As per Intent Market Research, the 3D Animation Software Market was valued at USD 21.6 billion in 2023 and will surpass USD 40.2 billion by 2030; growing at a CAGR of 9.3% during 2024 - 2030.

The 3D Animation Software Market is experiencing robust growth, driven by the increasing demand for advanced visual effects in various industries, including entertainment, gaming, and advertising. As businesses recognize the value of engaging visual content to capture consumer attention, the need for sophisticated 3D animation tools has escalated. This market is characterized by rapid technological advancements and the integration of artificial intelligence and machine learning, which have enhanced the capabilities of 3D animation software.

The base year for this analysis is 2024, providing a current perspective on market dynamics and growth potential. As industries continue to evolve, the adoption of 3D animation software is becoming increasingly prevalent, and key players are innovating to meet the demands of a growing customer base. This comprehensive overview will delve into various market segments, highlighting significant subsegments that contribute to overall market growth.

Software Segment is Largest Owing to Demand in Media & Entertainment

The software segment of the 3D animation software market is the largest, driven by the burgeoning media and entertainment industry. The demand for high-quality animated content in movies, television, and online platforms has surged, leading to a greater reliance on advanced software solutions. These tools not only streamline the animation process but also provide animators with the ability to create intricate designs and lifelike characters, significantly enhancing storytelling capabilities. Major software such as Autodesk Maya, Blender, and Cinema 4D are at the forefront, offering cutting-edge features that cater to professional animators and studios.

In this segment, the demand for character animation software is particularly noteworthy. This subsegment is gaining traction as it allows creators to breathe life into characters through detailed motion and expression control. The rise of animated films and series, coupled with the growth of independent game developers, has fueled the demand for character animation tools, positioning this subsegment for sustained growth. As a result, companies are focusing on refining user interfaces and incorporating user-friendly features to attract a broader audience of creators.

Services Segment is Fastest Growing Owing to Rising Training Needs

The services segment of the 3D animation software market is the fastest-growing, primarily due to the increasing demand for training and support services. As more businesses and individuals enter the realm of 3D animation, the need for comprehensive training programs and technical support has escalated. This trend is particularly pronounced among small to medium-sized enterprises (SMEs) and freelance animators, who may require assistance in mastering complex software applications. Consequently, many service providers are developing tailored training modules and workshops to meet this demand, fostering a skilled workforce in the industry.

Consultation services within this segment are also expanding rapidly. As companies seek to implement 3D animation into their workflows, consulting services can offer valuable insights into best practices and software integration. This growth is further propelled by the increasing complexity of projects that require expertise in various animation techniques and software tools. As more industries recognize the potential of 3D animation, the demand for expert guidance and tailored solutions will continue to rise, solidifying the services segment's status as a key growth driver.

Hardware Segment is Largest Owing to Enhanced Performance Needs

The hardware segment in the 3D animation software market is the largest, reflecting the essential role that powerful computing devices play in the animation process. High-performance workstations equipped with advanced graphics cards are critical for handling the demanding workloads associated with 3D rendering and animation. The increasing complexity of 3D models and animations necessitates robust hardware solutions that can deliver exceptional performance without lag, thereby ensuring a seamless creative process for animators.

Within this segment, graphics processing units (GPUs) represent the largest subsegment. The rise in rendering demands has driven significant innovation in GPU technology, enabling faster processing speeds and enhanced rendering capabilities. Major hardware manufacturers are continually developing more powerful GPUs to cater to the needs of professional animators and studios. As the demand for real-time rendering and virtual reality experiences grows, the reliance on high-quality GPUs will only increase, positioning this subsegment as a cornerstone of the 3D animation ecosystem.

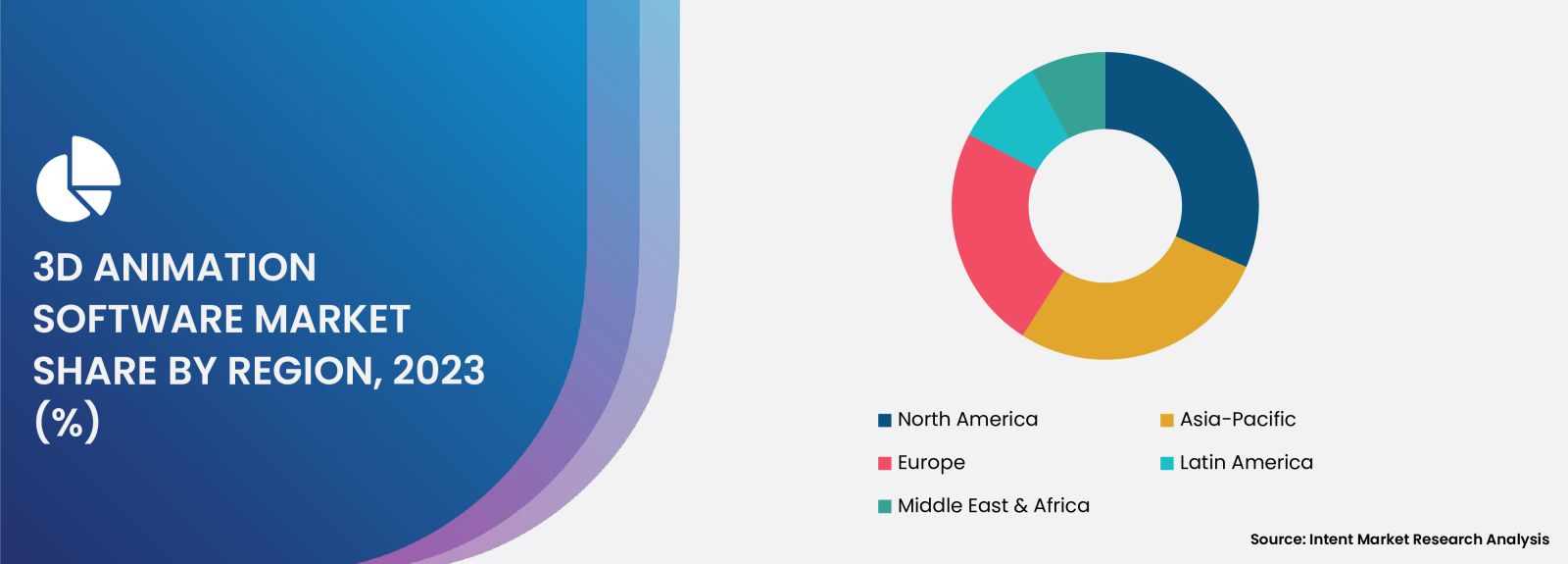

Geographical Insights: North America is the Largest Region Owing to Technological Advancements

North America is the largest region in the 3D animation software market, primarily due to its advanced technological infrastructure and a strong presence of key players in the media and entertainment industry. The region is home to numerous animation studios and production houses, which drive the demand for high-quality 3D animation software and hardware. Additionally, the increasing adoption of 3D animation in various sectors, such as advertising, gaming, and virtual reality, has further bolstered the market in North America.

The United States stands out as a significant contributor to this market, with major companies like Pixar, DreamWorks, and Adobe operating within its borders. Furthermore, the region's emphasis on innovation and research & development fosters an environment conducive to technological advancements in animation. As the demand for immersive experiences continues to grow, North America is expected to maintain its dominance in the 3D animation software market throughout the forecast period.

Competitive Landscape and Leading Companies

The competitive landscape of the 3D animation software market is characterized by a mix of established players and emerging startups. Key companies such as Autodesk, Adobe Systems, and Blender Foundation dominate the market, leveraging their extensive experience and technological prowess to deliver innovative solutions. These companies are continually investing in research and development to enhance their software capabilities and cater to the evolving needs of their customers.

Additionally, the market is witnessing a surge in smaller companies offering specialized tools and services, fostering a dynamic competitive environment. Epic Games, with its Unreal Engine, has gained significant traction in the gaming and film sectors, providing powerful real-time rendering capabilities. As the market continues to evolve, collaboration and partnerships between software developers and industry stakeholders will be crucial for driving innovation and maintaining a competitive edge. Overall, the 3D animation software market is poised for substantial growth, driven by technological advancements, increasing demand for high-quality content, and a diverse range of applications across various industries.

Report Objectives:

The report will help you answer some of the most critical questions in the 3D Animation Software Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the 3D Animation Software Market?

- What is the size of the 3D Animation Software Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 21.6 billion |

|

Forecasted Value (2030) |

USD 40.2 billion |

|

CAGR (2024 – 2030) |

9.3% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

3D Animation Software Market By Deployment (On-Premises, Cloud-Based), By Technology (3D Modelling, Motion Graphics, 3D Rendering, Visual Effects), By Industry Vertical (Media & Entertainment, Gaming, Healthcare, Manufacturing & Industrial) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. 3D Animation Software Market, by Deployment (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. On-Premises |

|

4.2. Cloud-Based |

|

5. 3D Animation Software Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. 3D Modelling |

|

5.2. Motion Graphics |

|

5.3. 3D Rendering |

|

5.4. Visual Effects |

|

5.5. Others |

|

6. 3D Animation Software Market, by Industry Vertical (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Media & Entertainment |

|

6.2. Gaming |

|

6.3. Healthcare |

|

6.4. Manufacturing & Industrial |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America 3D Animation Software Market, by Deployment |

|

7.2.7. North America 3D Animation Software Market, by Technology |

|

7.2.8. North America 3D Animation Software Market, by Industry Vertical |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US 3D Animation Software Market, by Deployment |

|

7.2.9.1.2. US 3D Animation Software Market, by Technology |

|

7.2.9.1.3. US 3D Animation Software Market, by Industry Vertical |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Adobe Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Autodesk, Inc. |

|

9.3. AutoDesSys, Inc. |

|

9.4. Blender Foundation |

|

9.5. Corel Corporation |

|

9.6. Epic Games, Inc. |

|

9.7. Maxon Computer GmbH |

|

9.8. SideFX |

|

9.9. The Foundry Visionmongers Ltd |

|

9.10. Unity Technologies |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the 3D Animation Software Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the 3D Animation Software Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the 3D Animation Software ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the 3D Animation Software Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA