sales@intentmarketresearch.com

+1 463-583-2713

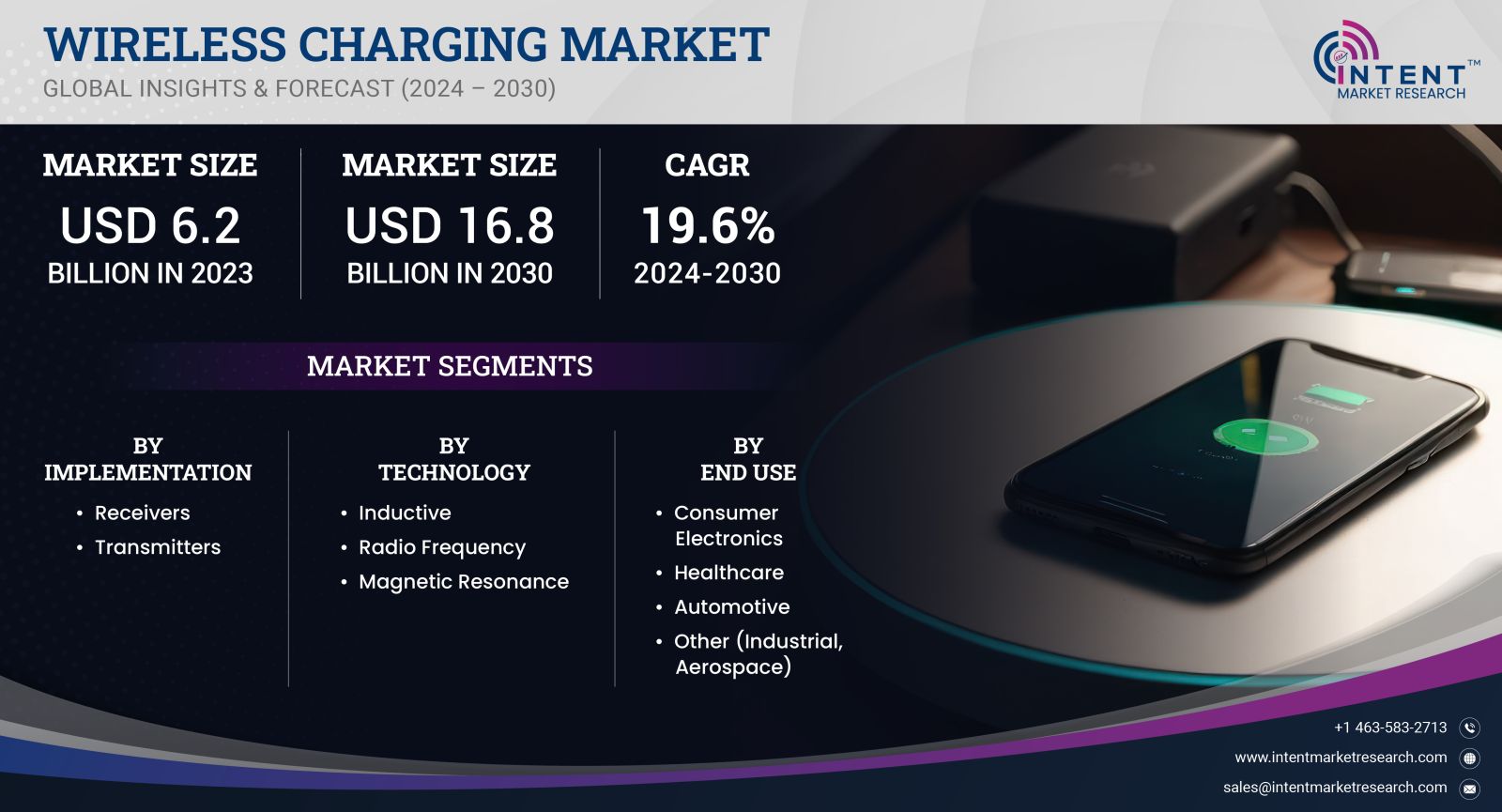

Wireless Charging Market By Implementation (Receivers, Transmitters), By Technology (Inductive, Radio Frequency, Magnetic Resonance), By End-use (Healthcare, Automotive, Consumer Electronics), and by Region; Global Insights & Forecast (2024 - 2030)

As per Intent Market Research, the Wireless Charging Market was valued at USD 6.2 billion in 2023-e and will surpass USD 16.8 billion by 2030; growing at a CAGR of 19.6% during 2024 - 2030.

The wireless charging market is witnessing significant growth, driven by the increasing demand for convenient and efficient power solutions across various industries. With the advent of smartphones, wearables, and electric vehicles, the adoption of wireless charging technologies has surged. This market encompasses a range of applications, including consumer electronics, automotive, and industrial sectors. Innovations in technology, along with the push towards sustainable energy solutions, are propelling the market forward.

The increasing need for seamless connectivity and hassle-free charging experiences among consumers is driving investment and development in this market. Companies are actively focusing on enhancing efficiency and charging speed, thus creating a competitive landscape characterized by rapid technological advancements and strategic collaborations. The wireless charging market's growth is supported by the integration of technologies such as resonant inductive coupling and radio frequency charging, which further cater to consumer needs and preferences.

Consumer Electronics Segment is Largest Owing to High Adoption Rates

The consumer electronics segment holds the largest share in the wireless charging market, primarily due to the high adoption rates of smartphones and other personal electronic devices. As consumers seek more convenient charging solutions, manufacturers are increasingly incorporating wireless charging capabilities into their products. The proliferation of Qi-compatible devices has made wireless charging a mainstream option for consumers, providing a frictionless experience that aligns with the modern lifestyle.

Furthermore, the consumer electronics segment is characterized by rapid technological advancements, with companies continuously innovating to improve charging efficiency and reduce charging times. Wireless charging stations are becoming more widely available in public spaces, such as cafes, airports, and offices, further driving adoption. As the demand for smart home devices and wearables continues to rise, the consumer electronics segment is poised to maintain its dominance in the wireless charging market.

Automotive Segment is Fastest Growing Owing to Electrification Trends

The automotive segment is emerging as the fastest-growing sector in the wireless charging market, primarily driven by the increasing electrification of vehicles. As electric vehicles (EVs) gain popularity, the demand for efficient and user-friendly charging solutions is rising. Wireless charging technology offers a seamless and convenient charging experience for EV owners, reducing the need for physical connectors and plugs.

Moreover, automotive manufacturers are actively investing in the development of wireless charging systems to enhance the overall EV experience. The integration of wireless charging technology into public and private charging infrastructure is expected to facilitate the widespread adoption of EVs, further accelerating growth in the automotive segment. With significant investments and innovations in this space, the automotive sector is set to experience robust growth in the wireless charging market in the coming years.

Industrial Segment is Fastest Growing Owing to Automation and IoT Integration

The industrial segment is witnessing rapid growth, driven by the increasing adoption of automation and the Internet of Things (IoT) technologies. As industries seek to enhance operational efficiency, wireless charging solutions are becoming integral to the charging infrastructure for automated guided vehicles (AGVs) and other industrial equipment. Wireless charging systems offer flexibility and reduce downtime associated with traditional charging methods, thereby improving productivity.

Additionally, the integration of wireless charging technology within IoT-enabled devices is further propelling growth in the industrial segment. The ability to charge devices wirelessly while they operate contributes to the efficiency of industrial processes, making wireless charging an attractive solution for manufacturers. As the push towards Industry 4.0 continues, the industrial segment is anticipated to expand rapidly, leveraging wireless charging technologies to enhance automation and connectivity.

Healthcare Segment is Largest Owing to Increased Demand for Medical Devices

The healthcare segment of the wireless charging market is the largest, driven by the increasing demand for medical devices that require efficient and reliable charging solutions. Wireless charging technology is being increasingly adopted for various medical devices, including implants, monitoring devices, and mobile healthcare applications. The ability to charge devices wirelessly enhances convenience for healthcare professionals and patients alike, minimizing interruptions and increasing efficiency.

Moreover, the healthcare industry is progressively moving towards digitalization and connected healthcare solutions. Wireless charging offers a hygienic solution by eliminating the need for physical connectors, thus reducing the risk of infections in clinical settings. As the demand for advanced medical technology continues to rise, the healthcare segment is expected to maintain its position as a significant contributor to the growth of the wireless charging market.

Region Analysis: North America is Largest Owing to Technological Advancements

North America is the largest region in the wireless charging market, primarily due to the advanced technological landscape and the high penetration of consumer electronics. The region boasts a well-established infrastructure for wireless charging, with numerous companies investing in research and development to innovate and enhance wireless charging technologies. The increasing adoption of electric vehicles and the integration of wireless charging in automotive applications further bolster growth in this region.

Additionally, North America is home to several leading technology companies that are actively pushing the boundaries of wireless charging technology. The presence of a tech-savvy consumer base and a robust economy supports the growth of wireless charging solutions across various sectors. As the market for wireless charging continues to evolve, North America is expected to maintain its dominance, leading advancements in technology and market development.

Competitive Landscape of Leading Companies

The competitive landscape of the wireless charging market is characterized by the presence of several leading companies that are at the forefront of innovation and technology. Some of the top players include:

- Qualcomm Incorporated: A leading technology company known for its advancements in wireless charging technology, particularly in the automotive and consumer electronics sectors.

- NXP Semiconductors: This company specializes in providing secure connectivity solutions and is actively involved in developing wireless charging technology for various applications.

- Texas Instruments: Known for its extensive range of semiconductor products, Texas Instruments is a key player in the wireless charging market, offering solutions for consumer electronics and automotive applications.

- Samsung Electronics: A major player in the consumer electronics market, Samsung is also involved in developing wireless charging solutions for its smartphones and other devices.

- Powermat Technologies: A pioneer in wireless charging technology, Powermat is focusing on creating innovative solutions for public and commercial charging stations.

- WiTricity Corporation: This company specializes in resonant magnetic charging technology, providing solutions for electric vehicles and consumer electronics.

- ZTE Corporation: A global provider of telecommunications equipment and systems, ZTE is investing in wireless charging solutions for its range of devices.

- Apple Inc.: A major player in consumer electronics, Apple has integrated wireless charging technology into its product lineup, driving demand and market growth.

- Murata Manufacturing Co., Ltd.: This company offers various wireless charging solutions, focusing on efficient energy transfer and miniaturization for electronic devices.

- Bosch: A leading supplier of automotive components, Bosch is actively developing wireless charging solutions for electric vehicles, enhancing the convenience of charging.

The competitive landscape in the wireless charging market is dynamic, with companies continuously investing in research and development to enhance their offerings. Strategic collaborations, mergers, and acquisitions are common as firms seek to gain a competitive edge in this rapidly evolving market. The focus on technological advancements, along with the integration of wireless charging in emerging applications, positions these companies well to capitalize on the growing demand in the coming years.

Report Objectives

The report will help you answer some of the most critical questions in the Wireless Charging market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the wireless charging market?

- What is the size of the wireless charging market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 6.2 billion |

|

Forecasted Value (2030) |

USD 16.8 billion |

|

CAGR (2024-2030) |

19.6% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Wireless Charging Market By Implementation (Receivers, Transmitters), By Technology (Inductive, Radio Frequency, Magnetic Resonance), By End-use (Healthcare, Automotive, Consumer Electronics) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Wireless Charging Market, by Implementation (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Receivers |

|

4.2.Transmitters |

|

5.Wireless Charging Market, by Technology (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Inductive |

|

5.2.Radio Frequency |

|

5.3.Magnetic Resonance |

|

6.Wireless Charging Market, by End Use (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Consumer Electronics |

|

6.2.Healthcare |

|

6.3.Automotive |

|

6.4.Other (Industrial, Aerospace) |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Wireless Charging Market, by Implementation |

|

7.2.7.North America Wireless Charging Market, by Technology |

|

7.2.8.North America Wireless Charging Market, by End Use |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Wireless Charging Market, by Implementation |

|

7.3.1.2.US Wireless Charging Market, by Technology |

|

7.3.1.3.US Wireless Charging Market, by End Use |

|

7.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.Qualcomm Technologies |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Plugless Power |

|

9.3.Ossia |

|

9.4.Energizer |

|

9.5.Infineon Technologies |

|

9.6.Leggett & Platt |

|

9.7.Witricity |

|

9.8.Anker Innovations |

|

9.9.Energous |

|

9.10.Convenientpower |

|

10.Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Wireless Charging Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the wireless charging Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the wireless charging ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the wireless charging market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

Available Formats

.jpg)