sales@intentmarketresearch.com

+1 463-583-2713

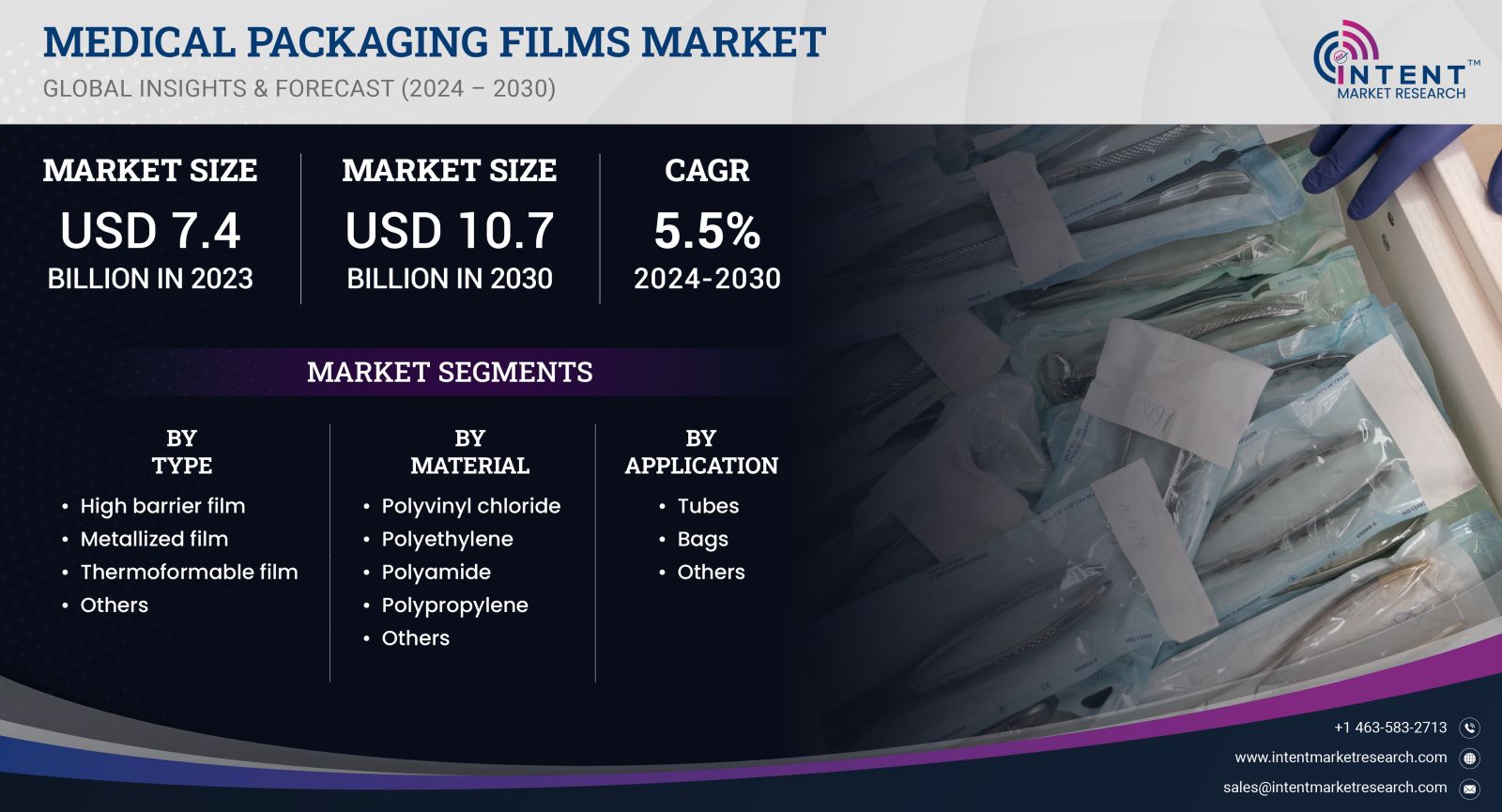

Medical Packaging Films Market By Type (High Barrier Film, Thermoformable Film, Metallized Film), By Material (Polyvinyl Chloride, Polyethylene, Polypropylene, Polyamide), By Application (Tubes, Bags), and By Region; Global Insights & Forecast (2024 – 2030)

As per Intent Market Research, the Medical Packaging Films Market was valued at USD 7.4 billion in 2023-e and will surpass USD 10.7 billion by 2030; growing at a CAGR of 5.5% during 2024 - 2030.

The medical packaging films market is integral to the healthcare industry, playing a crucial role in ensuring the safety and efficacy of medical devices and pharmaceuticals. The increasing demand for advanced medical devices, coupled with stringent regulatory requirements for packaging, is driving this growth. As the healthcare landscape evolves, the need for innovative, reliable, and safe packaging solutions has become paramount, positioning the medical packaging films market for significant advancements.

Medical packaging films serve various purposes, including protection against contamination, preservation of sterility, and compliance with regulatory standards. The market comprises several segments, including flexible films, rigid films, and specialty films. Each of these segments caters to specific needs and applications, influenced by factors such as material composition, end-use requirements, and technological advancements. As manufacturers prioritize safety and quality, the evolution of medical packaging films is essential to support the expanding medical device and pharmaceutical sectors.

Flexible Films Segment is Largest Owing to Versatility and Demand

The flexible films segment is the largest within the medical packaging films market, primarily due to its versatility and adaptability across a wide range of medical applications. Flexible films, including polyethylene, polypropylene, and laminate films, are extensively used for packaging medical devices, sterile products, and pharmaceuticals. The growing demand for customized packaging solutions that meet the unique specifications of various medical products drives the prominence of this segment. Flexible films offer benefits such as lightweight design, ease of storage, and cost-effectiveness, making them a preferred choice for manufacturers.

Moreover, the emphasis on sustainability is increasingly influencing the flexible films segment. Manufacturers are adopting eco-friendly materials and developing recyclable packaging solutions to align with global environmental goals. As healthcare providers and consumers prioritize sustainability, the demand for flexible films made from biodegradable and recyclable materials is expected to rise. This alignment of flexibility, cost efficiency, and environmental responsibility solidifies the position of the flexible films segment as the largest in the medical packaging films market.

Rigid Films Segment is Fastest Growing Owing to Enhanced Protection

The rigid films segment is the fastest growing in the medical packaging films market, primarily due to its ability to provide enhanced protection for medical devices and pharmaceuticals. Rigid films, which include PVC and PET films, offer superior structural integrity and barrier properties, making them ideal for packaging products that require tamper-evident and contamination-resistant solutions. The increasing focus on patient safety and the need to maintain product sterility are driving the demand for rigid films in various applications, including surgical instruments, diagnostic devices, and sterile products.

Additionally, the development of advanced rigid packaging technologies, such as thermoforming and vacuum forming, is contributing to the growth of this segment. These technologies allow for the creation of tailored packaging solutions that meet specific regulatory standards while enhancing the user experience. As healthcare regulations become more stringent, the rigid films segment is expected to experience significant growth, driven by the demand for high-performance packaging solutions that ensure safety and compliance.

Specialty Films Segment is Largest Owing to Innovative Solutions

The specialty films segment is recognized as the largest segment within the medical packaging films market, owing to its innovative solutions tailored for specific applications. Specialty films, including heat-sealable, breathable, and moisture-resistant films, cater to unique packaging requirements in the medical industry. These films are designed to address specific challenges such as maintaining sterility, providing moisture control, and facilitating product visibility. The rising complexity of medical devices and the need for specialized packaging solutions contribute to the dominance of this segment.

Furthermore, the growing trend towards personalized medicine is driving demand for specialty films that accommodate diverse packaging needs. As medical manufacturers strive to deliver tailored solutions for patients, specialty films offer the flexibility and functionality required to support this trend. The continuous advancements in film technology, coupled with the increasing focus on patient-centric packaging, position the specialty films segment as a significant player in the medical packaging films market.

Fastest Growing Region: Asia-Pacific is Fastest Growing Owing to Expanding Healthcare Sector

The Asia-Pacific region is emerging as the fastest growing market for medical packaging films, driven by the rapid expansion of the healthcare sector and increasing investments in medical infrastructure. Countries such as China, India, and Japan are witnessing significant growth in healthcare expenditures, leading to a surge in demand for medical devices and pharmaceuticals. This, in turn, fuels the need for advanced packaging solutions that ensure product safety and compliance.

Moreover, the Asia-Pacific region is characterized by a growing middle-class population with rising disposable incomes, leading to increased access to healthcare services. As the demand for high-quality medical products rises, manufacturers are focusing on adopting advanced packaging technologies to meet stringent regulatory requirements. The combination of a burgeoning healthcare market, technological advancements, and a growing emphasis on safety and quality positions the Asia-Pacific region as a key player in the medical packaging films market.

Competitive Landscape of Leading Companies

The competitive landscape of the medical packaging films market is characterized by a mix of established players and innovative newcomers, all striving to capture market share through technological advancements and strategic collaborations. The top companies in this sector include:

- Amcor plc: A global leader in packaging solutions, Amcor specializes in developing flexible and rigid packaging films that prioritize safety, sustainability, and innovation.

- Berry Global, Inc.: Berry Global offers a diverse range of medical packaging films, including flexible and rigid solutions, catering to the unique requirements of the healthcare sector.

- Sealed Air Corporation: Known for its protective packaging solutions, Sealed Air provides innovative medical packaging films designed to enhance product safety and compliance.

- MediPak: MediPak focuses on sterile packaging solutions for medical devices, offering films that maintain product integrity and sterility throughout the supply chain.

- DuPont de Nemours, Inc.: DuPont is recognized for its advanced packaging materials, including specialty films designed for medical applications, emphasizing quality and performance.

- Schott AG: Schott specializes in high-quality glass and polymer packaging solutions for the medical industry, known for its commitment to safety and regulatory compliance.

- Wipak Group: Wipak is a key player in the medical packaging films market, offering a variety of flexible packaging solutions designed for healthcare applications.

- Constantia Flexibles: Constantia Flexibles provides innovative packaging solutions, including specialty films for the medical sector, focusing on sustainability and performance.

- Ahlstrom-Munksjö: Ahlstrom-Munksjö offers a range of specialty packaging films, emphasizing moisture resistance and sterility for medical applications.

- Tredegar Corporation: Tredegar specializes in flexible packaging films, offering customized solutions for the medical industry that prioritize safety and regulatory compliance.

The competitive landscape in the medical packaging films market is dynamic, with companies continuously investing in research and development to improve their offerings. As the demand for advanced medical packaging solutions continues to rise, these leading manufacturers are well-positioned to leverage their expertise and technological capabilities to drive future growth in the market.

Report Objectives:

The report will help you answer some of the most critical questions in the Medical Packaging Films Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Medical Packaging Films market?

- What is the size of the Medical Packaging Films market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 7.4 billion |

|

Forecasted Value (2030) |

USD 10.7 billion |

|

CAGR (2024-2030) |

5.5% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Medical Packaging Films Market By Type (High Barrier Film, Thermoformable Film, Metallized Film), By Material (Polyvinyl Chloride, Polyethylene, Polypropylene, Polyamide), By Application (Tubes, Bags) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Medical Packaging Films Market, by Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.High barrier film |

|

4.2.Metallized film |

|

4.3.Thermoformable film |

|

4.4.Others |

|

5.Medical Packaging Films Market, by Material (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Polyvinyl chloride |

|

5.2.Polyethylene |

|

5.3.Polyamide |

|

5.4.Polypropylene |

|

5.5.Others |

|

6.Medical Packaging Films Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Tubes |

|

6.2.Bags |

|

6.3.Others |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Medical Packaging Films Market, by Type |

|

7.2.7.North America Medical Packaging Films Market, by Material |

|

7.2.8.North America Medical Packaging Films Market, by Application |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Medical Packaging Films Market, by Type |

|

7.3.1.2.US Medical Packaging Films Market, by Material |

|

7.3.1.3.US Medical Packaging Films Market, by Application |

|

7.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.DuPont |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Berry Global |

|

9.3.Amcor |

|

9.4.Covestro |

|

9.5.Weigao Group |

|

9.6.3M |

|

9.7.Mitsubishi Chemical |

|

9.8.Toppan |

|

9.9.Tekniplex |

|

9.10.Sealed Air |

|

10.Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Medical Packaging Films Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the Medical Packaging Films Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Medical Packaging Films ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the Medical Packaging Films market. These methods were also employed to estimate the size of various sub-segments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

Available Formats