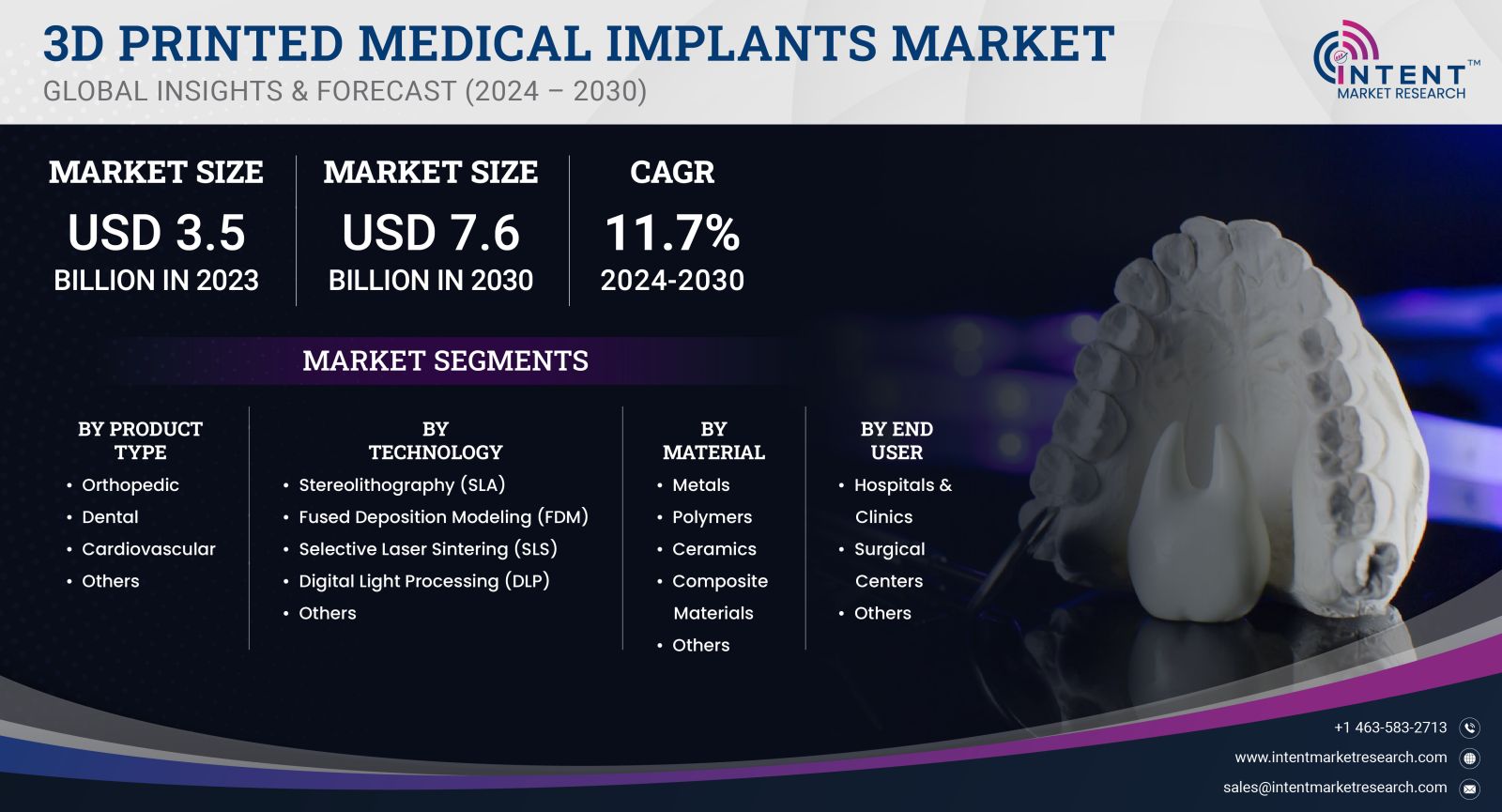

As per Intent Market Research, the 3D Printed Medical Implants Market was valued at USD 3.5 billion in 2023 and will surpass USD 7.6 billion by 2030; growing at a CAGR of 11.7% during 2024 - 2030.

The 3D printed medical implants market is poised for significant growth over the forecast period from 2024 to 2030. This market is driven by advancements in additive manufacturing technologies, which have revolutionized the healthcare sector by enabling the production of custom implants tailored to individual patients. 3D printing allows for greater precision in implant design, faster production times, and reduced overall costs, making it a highly attractive alternative to traditional manufacturing methods. Moreover, 3D printing in medical implants is particularly beneficial in complex surgeries, such as orthopedic, dental, and cranial surgeries, where customized implants can lead to better patient outcomes. The growing prevalence of chronic diseases, an aging population, and increasing demand for personalized healthcare are key factors driving the demand for 3D printed medical implants.. As the technology continues to mature, the scope of 3D printing in medical implants is expected to expand, opening up new applications and boosting market growth across various healthcare sectors.

Orthopedic Implants Segment is Largest Owing to High Demand for Customization and Precision

The orthopedic implants segment is the largest within the 3D printed medical implants market, driven by the growing demand for customized implants and the increasing prevalence of bone-related disorders. In orthopedics, 3D printing is particularly valuable as it allows for the creation of patient-specific implants, such as joint replacements, bone plates, and spinal implants, that are tailored to the unique anatomy of the patient. Traditional implant manufacturing processes often result in implants that are standardized in shape and size, which may not fit patients' individual needs. 3D printing addresses this limitation by offering a high degree of customization and precision, leading to better post-surgery recovery and fewer complications.

Additionally, the rising number of orthopedic surgeries, such as knee and hip replacements, due to an aging population and an increasing incidence of osteoporosis, arthritis, and bone fractures is fueling the demand for these implants. As the technology matures, innovations in 3D printed biomaterials, such as titanium alloys and polymers that mimic the mechanical properties of bone, are further contributing to the growth of the orthopedic implants subsegment. With continued advancements in 3D printing and the potential for reducing surgery time and improving recovery rates, the orthopedic implants segment is expected to maintain its dominance throughout the forecast period.

Dental Implants Segment is Fastest Growing Owing to Personalized Solutions and Aesthetic Appeal

The dental implants segment is the fastest-growing subsegment within the 3D printed medical implants market, driven by the increasing demand for customized dental solutions and the focus on aesthetic outcomes. 3D printing technology allows for the creation of highly personalized dental implants that perfectly match the patient’s oral anatomy, which is particularly important in dental restoration procedures. This includes implants, crowns, bridges, dentures, and other dental prosthetics that are tailored to provide better functionality and appearance. As dental patients seek more natural-looking and comfortable alternatives to traditional dental solutions, the demand for 3D printed dental implants continues to surge.

Moreover, advancements in 3D printing materials, such as biocompatible resins and metal alloys, have significantly enhanced the quality and longevity of dental implants. The increased affordability of 3D printing technology and the growing number of dental procedures performed globally are contributing factors to the segment’s rapid growth. With the rise in cosmetic dental procedures, as well as the increasing awareness of the benefits of personalized dental implants, this subsegment is projected to experience strong growth during the 2024-2030 period.

North America Leads Market Share Owing to Strong Healthcare Infrastructure and Adoption of Advanced Technologies

North America holds the largest market share in the 3D printed medical implants market, primarily driven by the region's strong healthcare infrastructure, high adoption of advanced technologies, and significant investment in research and development. The U.S., in particular, is a global leader in the use of 3D printing for medical implants, with numerous hospitals, research institutions, and companies involved in the development and production of 3D printed medical devices. North America's mature healthcare system, high healthcare spending, and the presence of key players in the medical device industry have facilitated rapid adoption of 3D printing technologies for the production of custom medical implants.

The regulatory environment in North America, particularly the U.S. Food and Drug Administration (FDA), has also played a crucial role in enabling the market's growth by granting approvals for various 3D printed medical implants, further encouraging their use in clinical settings. Furthermore, the increasing number of clinical trials and research initiatives focused on exploring new materials and 3D printing techniques is expected to continue driving growth in the region. As a result, North America is expected to maintain its dominance throughout the forecast period, with strong growth prospects for 3D printed medical implants.

Competitive Landscape and Key Players

The 3D printed medical implants market is highly competitive, with numerous players focusing on innovation, material science, and regulatory compliance to stay ahead. Key players in this market include Stratasys Ltd., Materialise NV, 3D Systems, Stryker Corporation, Zimmer Biomet, and EOS GmbH, among others. These companies are investing heavily in the development of advanced 3D printing technologies and biocompatible materials to meet the growing demand for personalized and high-performance medical implants.

Strategic partnerships, collaborations, and acquisitions are common in the industry as companies aim to expand their technological capabilities and product offerings. For instance, partnerships with hospitals and medical device manufacturers are enabling 3D printing companies to enhance their product validation processes and accelerate the commercialization of their implants. Additionally, companies are focusing on obtaining necessary certifications and regulatory approvals, particularly from the FDA and European Medicines Agency (EMA), to ensure that their 3D printed implants meet stringent safety and quality standards.

The competitive landscape also reflects the increasing focus on offering a wide range of 3D printed medical implants across multiple applications, including orthopedics, dental, and cranial implants. As the market continues to evolve, companies are prioritizing R&D efforts to create next-generation implant materials that offer improved biocompatibility, functionality, and performance, which is likely to define the competitive dynamics of the market.

Report Objectives:

The report will help you answer some of the most critical questions in the 3D Printed Medical Implants Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the 3D Printed Medical Implants Market?

- What is the size of the 3D Printed Medical Implants Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 3.5 billion |

|

Forecasted Value (2030) |

USD 7.6 billion |

|

CAGR (2024 – 2030) |

11.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

3D Printed Medical Implants Market By Product Type (Orthopedic, Dental, Cardiovascular), By Technology (SLA, FDM, SLS, DLP), By Material (Metals, Polymers, Ceramics, Composite Materials), and By End User (Hospitals & Clinics, Surgical Centers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. 3D Printed Medical Implants Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Orthopedic |

|

4.1.1. Joint Implants |

|

4.1.2. Spinal Implants |

|

4.1.3. Bone Plates and Screws |

|

4.2. Dental |

|

4.2.1. Endosteal Implants |

|

4.2.2. Subperiosteal Implants |

|

4.2.3. Zygomatic Implants |

|

4.3. Cardiovascular |

|

4.3.1. Stents |

|

4.3.2. Heart Valves |

|

4.4. Others |

|

5. 3D Printed Medical Implants Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Stereolithography (SLA) |

|

5.2. Fused Deposition Modeling (FDM) |

|

5.3. Selective Laser Sintering (SLS) |

|

5.4. Digital Light Processing (DLP) |

|

5.5. Others |

|

6. 3D Printed Medical Implants Market, by Material (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Metals |

|

6.2. Polymers |

|

6.3. Ceramics |

|

6.4. Composite Materials |

|

6.5. Others |

|

7. 3D Printed Medical Implants Market, by End User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Hospitals & Clinics |

|

7.2. Surgical Centers |

|

7.3. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America 3D Printed Medical Implants Market, by Product Type |

|

8.2.7. North America 3D Printed Medical Implants Market, by Technology |

|

8.2.8. North America 3D Printed Medical Implants Market, by Material |

|

8.2.9. North America 3D Printed Medical Implants Market, by End User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US 3D Printed Medical Implants Market, by Product Type |

|

8.2.10.1.2. US 3D Printed Medical Implants Market, by Technology |

|

8.2.10.1.3. US 3D Printed Medical Implants Market, by Material |

|

8.2.10.1.4. US 3D Printed Medical Implants Market, by End User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. 3D Systems |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Allevi, Inc. |

|

10.3. B. Braun |

|

10.4. EOS GmbH |

|

10.5. Formlabs |

|

10.6. GE Additive |

|

10.7. HP Inc. |

|

10.8. Materialise |

|

10.9. Medtronic |

|

10.10. Renishaw |

|

10.11. Smith & Nephew |

|

10.12. Stratasys |

|

10.13. Stryker |

|

10.14. Xilloc Medical |

|

10.15. Zimmer Biomet |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the 3D Printed Medical Implants Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the 3D Printed Medical Implants Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the 3D Printed Medical Implants ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the 3D Printed Medical Implants Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA