As per Intent Market Research, the 3D Food Printing Market was valued at USD 231.5 million in 2023 and will surpass USD 2,153.2 million by 2030; growing at a CAGR of 37.5% during 2024 - 2030.

Between 2024 and 2030, the CAGR of the 3D food printing market is expected to remain strong, driven by technological advancements, increasing investments from the food industry, and rising consumer demand for convenience and novelty in food products. This market is anticipated to witness continued growth, with applications expanding across sectors such as commercial food production, the hospitality industry, home-based printing solutions, and even personalized nutrition. The market dynamics are influenced by the convergence of culinary arts with cutting-edge technologies, and are expected to pave the way for next-generation food experiences.

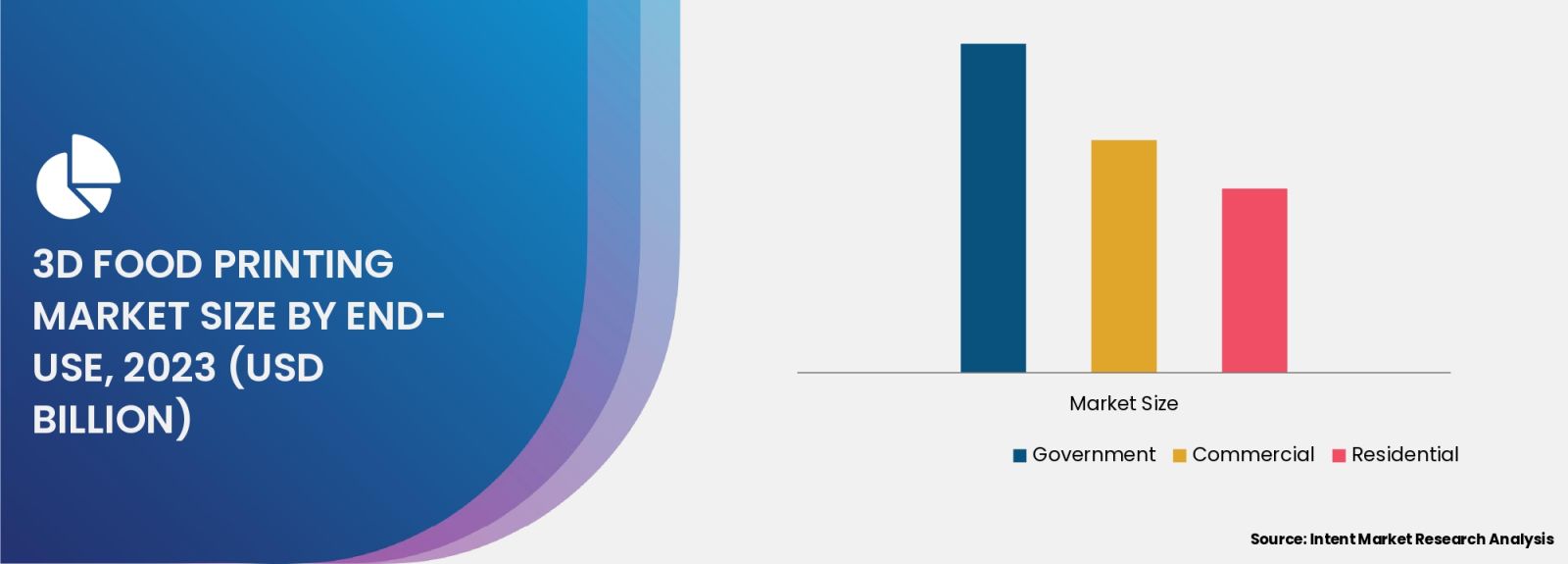

Commercial Food Printing Segment is Largest Owing to Mass Customization and Innovation

The Commercial Food Printing segment is the largest within the 3D food printing market, driven by the growing demand for personalized food products and the ability to streamline food production processes. Commercial establishments, such as restaurants, hotels, and bakeries, are increasingly adopting 3D food printing technologies to differentiate their offerings and cater to niche customer demands. This is particularly important in the foodservice industry, where customization and innovation are key differentiators in a highly competitive market.

The ability to print food in unique shapes, sizes, and textures allows businesses to create visually appealing dishes that stand out in a crowded market. Additionally, 3D food printing helps optimize production efficiency by reducing food waste, particularly in high-volume commercial settings. This technology enables faster preparation times and reduced reliance on manual labor. As consumer preferences for personalized and visually exciting foods continue to rise, the commercial food printing segment is expected to lead the market’s growth during the forecast period.

Home-Based Food Printing Segment is Fastest Growing Owing to Increasing Consumer Adoption

The Home-Based Food Printing segment is the fastest growing within the 3D food printing market, driven by increased interest in personalized and DIY food preparation at the consumer level. As 3D printing technology becomes more accessible, home-based food printers are gaining popularity among food enthusiasts and technology-savvy consumers. These printers allow individuals to create custom-designed food items, experiment with new textures, and even cater to specific dietary needs from the comfort of their own kitchens.

The rise of social media and the "foodie" culture has significantly contributed to the growing demand for innovative and visually appealing food items, which is fueling consumer adoption of 3D food printers for personal use. These printers are particularly attractive to health-conscious consumers, as they enable the creation of customized nutrition profiles, such as gluten-free, plant-based, or low-calorie foods. As the price of 3D food printers for home use continues to decrease and consumer awareness rises, this segment is expected to experience rapid growth, with increasing adoption rates through 2030.

Printing Materials Segment is Largest Owing to Expanding Ingredient Options

The Printing Materials segment is one of the largest within the 3D food printing market, driven by the diverse range of ingredients that can be used to print food. Traditionally, 3D food printers have utilized simple materials like dough, chocolate, and sugar, but the scope of printable ingredients is expanding rapidly. The market now includes a wide variety of materials, including plant-based proteins, pureed vegetables, and even meat pastes, reflecting the increasing demand for plant-based and alternative protein sources in the food industry.

This segment's growth is largely fueled by innovation in food science and the development of new edible materials that can be used in 3D food printers. For example, ingredients like algae-based proteins, sustainable carbohydrates, and lab-grown meats are being adapted for 3D food printing, enabling the creation of novel and eco-friendly food items. Furthermore, companies are working to improve the texture, taste, and nutritional content of these materials to make them more suitable for mass consumption. As the variety of available printing materials continues to expand, this segment is expected to drive the overall market growth.

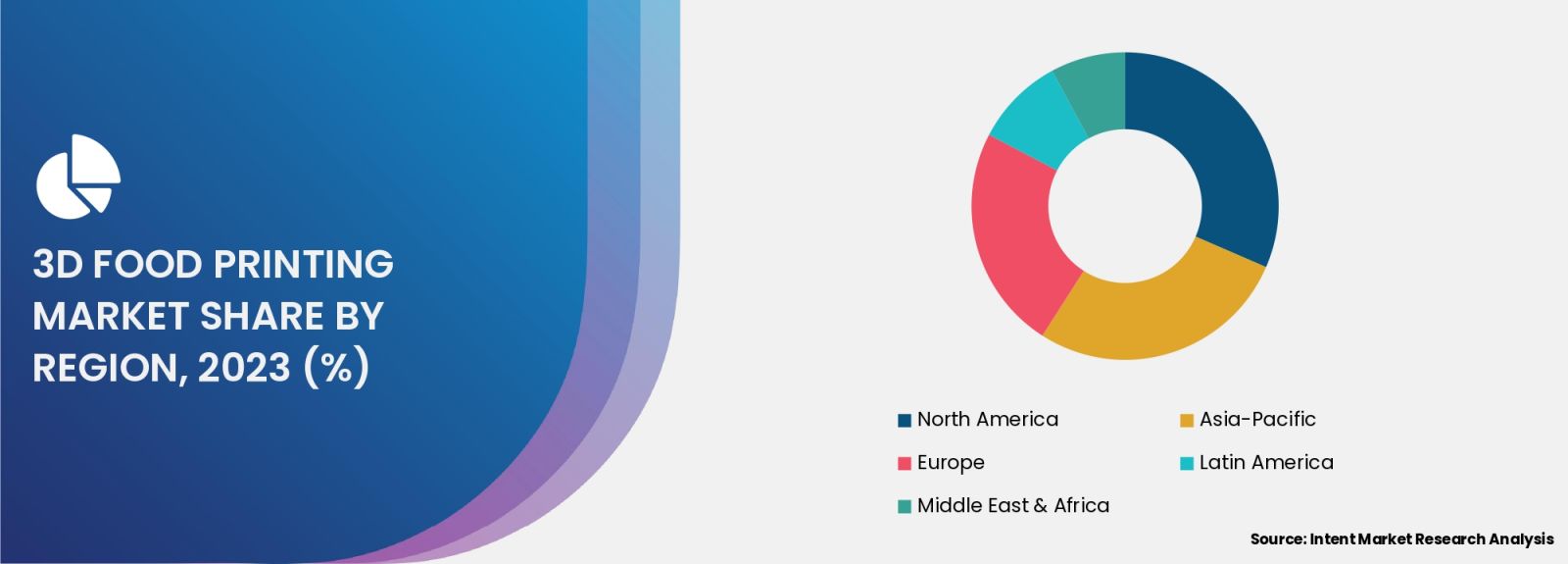

North America Region is Largest Owing to Strong Demand from Innovation and Sustainability Initiatives

North America is the largest region for the 3D food printing market, supported by significant investments in research and development, as well as growing consumer demand for sustainable and personalized food solutions. The United States, in particular, is home to several startups and established companies that are leading innovations in 3D food printing technologies. The region's strong focus on food innovation, technological advancement, and sustainability is driving the adoption of 3D food printing both in commercial settings and for home use.

In addition, the increasing popularity of plant-based foods and the demand for customization in food products are key drivers of the 3D food printing market in North America. Companies in the region are exploring the use of 3D printing for alternative proteins, sustainable ingredients, and personalized nutrition. Government initiatives aimed at enhancing food security and sustainability are also contributing to the growth of this market. As the region continues to lead in both technological development and consumer demand for innovative food solutions, North America is expected to maintain its position as the largest market for 3D food printing through 2030.

Asia Pacific Region is Fastest Growing Owing to Growing Investment in Food Technology

The Asia Pacific (APAC) region is the fastest growing market for 3D food printing, driven by increasing investment in food technology and growing interest in personalized and on-demand food production. In countries like China, Japan, and India, there is a burgeoning demand for innovative food solutions, particularly in urban areas where consumers are seeking more convenience, customization, and eco-friendly alternatives in their diets. The rise of the middle class, along with increasing disposable incomes and changing consumer habits, is further contributing to the demand for 3D food printing technologies in the region.

In particular, Japan has emerged as a leader in food technology innovation, with several local companies pioneering the use of 3D printing for food production. Additionally, the growing focus on sustainability and reducing food waste in APAC countries is driving the adoption of 3D food printing as a means of optimizing ingredient use and minimizing food loss. As the region continues to urbanize and adopt new food technologies, APAC is expected to witness the fastest growth in the 3D food printing market.

Leading Companies and Competitive Landscape

The 3D Food Printing Market is characterized by the presence of both established players and emerging startups. Key companies include TNO (Netherlands Organization for Applied Scientific Research), Natural Machines, ByFlow, 3D Systems, Print2Taste, and BeeHex, which are at the forefront of developing 3D food printing technologies. These companies are driving innovation by focusing on the development of user-friendly, customizable 3D printers, expanding the range of printable materials, and enhancing the scalability of 3D food printing for commercial use.

The competitive landscape is also shaped by the growing number of partnerships and collaborations between food manufacturers, technology companies, and research institutions. Leading companies are investing heavily in R&D to improve the efficiency and functionality of 3D food printers, reduce the cost of equipment for both commercial and home use, and expand the range of printable ingredients. As the market continues to mature, competition is expected to intensify, with companies focusing on differentiation through technological innovation, new product offerings, and strategic alliances.

Report Objectives:

The report will help you answer some of the most critical questions in the 3D Food Printing Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the 3D Food Printing Market?

- What is the size of the 3D Food Printing Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 231.5 million |

|

Forecasted Value (2030) |

USD 2,153.2 million |

|

CAGR (2024 – 2030) |

37.5% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

3D Food Printing Market By Ingredient (Dough, Fruits and Vegetables, Proteins, Sauces, Dairy Products, Carbohydrates), By Technology (Extrusion-Based Printing, Binder Jetting, Selective Laser Sintering, Inkjet Printing), By End-Use (Government, Commercial, Residential) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. 3D Food Printing Market, by Ingredient (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Dough |

|

4.2. Fruits and Vegetables |

|

4.3. Proteins |

|

4.4. Sauces |

|

4.5. Dairy Products |

|

4.6. Carbohydrates |

|

4.7. Others |

|

5. 3D Food Printing Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Extrusion-Based Printing |

|

5.2. Binder Jetting |

|

5.3. Selective Laser Sintering |

|

5.4. Inkjet Printing |

|

6. 3D Food Printing Market, by End-Use (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Government |

|

6.2. Commercial |

|

6.3. Residential |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America 3D Food Printing Market, by Ingredient |

|

7.2.7. North America 3D Food Printing Market, by Technology |

|

7.2.8. North America 3D Food Printing Market, by End-Use |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US 3D Food Printing Market, by Ingredient |

|

7.2.9.1.2. US 3D Food Printing Market, by Technology |

|

7.2.9.1.3. US 3D Food Printing Market, by End-Use |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. 3D Systems |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Barilla |

|

9.3. BeeHex Automation |

|

9.4. byFlow B.V. |

|

9.5. CandyFab |

|

9.6. Choc Edge |

|

9.7. Novameat |

|

9.8. Procusini |

|

9.9. TNO |

|

9.10. Wiibox |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the 3D Food Printing Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the 3D Food Printing Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the 3D Food Printing ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the 3D Food Printing Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

.jpg)