As per Intent Market Research, the 360 Degree Camera Market was valued at USD 1.9 billion in 2023 and will surpass USD 4.6 billion by 2030; growing at a CAGR of 13.7% during 2024 - 2030.

The 360-degree camera market has witnessed substantial growth in recent years due to its increasing adoption across various industries, including media and entertainment, automotive, consumer electronics, and commercial sectors. These cameras offer an immersive experience by capturing images and videos in all directions, providing a holistic view. The market is poised to expand rapidly from 2024 to 2030, driven by technological advancements, rising demand for virtual reality (VR) content, and the growing popularity of 360-degree cameras in social media platforms.

Consumer Electronics Segment is Largest Owing to Increasing Demand for Immersive Experiences

In the consumer electronics segment, the 360-degree camera market has been growing steadily, primarily fueled by the rise of immersive content creation for personal and professional use. The increasing demand for VR gaming, live streaming, and 360-degree social media content has contributed significantly to the adoption of these cameras by consumers. Among the subsegments, action cameras are the largest, as they have become increasingly popular among consumers for outdoor activities and adventure sports. The compact, rugged designs of these cameras, combined with high-quality video resolution and durability, make them the most widely adopted product category in this space.

Moreover, the rising influence of social media platforms, where users are keen to create and share immersive content, has also helped boost the demand for action cameras. This trend, combined with price reductions and improved features such as waterproof designs and better stabilization, has made action cameras the leading subsegment in the consumer electronics category.

Automotive Segment is Fastest Growing Owing to Integration in Advanced Driver Assistance Systems (ADAS)

The automotive sector is expected to emerge as the fastest-growing segment for 360-degree cameras, with a particularly strong focus on their integration into Advanced Driver Assistance Systems (ADAS). Automakers are increasingly incorporating these cameras into vehicles to enhance safety and navigation by providing drivers with a full, real-time panoramic view of the car’s surroundings. The demand for safer driving experiences and compliance with stringent government regulations for vehicle safety are driving the rapid growth of this subsegment.

In addition to safety, 360-degree cameras in ADAS support features like parking assistance, obstacle detection, and collision avoidance, which are becoming standard in modern vehicles. The growing adoption of electric and autonomous vehicles, which rely heavily on sensors and cameras, further accelerates this trend, making ADAS the fastest-growing subsegment within the automotive market for 360-degree cameras.

Commercial Segment is Largest Owing to Demand for Surveillance and Security Applications

In the commercial sector, the adoption of 360-degree cameras is driven by the growing demand for enhanced surveillance and security solutions. Within this segment, the security and surveillance subsegment holds the largest share, as these cameras are increasingly deployed across retail, commercial buildings, and public spaces to monitor activities comprehensively. The panoramic view provided by these cameras reduces blind spots and allows security personnel to observe large areas with fewer devices, making them a cost-effective solution.

The commercial adoption of 360-degree cameras is also supported by advancements in AI and machine learning, which allow for more intelligent video analysis, real-time threat detection, and improved image quality. As businesses and government organizations seek to enhance their security infrastructure, the demand for 360-degree cameras in this subsegment will continue to dominate the commercial segment.

Media and Entertainment Segment is Fastest Growing Owing to Immersive Content Creation

The media and entertainment sector is experiencing rapid growth in the adoption of 360-degree cameras, driven by the increasing popularity of immersive content such as virtual tours, live events, and cinematic VR experiences. Within this sector, the virtual reality content creation subsegment is the fastest-growing, as filmmakers, content creators, and production companies increasingly turn to 360-degree cameras to deliver more engaging and interactive content.

With the rise of VR headsets and platforms like YouTube and Facebook supporting 360-degree videos, content creators are exploring new ways to captivate audiences. The ability to produce immersive, lifelike experiences that can transport viewers into different environments has been a significant factor in the fast adoption of 360-degree cameras in this subsegment. As more companies and creators invest in VR content, the demand for high-quality 360-degree cameras is expected to grow exponentially.

Healthcare Segment is Largest Owing to Training and Simulation Applications

In the healthcare industry, 360-degree cameras are being increasingly utilized for medical training, surgical simulations, and patient care. The training and simulation subsegment is the largest within the healthcare sector, as these cameras provide medical professionals with a full view of complex procedures, enabling enhanced learning experiences. The ability to record surgeries and medical processes from all angles helps in improving the precision and accuracy of medical training, making it an essential tool in the education of surgeons and healthcare workers.

Furthermore, the integration of 360-degree cameras with VR platforms allows for realistic and immersive simulations, which are particularly useful in remote learning and telemedicine. As healthcare providers seek to improve training programs and patient care, the demand for 360-degree cameras in this subsegment is expected to maintain its strong growth trajectory.

Fastest Growing Region: Asia-Pacific Owing to Technological Advancements and Rising Adoption in Automotive and Consumer Electronics

The Asia-Pacific region is projected to be the fastest-growing market for 360-degree cameras during the forecast period, driven by several key factors. Countries like China, Japan, and South Korea are witnessing rapid advancements in technology, especially in the automotive and consumer electronics industries. The growing consumer base in these countries, coupled with increasing disposable income, has led to higher adoption rates of 360-degree cameras in personal and commercial applications.

Moreover, the region is home to several major manufacturers and technology innovators, which helps to reduce production costs and introduce new, advanced products more quickly. The automotive sector, in particular, has been a significant growth driver, as the region experiences a rise in demand for electric and autonomous vehicles, which rely heavily on ADAS and other camera-based systems. This, combined with increasing interest in VR and immersive content creation, has positioned the Asia-Pacific region as the fastest-growing market for 360-degree cameras.

Competitive Landscape and Key Players

The 360-degree camera market is highly competitive, with a diverse range of players including established camera manufacturers, tech giants, and startups specializing in immersive technologies. Some of the leading companies in this market include Samsung Electronics, GoPro, Insta360, Nikon Corporation, and Ricoh Company, Ltd. These companies are continually innovating to enhance product features, improve camera resolution, and integrate AI-powered functionalities such as image stabilization and automatic video editing.

The competitive landscape is characterized by product differentiation, with companies focusing on catering to specific industries such as media, automotive, and healthcare. Additionally, strategic partnerships, mergers and acquisitions, and collaborations with software and platform providers are common as companies aim to expand their market presence and improve their technological capabilities. As the demand for 360-degree cameras grows, the market will likely see increased investments in R&D, further enhancing product performance and driving competition.

Report Objectives:

The report will help you answer some of the most critical questions in the 360 Degree Camera Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the 360 Degree Camera Market?

- What is the size of the 360 Degree Camera Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 1.9 billion |

|

Forecasted Value (2030) |

USD 4.6 billion |

|

CAGR (2024 – 2030) |

13.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

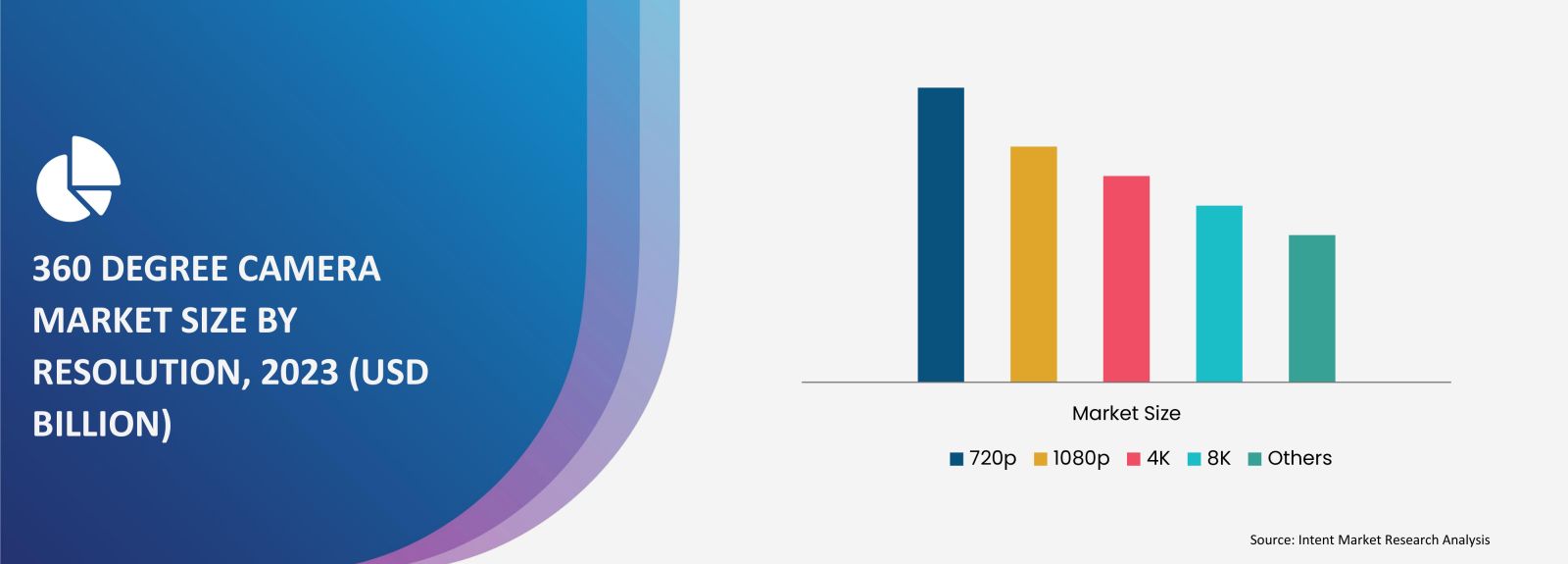

360 Degree Camera Market By Resolution (720p, 1080p, 4K, 8K), By Connectivity (Wired, Wireless), By Application (Media & Entertainment, Travel & Tourism, Real Estate, Gaming, Surveillance & Security, Sports & Events) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. 360 Degree Camera Market, by Resolution (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. 720p |

|

4.2. 1080p |

|

4.3. 4K |

|

4.4. 8K |

|

4.5. Others |

|

5. 360 Degree Camera Market, by Connectivity (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Wired |

|

5.2. Wireless |

|

6. 360 Degree Camera Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Media & Entertainment |

|

6.2. Travel & Tourism |

|

6.3. Real Estate |

|

6.4. Gaming |

|

6.5. Surveillance & Security |

|

6.6. Sports & Events |

|

6.7. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America 360 Degree Camera Market, by Resolution |

|

7.2.7. North America 360 Degree Camera Market, by Connectivity |

|

7.2.8. North America 360 Degree Camera Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US 360 Degree Camera Market, by Resolution |

|

7.2.9.1.2. US 360 Degree Camera Market, by Connectivity |

|

7.2.9.1.3. US 360 Degree Camera Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Garmin |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. GoPro |

|

9.3. Insta360 |

|

9.4. Kandao |

|

9.5. Kodak |

|

9.6. Labpano |

|

9.7. LG Electronics |

|

9.8. Ricoh |

|

9.9. Samsung |

|

9.10. Xiaomi |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the 360 Degree Camera Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the 360 Degree Camera Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the 360 Degree Camera ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the 360 Degree Camera Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA