sales@intentmarketresearch.com

+1 463-583-2713

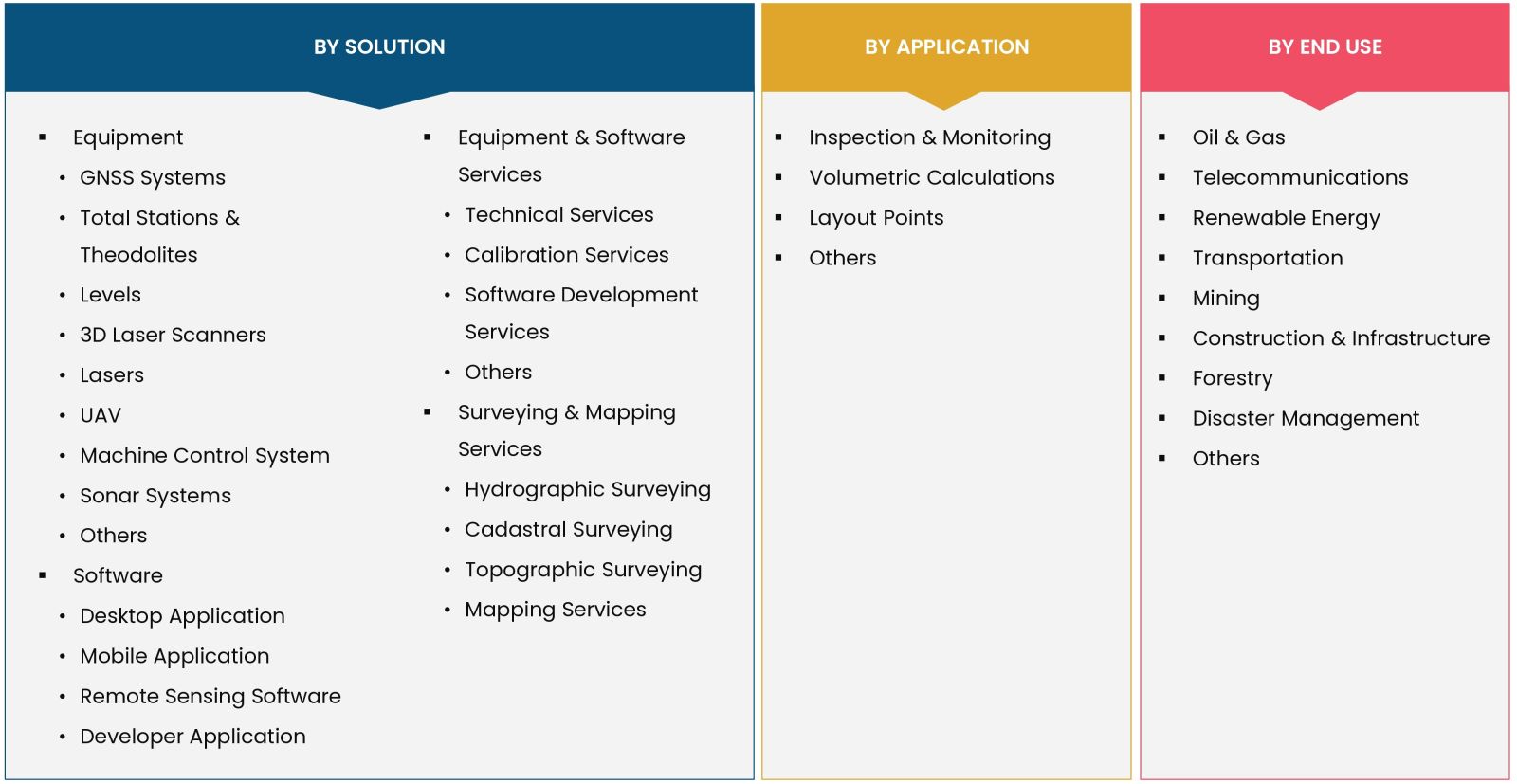

Surveying and Mapping Market Research Report By Solution (Equipment, Software, Equipment & Software Services, Surveying & Mapping Services, By Application (Inspection and Monitoring, Volumetric Calculations, Layout Points), By End Use (Oil & Gas, Telecommunications, Renewable Energy, Transportation, Mining, Construction & Infrastructure, Forestry, Disaster Management) and By Region; Global Insights & Forecast (2024 – 2030)

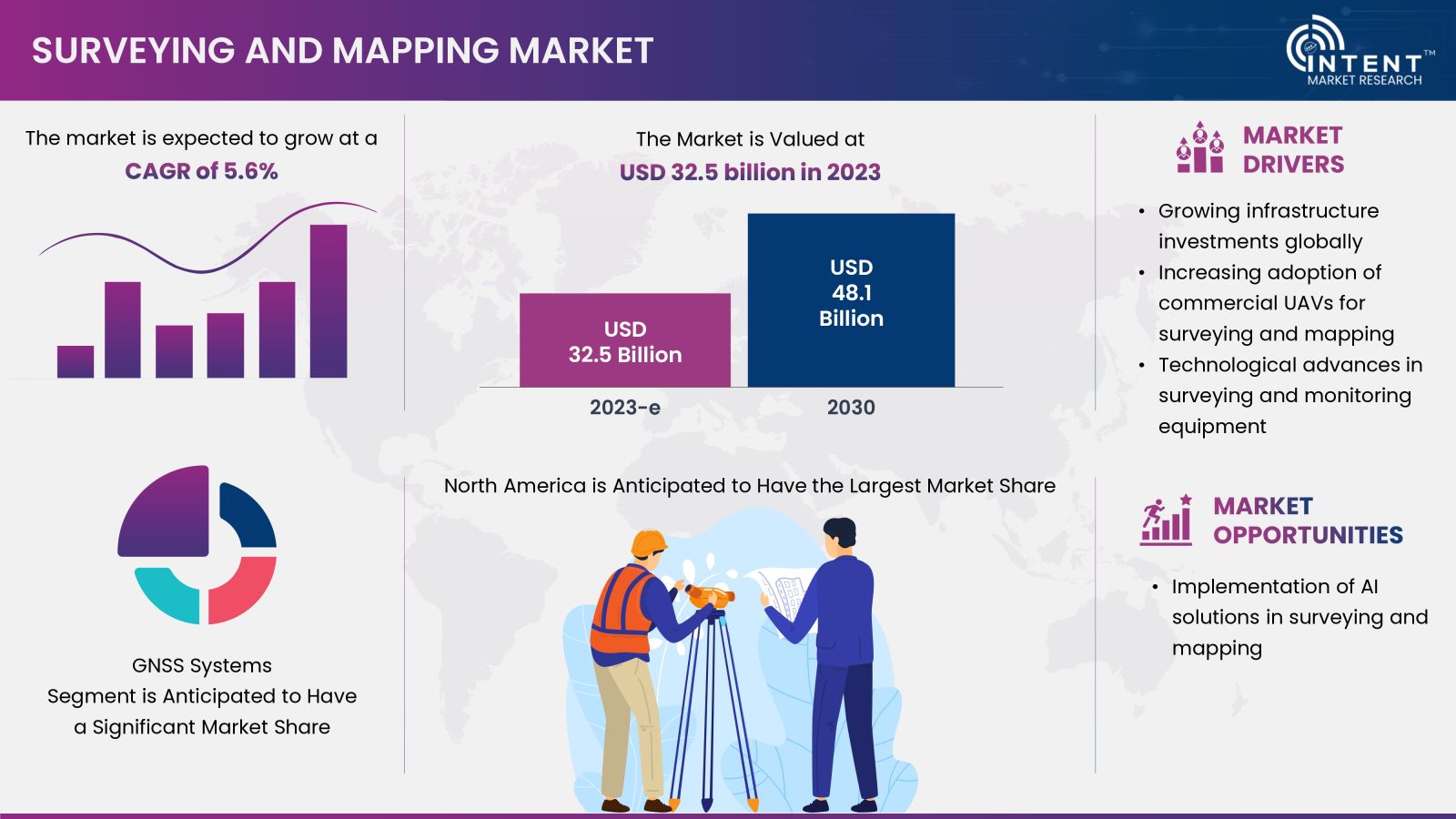

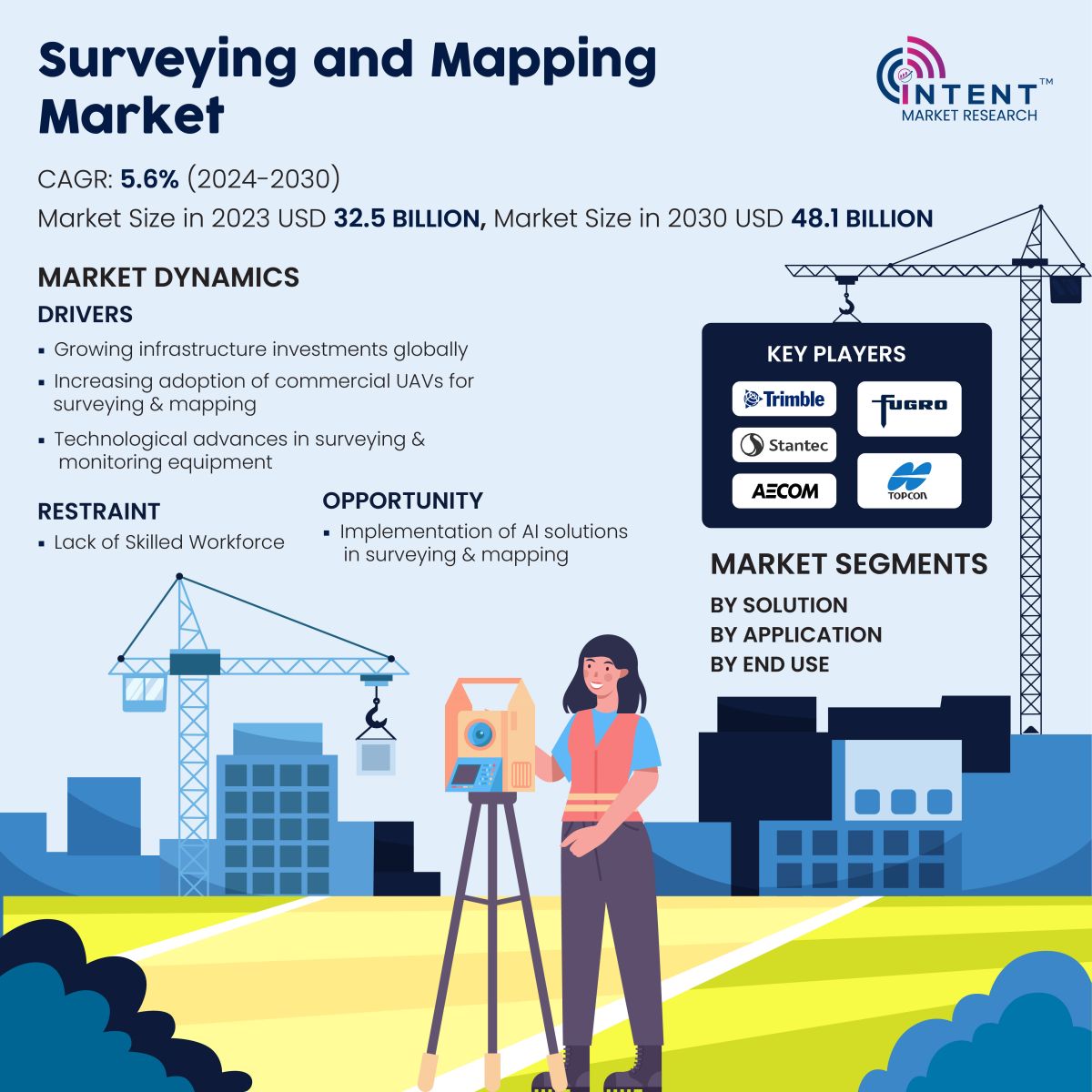

According to Intent Market Research, the Surveying and Mapping Market is expected to grow from USD 32.5 billion in 2023-e at a CAGR of 5.6% to touch USD 48.1 billion by 2030. The surveying and mapping market is moderately competitive, the prominent players in the global market include AECOM, Bosch, Fugro, Hexagon AB, Hi-Target, NV5 Global, Stantec, Stonex, Topcon, and Trimble. The market is driven by growing infrastructure investments globally and increasing adoption of commercial UAVs for surveying and mapping. Technological advances in surveying and monitoring equipment are also driving market growth.

Click here to: Get FREE Sample Pages of this Report

Surveying and Mapping Market Overview

Surveying and mapping is the study of geospatial measurement that provides critical information about the characteristics of a site, including its boundaries, topography, and infrastructure. It provides a comprehensive analysis and complete view of the surrounding environment. Surveying and mapping aid in planning and executing projects with a high degree of accuracy, reducing the risk of costly errors, safety hazards, and project delays. Organizations use geospatial data gathered from surveying and mapping to improve the overall efficiency of company operations. Surveying and mapping has its application in several industries including oil and gas, telecommunications, transportation, mining, construction & infrastructure, and disaster management, among others.

The surveying and mapping market is driven by growing infrastructure investments globally. The global infrastructure sector is set for significant expansion, driven by increasing investments in offshore wind infrastructure, offshore oil and gas infrastructure, construction services, and water infrastructure. This growth reflects a robust trend towards developing and enhancing various facets of global infrastructure.

According to the Global Wind Energy Council, the global offshore wind capacity reached 64.3 GW across three continents and 19 countries in 2022, accounting for 7.1% of global wind power installation. With an anticipated offshore wind capacity surpassing 380 GW by 2030, the global surge in infrastructure investments is propelling the surveying and mapping market forward. This growth is notably influenced by increasing developments in infrastructure projects worldwide.

.jpg)

Advent of the Next Generation of GNSS is Driving Market Growth

Global Navigation Satellite System (GNSS) is one of the core technologies for surveying and mapping applications. The equipment GNSS systems include GNSS receivers (rovers), GNSS antennas, a data collector or mobile device, and surveying accessories such as tripods, poles, and cables. Several advances in global satellite navigation and positioning technology implementing artificial intelligence and the Internet of Things (IoT) for devices such as GNSS smart antennas are further driving the market. For instance, in August 2023, Hemisphere GNSS launched the A631 GNSS smart antenna for agricultural, marine, GIS, mapping, and other applications.

The launching of the next generation of GNSS and an increased number of satellites is further anticipated to improve the accuracy and precision of the GNSS systems significantly. This could broaden the range of applications to benefit from the GNSS-provided positioning information. For instance, in March 2022, Airbus announced that it completed the Preliminary Design Review (PDR) for its system concept for the second-generation Galileo navigation satellites. Thus, the GNSS systems segment is anticipated to hold a significant market share in the surveying and mapping market.

.jpg)

Increasing Utilization of AI and IoT in Inspection and Monitoring Solutions will boost the Market Growth

Various tools and sensors including geodetic, geotechnical, and meteorological sensors carry out inspection and monitoring. These are utilized for precise data acquisition which are processed for surveying and mapping. Inspection and monitoring solutions are widely applied in construction industries for various applications including piling works, demolition, basement excavation, and underpinning.

Advances in automated monitoring solutions and increasing utilization of AI and IoT in inspection and monitoring solutions are driving the growth of the market. For instance, in August 2022, Trimble launched GNSS Data Integrity Monitoring for the PPP Correction Service. The adoption of powerful software for inspection and monitoring, facilitated by the increasing computing power of mobile devices, is enhancing the efficiency of inspection and monitoring workflows. Consequently, the inspection and monitoring segment is expected to maintain a substantial market share in the surveying and mapping market.

Increasing CapEx in Oil & Gas Industry is Augmenting the Surveying and Mapping Market

The oil and gas industry has been increasingly investing in surveying and mapping solutions owing to a significant upsurge in demand for oil and gas production globally. According to the OPEC World Oil Outlook 2023, global primary energy demand is anticipated to increase from around 291 million barrels of oil equivalent per day (mboe/d) in 2022 to around 359 mboe/d in 2045, an increase of about 23% over the forecast period.

A large part of the 2023 demand growth is expected from Asia and the Middle East. The increasing demand for oil and gas is fuelling capital expenditures (CapEx) in the sector, propelling growth in the surveying and mapping market. As a result, the oil and gas segment is expected to emerge as the largest within the surveying and mapping market.

North America Accounted for the Largest Market Share owing to High Government Spending

There has been a significant growth in capital expenditures in the North America owing to several factors including reshoring, fiscal stimulus, government incentives to boost manufacturing, and a rise in automation due to labor shortages. In addition, in recent years, there has been exponential growth in North American oil production capacity. According to the U.S. Energy Information Administration (EIA), it expects U.S. crude oil production to surpass 12.9 million barrels per day in 2023 and to exceed 13 million barrels per day in early 2024. The expansion oil extraction activities will also contribute to the advancement of surveying and mapping industry across the region.

High spending on surveying and mapping data in the region by the governments is also among the factors driving the market. For instance, Woolpert (U.S.), an architecture, engineering, geospatial (AEG) and strategic consulting firm signed a contract amounting to about USD 7 million by the National Oceanic and Atmospheric Administration (NOAA) to perform hydrographic surveying and collect bathymetric data in and around Nome, Alaska. The surge in offshore wind energy capital expenditures is an additional driver of market growth, leading to North America emerging as the largest region in the surveying and mapping market.

Competitive Analysis

The scope of the surveying and mapping market encompasses various entities, including equipment manufacturers, software developers, surveying and mapping service providers, and third-party equipment maintenance service providers. These diverse participants play integral roles in the dynamic landscape of the surveying and mapping industry. Companies in surveying and mapping services often sign long-term contracts with various industries and governments across the world.

The companies are actively expanding their portfolios with the growing CapEx spending. The surveying and mapping market is dominated by a few key global market players having a significant market share. The market is also highly competitive with the number of regional and local players present in the market. Some of the key players in the market are AECOM, Bosch, Fugro, Hexagon AB, Hi-Target, NV5 Global, Stantec, Stonex, Topcon, and Trimble.

Following are the key developments in the surveying and mapping market:

- In November 2023, Harxon launched two advanced high-accuracy positioning products, the Survey GNSS Antenna (HX-CSX600A) and the Helix Antenna (HX-CUX615A).

- In April 2022, Juniper Systems has introduced the all-new Geode GNS3 GNSS receiver

- In December 2022, ComNav Technology launched a laser GNSS receiver, the Venus Laser RTK as part of its new Universe series of GNSS receivers.

Click here to: Get your custom research report today

Surveying and Mapping Market Coverage

The report provides key insights into the surveying and mapping market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 32.5 billion |

|

Forecast Revenue (2030) |

USD 48.1 billion |

|

CAGR (2024-2030) |

5.6% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Solution (Equipment (GNSS Systems, Total Stations & Theodolites, Levels, 3D Laser Scanners, Lasers, UAV, Machine Control System, Sonar Systems, Others), Software (Desktop Application, Mobile Application, Remote Sensing Software, Developer Application), Equipment & Software Services (Technical Services, Calibration Services, Software Development Services, Others), Surveying & Mapping Services (Hydrographic Surveying, Cadastral Surveying, Topographic Surveying, Technical Services, Calibration Services, Software Development Services)), By Application (Inspection and Monitoring, Volumetric Calculations, Layout Points), By End Use (Oil & Gas, Telecommunications, Renewable Energy, Transportation, Mining, Construction & Infrastructure, Forestry, Disaster Management, Others) |

|

Regional Analysis |

North America (US, Canada, and Mexico), Europe (Germany, UK, France, Norway, Italy), Asia-Pacific (China, India, Japan, South Korea), Latin America (Brazil, Argentina), Middle East and Africa (Saudi Arabia, UAE) |

|

Competitive Landscape |

AECOM, Bosch, Fugro, Hexagon AB, Hi-Target, NV5 Global, Stantec, Stonex, Topcon, and Trimble. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1. Study Assumptions and Market Definition |

|

1.2. Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1. Market Drivers |

|

4.1.1. Growing infrastructure investments globally |

|

4.1.2. Increasing adoption of commercial UAVs for surveying and mapping |

|

4.1.3. Technological advances in surveying and monitoring equipment |

|

4.2. Market Restraints |

|

4.2.1. Lack of Skilled Workforce |

|

4.2.2. Regularity Complexities |

|

4.3. Market Opportunities |

|

4.3.1. Implementation of AI solutions in surveying and mapping |

|

4.4. Porter’s Five Forces |

|

4.5. PESTLE Analysis |

|

5.Market Outlook |

|

5.1. Supply Chain Analysis |

|

5.2. Regulatory Framework Analysis |

|

5.3. Pricing Analysis |

|

5.4. Technology Analysis |

|

5.5. Impact of COVID-19 and Russia-Ukraine War on the Surveying and Mapping Market |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1. Segment Synopsis |

|

6.2. By Solution |

|

6.2.1. Equipment |

|

6.2.1.1.GNSS Systems |

|

6.2.1.2.Total Stations and Theodolites |

|

6.2.1.3.Levels |

|

6.2.1.4.3D Laser Scanners |

|

6.2.1.5.Lasers |

|

6.2.1.6.UAV |

|

6.2.1.7.Machine Control System |

|

6.2.1.8.Sonar Systems |

|

6.2.1.9.Others |

|

6.2.2. Software |

|

6.2.2.1.Desktop Application |

|

6.2.2.2.Mobile Application |

|

6.2.2.3.Remote Sensing Software |

|

6.2.2.4.Developer Application |

|

6.2.3. Equipment and Software Services |

|

6.2.3.1.Technical Services |

|

6.2.3.2.Calibration Services |

|

6.2.3.3.Software Development Services |

|

6.2.3.4.Others |

|

6.2.4. Surveying and Mapping Services |

|

6.2.4.1.Hydrographic Surveying |

|

6.2.4.2.Cadastral Surveying |

|

6.2.4.3.Topographic Surveying |

|

6.2.4.4.Mapping Services |

|

6.3. By Application |

|

6.3.1. Inspection and Monitoring |

|

6.3.2. Volumetric Calculations |

|

6.3.3. Layout Points |

|

6.3.4. Others |

|

6.4. By End Use |

|

6.4.1. Oil and Gas |

|

6.4.2. Telecommunications |

|

6.4.3. Renewable Energy |

|

6.4.4. Transportation |

|

6.4.5. Mining |

|

6.4.6. Construction & Infrastructure |

|

6.4.7. Forestry |

|

6.4.8. Disaster Management |

|

6.4.9. Others |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1. Global Market Synopsis |

|

7.2. North America |

|

7.2.1. North America Surveying and Mapping Market Outlook |

|

7.2.2. US |

|

7.2.2.1.US Surveying and Mapping Market, By Solution |

|

7.2.2.2.US Surveying and Mapping Market, By Application |

|

7.2.2.3.US Surveying and Mapping Market, By End Use |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3. Canada |

|

7.2.4. Mexico |

|

7.3. Europe |

|

7.3.1. Europe Surveying and Mapping Market Outlook |

|

7.3.2. Germany |

|

7.3.3. UK |

|

7.3.4. France |

|

7.3.5. Spain |

|

7.3.6. Italy |

|

7.3.7. Rest of Europe |

|

7.4. Asia-Pacific |

|

7.4.1. Asia-Pacific Surveying and Mapping Market Outlook |

|

7.4.2. China |

|

7.4.3. India |

|

7.4.4. Japan |

|

7.4.5. South Korea |

|

7.4.6. Australia |

|

7.4.7. Rest of Asia-Pacific |

|

7.5. Latin America |

|

7.5.1. Latin America Surveying and Mapping Market Outlook |

|

7.5.2. Brazil |

|

7.5.3. Argentina |

|

7.5.4. Rest of Latin America |

|

7.6. Middle East and Africa |

|

7.6.1. Middle East and Africa Surveying and Mapping Market Outlook |

|

7.6.2. Saudi Arabia |

|

7.6.3. UAE |

|

7.6.4. Rest of MEA |

|

8.Competitive Landscape |

|

8.1. Market Share Analysis |

|

8.2. Company Strategy Analysis |

|

8.3. Competitive Matrix |

|

9.Company Profiles |

|

9.1. Surveying and Mapping Companies (Supply-Side) |

|

9.1.1. AECOM |

|

9.1.1.1.Company Synopsis |

|

9.1.1.2.Company Financials |

|

9.1.1.3.Product/Service Portfolio |

|

9.1.1.4.Recent Developments |

|

*Note: All the companies in section 9.1 will cover the same sub-chapters as above. |

|

9.1.2. Bosch |

|

9.1.3. Fugro |

|

9.1.4. Hexagon AB |

|

9.1.5. Hi-Target |

|

9.1.6. NV5 Global |

|

9.1.7. Stantec |

|

9.1.8. Stonex |

|

9.1.9. Topcon |

|

9.1.10. Trimble |

Let us connect with you TOC

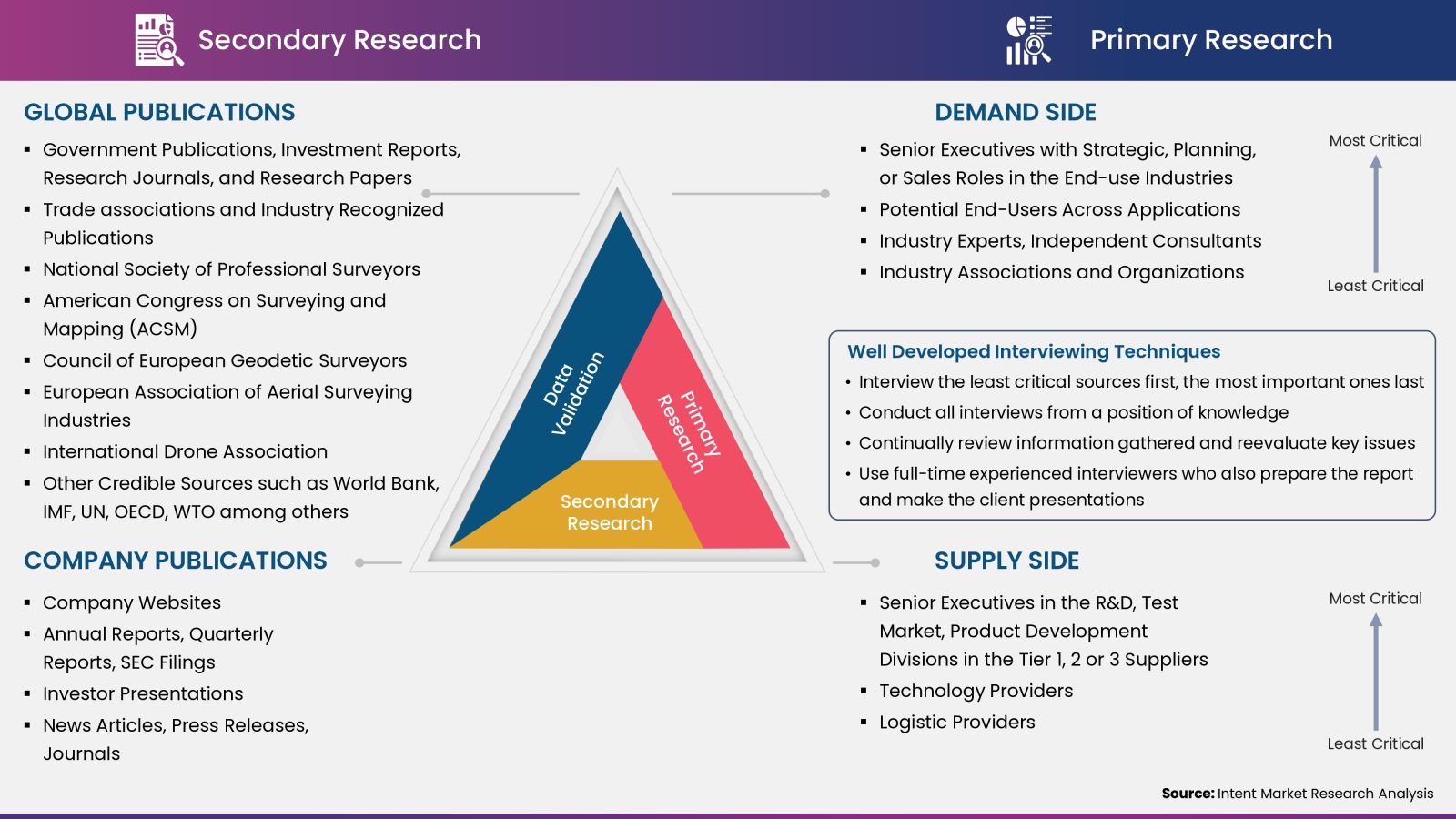

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

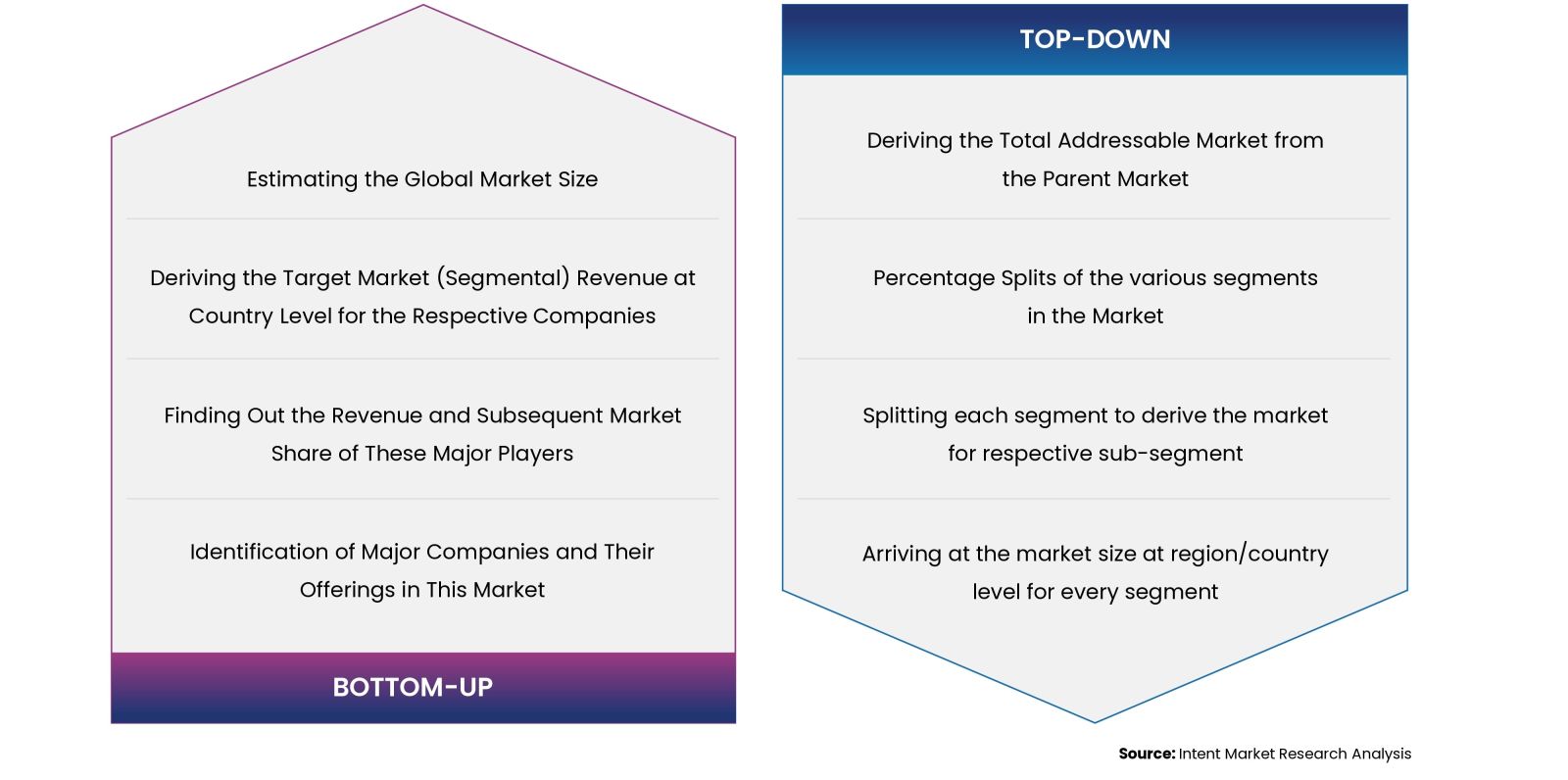

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats