste and enhanced material properties, which traditional manufacturing methods struggle to achieve.

The growth of the metals segment is largely attributed to the continued advancements in metal 3D printing technologies, such as Selective Laser Melting (SLM) and Direct Energy Deposition (DED), which enable the creation of intricate metal components with minimal post-processing. As industries such as aerospace and automotive continue to demand high-performance parts that are both lightweight and durable, metal 3D printing is gaining traction as a viable solution for producing end-use components, not just prototypes. The expanding use of metal 3D printing in the production of medical implants, tooling, and spare parts further drives the growth of the metal segment, making it the fastest-growing area in the 3D printing materials market.

North America Leads Market Share Owing to Strong Demand from Aerospace and Automotive Sectors

North America dominates the 3D printing materials market, driven by the strong demand for 3D printing solutions in industries such as aerospace, automotive, healthcare, and consumer goods. The U.S., in particular, has emerged as a leader in the adoption of 3D printing technologies, with widespread use of 3D printing across sectors like aerospace, automotive, and healthcare. The aerospace industry, in particular, is a major consumer of advanced 3D printing materials, especially metal powders for high-performance components used in aircraft manufacturing. Similarly, the automotive sector is increasingly adopting 3D printing for rapid prototyping, lightweight parts, and customized manufacturing.

North America's dominance in the 3D printing materials market is also supported by significant investments in research and development and the presence of leading 3D printing technology companies. The region's well-established manufacturing infrastructure, combined with favorable government policies and regulations, further fuels the adoption of 3D printing. As industries in North America continue to embrace Industry 4.0 and smart manufacturing practices, the region is expected to maintain its leadership position throughout the forecast period. Additionally, the growing demand for personalized medical devices, prosthetics, and implants in the healthcare sector will further contribute to the market's growth in North America.

Competitive Landscape and Key Players

The 3D printing materials market is highly competitive, with several key players dominating the landscape and continuously innovating to meet the growing demand for advanced materials. Major companies in the market include 3D Systems Corporation, Stratasys Ltd., Materialise NV, EOS GmbH, Renishaw plc, and Ultimaker, among others. These companies offer a wide range of 3D printing materials, including plastics, metals, ceramics, and composites, designed for various applications across industries such as aerospace, automotive, healthcare, and consumer goods.

The competitive dynamics of the market are driven by ongoing advancements in material science and 3D printing technologies. Key players are increasingly focusing on developing specialized materials with enhanced properties, such as improved strength, thermal resistance, and conductivity, to cater to the growing demands of high-performance applications in industries like aerospace and automotive. Moreover, partnerships and collaborations between 3D printing material manufacturers, technology providers, and end-users are becoming more common as companies strive to expand their product portfolios and gain a competitive edge.

As the market evolves, companies are also focusing on expanding their geographical reach and enhancing their customer service offerings. Strategic acquisitions and investments in R&D are essential for maintaining market leadership, with firms continuously striving to offer innovative materials that improve the overall efficiency and cost-effectiveness of the 3D printing process. With increasing demand for customized solutions and industrial-scale 3D printing, the competitive landscape is expected to remain dynamic, with companies vying for market share through technology innovation and strategic partnerships.

Report Objectives

The report will help you answer some of the most critical questions in the 3D Printing Materials Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the 3D Printing Materials market?

- What is the size of the 3D Printing Materials market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 2.2 billion |

|

Forecasted Value (2030) |

USD 11.4 billion |

|

CAGR (2024-2030) |

26.3% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

3D Printing Materials Market By Type (Ceramics, Metals, Plastics), By Form (Filament, Powder, Liquid), By Technology (SLS, FDM, DMLS, SLA), By Application (Manufacturing, Prototyping), By End-Use (Aerospace & Defense, Automotive, Consumer Products, Construction, Healthcare, Medical) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.3D Printing Materials Market, by Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Ceramics |

|

4.2.Metals |

|

4.3.Plastics |

|

4.4.Others |

|

5.3D Printing Materials Market, by Form (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Filament |

|

5.2.Liquid |

|

5.3.Powder |

|

6.3D Printing Materials Market, by Technology (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.SLS |

|

6.2.FDM |

|

6.3.DMLS |

|

6.4.SLA |

|

6.5.Others |

|

7.3D Printing Materials Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Manufacturing |

|

7.2.Prototyping |

|

7.3.Others |

|

8.3D Printing Materials Market, by End-Use (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Automotive |

|

8.2.Healthcare |

|

8.3.Consumer Products |

|

8.4.Aerospace & Defense |

|

8.5.Medical |

|

8.6.Construction |

|

8.7.Others |

|

9.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

9.1.Regional Overview |

|

9.2.North America |

|

9.2.1.Regional Trends & Growth Drivers |

|

9.2.2.Barriers & Challenges |

|

9.2.3.Opportunities |

|

9.2.4.Factor Impact Analysis |

|

9.2.5.Technology Trends |

|

9.2.6.North America 3D Printing Materials Market, by Type |

|

9.2.7.North America 3D Printing Materials Market, by Form |

|

9.2.8.North America 3D Printing Materials Market, by Technology |

|

9.2.9.North America 3D Printing Materials Market, by Application |

|

9.2.10.North America 3D Printing Materials Market, by End-Use |

|

*Similar segmentation will be provided at each regional level |

|

9.3.By Country |

|

9.3.1.US |

|

9.3.1.1.US 3D Printing Materials Market, by Type |

|

9.3.1.2.US 3D Printing Materials Market, by Form |

|

9.3.1.3.US 3D Printing Materials Market, by Technology |

|

9.3.1.4.US 3D Printing Materials Market, by Application |

|

9.3.1.5.US 3D Printing Materials Market, by End-Use |

|

9.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

9.4.Europe |

|

9.5.APAC |

|

9.6.Latin America |

|

9.7.Middle East & Africa |

|

10.Competitive Landscape |

|

10.1.Overview of the Key Players |

|

10.2.Competitive Ecosystem |

|

10.2.1.Platform Manufacturers |

|

10.2.2.Subsystem Manufacturers |

|

10.2.3.Service Providers |

|

10.2.4.Software Providers |

|

10.3.Company Share Analysis |

|

10.4.Company Benchmarking Matrix |

|

10.4.1.Strategic Overview |

|

10.4.2.Product Innovations |

|

10.5.Start-up Ecosystem |

|

10.6.Strategic Competitive Insights/ Customer Imperatives |

|

10.7.ESG Matrix/ Sustainability Matrix |

|

10.8.Manufacturing Network |

|

10.8.1.Locations |

|

10.8.2.Supply Chain and Logistics |

|

10.8.3.Product Flexibility/Customization |

|

10.8.4.Digital Transformation and Connectivity |

|

10.8.5.Environmental and Regulatory Compliance |

|

10.9.Technology Readiness Level Matrix |

|

10.10.Technology Maturity Curve |

|

10.11.Buying Criteria |

|

11.Company Profiles |

|

11.1.BASF |

|

11.1.1.Company Overview |

|

11.1.2.Company Financials |

|

11.1.3.Product/Service Portfolio |

|

11.1.4.Recent Developments |

|

11.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2.Höganäs AB |

|

11.3.3D Systems, Inc. |

|

11.4.General Electric |

|

11.5.Arkema |

|

11.6.Solvay |

|

11.7.Stratasys, Ltd. |

|

11.8.Evonik |

|

11.9.Henkel AG |

|

11.10.EnvisionTEC |

|

12.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the 3D Printing Materials Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the 3D Printing Materials Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the 3D printing materials ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the 3D printing materials market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates

NA

.jpg)