sales@intentmarketresearch.com

+1 463-583-2713

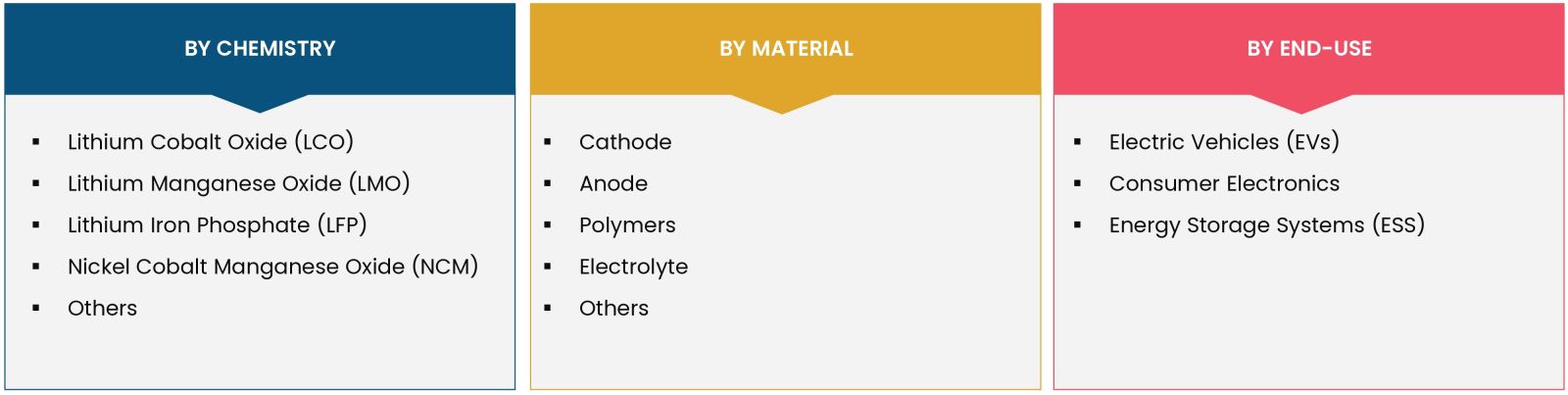

Lithium-ion Battery Materials Market By Type (Lithium Nickel Manganese Cobalt Oxide, Lithium Cobalt Oxide, Lithium Manganese Oxide, Lithium Iron Phosphate, Lithium Nickel Cobalt Aluminum Oxide, and Lithium Titanate Oxide), By Material (Cathode, Anode, Electrolyte, Separator), and By Application (Automotive, Consumer Electronics, Aerospace, Marine, Medical, Industrial, Power and Telecommunications) & By Region; Global Insights & Forecast (2024 – 2030)

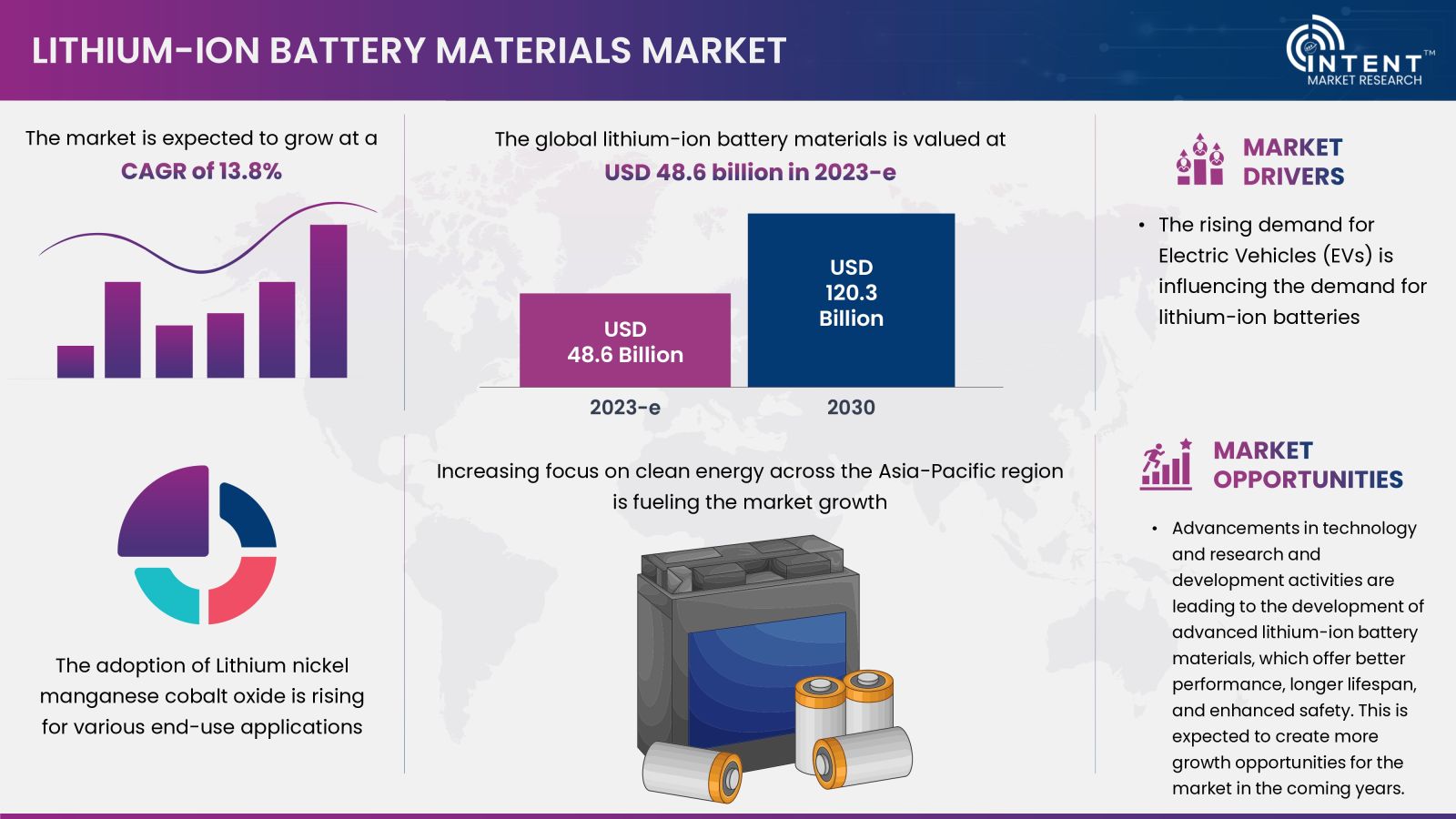

According to Intent Market Research, the Lithium-Ion Battery Materials Market is expected to grow from USD 48.6 billion in 2023-e at a CAGR of 13.8% to touch USD 120.3 billion by 2030. Prominent players include 3M, BASF, BTR New Material Group, JFE Chemical, Kureha Corporation, Landf, NEI, POSCO Future M, Resonac, SGL Carbon, Sumitomo Metal Mining, Tanaka Chemical, Toda Kogyo, UBE & Umicore among others.

The lithium-ion battery materials market is quite a dynamic space. It encompasses various components such as cathodes, anodes, electrolytes, and separators that play crucial roles in the performance of lithium-ion batteries. The demand for these materials has been on the rise, primarily driven by the growing electric vehicle market and the increasing adoption of portable electronic devices.

Lithium-ion Battery Materials Market Dynamics

The Rising Demand for Electric Vehicles (EVs) is Influencing the Demand for Lithium-Ion Batteries

The lithium-ion battery materials market is experiencing significant growth due to rising demand for Electric Vehicles (EVs). As the automotive industry increasingly shifts towards electric vehicles, there's a growing demand for high-performance lithium-ion batteries. In 2021, EV sales reached over 3 million units globally, marking a significant increase from previous years. According to the International Energy Agency (IEA), the number of electric cars on the road surpassed 10 million in 2020, and it is expected to reach 145 million by 2030. Hence, EVs use large battery packs, and this demand directly influences the market for lithium-ion battery materials.

Many governments worldwide are promoting the use of electric vehicles and renewable energy storage through incentives, subsidies, and regulations. For instance, the European Union aims to have at least 30 million electric cars on the road by 2030. This creates a conducive environment for the expansion of the lithium-ion battery materials market.

Stringent Regulations are Hindering the Lithium-Ion Battery Materials Market Growth

Stringent regulations regarding the transportation and disposal of lithium-ion batteries may pose challenges for manufacturers. The Basel Convention, an international treaty on hazardous waste, places restrictions on the transboundary movement of lithium-ion batteries, impacting their recycling and disposal. Increasing scrutiny of the environmental impact of mining and processing battery materials leads to regulatory challenges.

A study published in the journal Nature Communications suggests that the environmental footprint of lithium extraction and production could hinder the overall sustainability of electric vehicles. Incidents of battery fires in electronic devices and electric vehicles can raise safety concerns and impact consumer confidence. The National Highway Traffic Safety Administration (NHTSA) reported an increasing number of electric vehicle fire incidents. Hence, such factors are hindering the market growth.

Lithium-ion Battery Materials Segment Analysis

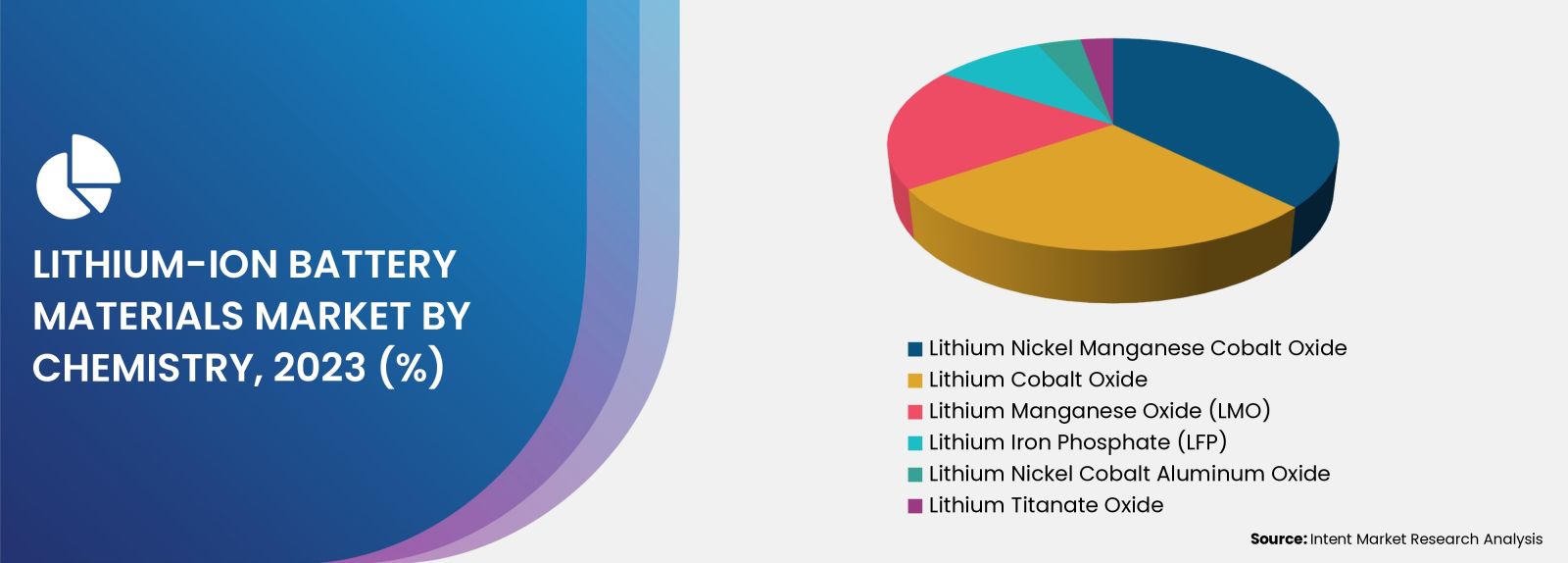

The Adoption of Lithium Nickel Manganese Cobalt Oxide is Rising for Various End-Use Applications

The demand for Lithium nickel manganese cobalt oxide (NMC) is rising due to their balanced combination of nickel, manganese, and cobalt, offering a good compromise between energy density, power capability, and overall performance. This chemistry excels in maintaining a good balance between high energy density, long life, and improved thermoelectricity.

It renders lithium-nickel-manganese-cobalt oxide batteries suitable for a wide range of applications, including electric vehicles and portable electronics. The increasing demand for electric vehicles and strict environmental standards underscores NMC's vital role in delivering reliable, eco-friendly energy storage solutions. Continuous technological innovation further solidifies NMC's position in meeting these evolving needs.

The Cathode is Responsible for storing and Releasing Lithium ions During Charge and Discharge Cycles

The cathode materials segment is the fastest-growing segment in the lithium-ion battery materials market. Cathode materials are critical components of lithium-ion batteries and are widely used in a variety of applications, from portable electronics to electric vehicles and grid energy storage systems. The cathode is responsible for storing and releasing lithium ions during charge and discharge cycles. The lithium-ion cathode materials market is further segmented into lithium iron phosphate (LFP), lithium cobalt oxide (LCO), lithium nickel manganese cobalt oxide (NMC), and lithium manganese oxide (LMO).

Increasing Demand for Lithium-Ion Battery Materials in Portable Devices is Driving the Market Growth

The portable devices segment is the fastest-growing segment in the lithium-ion battery materials market during the forecast period. The rapidly increasing demand for devices such as smartphones, laptops, and wearables, coupled with the growing demand for longer battery life and faster charging, has made Li-ion increasingly important in powering these everyday devices. Lithium-ion batteries are known for their high energy density, long lifespan, and lightweight design, making them an excellent choice for portable electronic devices.

Lithium-ion batteries have a high energy density, meaning they store a large amount of energy in a relatively small and lightweight package. This makes them ideal for devices where space and weight are crucial factors. Lithium-ion batteries are rechargeable, allowing users to charge their devices conveniently. This feature is essential for portable devices that are frequently used on the go. Lithium-ion batteries typically have a longer cycle life compared to other rechargeable batteries. This means they endure more charge and discharge cycles, making them reliable for long-term use in portable devices.

Lithium-ion batteries have a low self-discharge rate, which means they hold their charge for an extended period when not in use. This is beneficial for devices that is being used intermittently. Lithium-ion batteries are designed in various shapes and sizes, allowing manufacturers to create slim and compact devices. This flexibility in design is crucial for the aesthetics and functionality of portable gadgets. Overall, the portable nature of lithium-ion batteries aligns well with the demands of our modern, mobile-centric lifestyle, making them the preferred choice for a wide range of devices.

Regional Insights

Increasing Focus on Clean Energy across Asia-Pacific is Fueling the Market Growth

Asia-Pacific is the fastest-growing region in the lithium-ion battery materials market due to the increasing focus on clean energy. The rise in lithium-ion battery materials is driven by government initiatives such as tax incentives and rebates for electric vehicle purchases, along with subsidies for renewable energy projects. Due to the expanding consumer electronics industry and renewable energy initiatives, the demand for the lithium-ion battery materials is accelerating across the region.

Countries like China, Japan, and South Korea are major players in manufacturing lithium-ion batteries. China, in particular, has a robust and rapidly expanding battery industry, contributing significantly to the global market. The region is home to some of the world's largest electronics markets, driving the demand for lithium-ion batteries in smartphones, laptops, and other portable devices. The Asia Pacific region's influence on the lithium-ion battery market is likely to grow as technology advances and the demand for electric vehicles and portable electronics increases.

Competitive Landscape

Mergers and Acquisitions by Key Players are Responsible for the Market Growth

The lithium-ion battery materials market is moderately competitive, with numerous manufacturers vying for a significant share. Market participants employ essential strategies such as product launches, approvals, acquisitions, and innovations to sustain and expand their global presence. In June 2022, Umicore and Idemitsu Kosan announced a collaboration to develop high-performance catholyte materials for solid-state batteries. Combining their expertise in cathode active materials and solid electrolytes, the collaboration aims to achieve a technological breakthrough to extend the driving range and promote advancements in e-mobility.

Prominent players operating in the market includes 3M, BASF, BTR New Material Group, JFE Chemical, Kureha Corporation, Landf, NEI, POSCO Future M, Resonac, SGL Carbon, Sumitomo Metal Mining, Tanaka Chemical, Toda Kogyo, UBE, Umicore, among others.

Lithium-ion Battery Materials Market Coverage

The report provides key insights into the lithium-ion battery materials market, and it focuses on technological developments, trends, and initiatives taken by the government. In this sector, analysis explores market drivers, restraints, opportunities, and other relevant factors. The report analyses the market for lithium-ion battery materials, including key players and the competitive landscape

.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 48.6 billion |

|

Forecast Revenue (2030) |

USD 120.3 billion |

|

CAGR (2024-2030) |

13.8% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Type (Lithium Nickel Manganese Cobalt Oxide, Lithium Cobalt Oxide, Lithium Manganese Oxide, Lithium Iron Phosphate, Lithium Nickel Cobalt Aluminum Oxide, and Lithium Titanate Oxide), By Material (Cathode, Anode, Electrolyte, Separator, and Others), and By Application (Automotive, Consumer Electronics, Aerospace, Marine, Medical, Industrial, Power and Telecommunications) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Argentina), Middle East & Africa (Saudi Arabia, South Africa, United Arab Emirates) |

|

Competitive Landscape |

3M, BASF, BTR New Material Group, JFE Chemical, Kureha Corporation, Landf, NEI, POSCO Future M, Resonac, SGL Carbon, Sumitomo Metal Mining, Tanaka Chemical, Toda Kogyo, UBE, Umicore, among others. |

|

Customization Scope |

Customization for segments, regions, or country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1. Introduction |

|

1. 1. Study Assumptions and Lithium-ion Battery Materials Market Definition |

|

1.2. Scope of the Study |

|

2. Research Methodology |

|

3. Executive Summary |

|

4. Lithium-ion Battery Materials Market Dynamics |

|

4.1. Market Growth Drivers |

|

4.2 Market Growth Challenges |

|

5. Lithium-ion Battery Materials Market Outlook |

|

5.1 Porters Five Forces |

|

5.2 Value Chain Analysis |

|

5.3. Regulatory Framework |

|

5.4 Patent Analysis |

|

5.5. Technological Advancement |

|

5.6. Industry SWOT Analysis |

|

5.7. Pestle Analysis |

|

5.8. Pricing Analysis |

|

6. Global Lithium-ion Battery Materials Market Segmentation (Market Size & Forecast: USD billion, 2023 – 2030) |

|

6.1 Type |

|

6.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

6.1.2 Lithium Cobalt Oxide |

|

6.1.3 Lithium Manganese Oxide |

|

6.1.4 Lithium Iron Phosphate |

|

6.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

6.1.6 Lithium Titanate Oxide |

|

6.2 Material |

|

6.2.1 Cathode |

|

6.2.2 Anode |

|

6.2.3 Separator |

|

6.2.4 Electrolyte |

|

6.2.5 Others |

|

6.3 Application |

|

6.3.1 Automotive |

|

6.3.2 Consumer Electronics |

|

6.3.3 Aerospace |

|

6.3.4 Marine |

|

6.3.5 Medical |

|

6.3.6 Industrial |

|

6.3.7 Power |

|

6.3.8 Telecommunications |

|

6.4 Geography |

|

6.4.1 North America |

|

6.4.2 Europe |

|

6.4.3 Asia-Pacific |

|

6.4.4 Latin America |

|

6.4.3 Middle East and Africa |

|

7. North America Lithium-ion Battery Materials Market Segmentation (Market Size & Forecast: USD billion, 2023 – 2030) |

|

7.1 Type |

|

7.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

7.1.2 Lithium Cobalt Oxide |

|

7.1.3 Lithium Manganese Oxide |

|

7.1.4 Lithium Iron Phosphate |

|

7.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

7.1.7 Lithium Titanate Oxide |

|

7.2 Material |

|

7.2.1 Cathode |

|

7.2.2 Anode |

|

7.2.3 Separator |

|

7.2.4 Electrolyte |

|

7.2.5 Others |

|

7.3 Application |

|

7.3.1 Automotive |

|

7.3.2 Consumer Electronics |

|

7.3.3 Aerospace |

|

7.3.4 Marine |

|

7.3.5 Medical |

|

7.3.7 Industrial |

|

7.3.7 Power |

|

7.3.8 Telecommunications |

|

7.4 Country |

|

7.4.1 United States |

|

7.4.1.1 Type |

|

7.4.1.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

7.4.1.1.2 Lithium Cobalt Oxide |

|

7.4.1.1.3 Lithium Manganese Oxide |

|

7.4.1.1.4 Lithium Iron Phosphate |

|

7.4.1.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

7.4.1.1.6 Lithium Titanate Oxide |

|

7.4.1.2 Materials |

|

7.4.1.2.1 Cathode |

|

7.4.1.2.2 Anode |

|

7.4.1.2.3 Separator |

|

7.4.1.2.4 Electrolyte |

|

7.4.1.2.5 Others |

|

7.4.1.3 Application |

|

7.4.1.3.1 Automotive |

|

7.4.1.3.2 Consumer Electronics |

|

7.4.1.3.3 Aerospace |

|

7.4.1.3.4 Marine |

|

7.4.1.3.5 Medical |

|

7.4.1.3.6 Industrial |

|

7.4.1.3.7 Power |

|

7.4.1.3.8 Telecommunications |

|

7.4.2 Canada |

|

7.4.2.1 Type |

|

7.4.2.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

7.4.2.1.2 Lithium Cobalt Oxide |

|

7.4.2.1.3 Lithium Manganese Oxide |

|

7.4.2.1.4 Lithium Iron Phosphate |

|

7.4.2.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

7.4.2.1.6 Lithium Titanate Oxide |

|

7.4.2.2 Materials |

|

7.4.2.2.1 Cathode |

|

7.4.2.2.2 Anode |

|

7.4.2.2.3 Separator |

|

7.4.2.2.4 Electrolyte |

|

7.4.2.2.5 Others |

|

7.4.2.3 Application |

|

7.4.2.3.1 Automotive |

|

7.4.2.3.2 Consumer Electronics |

|

7.4.2.3.3 Aerospace |

|

7.4.2.3.4 Marine |

|

7.4.2.3.5 Medical |

|

7.4.2.3.6 Industrial |

|

7.4.2.3.7 Power |

|

7.4.2.3.8 Telecommunications |

|

8. Europe Market Lithium-ion Battery Materials Market Segmentation (Market Size & Forecast: USD billion, 2023 – 2030) |

|

8.1 Type |

|

8.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

8.1.2 Lithium Cobalt Oxide |

|

8.1.3 Lithium Manganese Oxide |

|

8.1.4 Lithium Iron Phosphate |

|

8.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

8.1.8 Lithium Titanate Oxide |

|

8.2 Material |

|

8.2.1 Cathode |

|

8.2.2 Anode |

|

8.2.3 Separator |

|

8.2.4 Electrolyte |

|

8.2.5 Others |

|

8.3 Application |

|

8.3.1 Automotive |

|

8.3.2 Consumer Electronics |

|

8.3.3 Aerospace |

|

8.3.4 Marine |

|

8.3.5 Medical |

|

8.3.8 Industrial |

|

8.3.8 Power |

|

8.3.8 Telecommunications |

|

8.4 Country |

|

8.4.1 United Kingdom |

|

8.4.1.1 Type |

|

8.4.1.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

8.4.1.1.2 Lithium Cobalt Oxide |

|

8.4.1.1.3 Lithium Manganese Oxide |

|

8.4.1.1.4 Lithium Iron Phosphate |

|

8.4.1.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

8.4.1.1.6 Lithium Titanate Oxide |

|

8.4.1.2 Materials |

|

8.4.1.2.1 Cathode |

|

8.4.1.2.2 Anode |

|

8.4.1.2.3 Separator |

|

8.4.1.2.4 Electrolyte |

|

8.4.1.2.5 Others |

|

8.4.1.3 Application |

|

8.4.1.3.1 Automotive |

|

8.4.1.3.2 Consumer Electronics |

|

8.4.1.3.3 Aerospace |

|

8.4.1.3.4 Marine |

|

8.4.1.3.5 Medical |

|

8.4.1.3.6 Industrial |

|

8.4.1.3.8 Power |

|

8.4.1.3.8 Telecommunications |

|

8.4.2 Germany |

|

8.4.2.1 Type |

|

8.4.2.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

8.4.2.1.2 Lithium Cobalt Oxide |

|

8.4.2.1.3 Lithium Manganese Oxide |

|

8.4.2.1.4 Lithium Iron Phosphate |

|

8.4.2.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

8.4.2.1.6 Lithium Titanate Oxide |

|

8.4.2.2 Materials |

|

8.4.2.2.1 Cathode |

|

8.4.2.2.2 Anode |

|

8.4.2.2.3 Separator |

|

8.4.2.2.4 Electrolyte |

|

8.4.2.2.5 Others |

|

8.4.2.3 Application |

|

8.4.2.3.1 Automotive |

|

8.4.2.3.2 Consumer Electronics |

|

8.4.2.3.3 Aerospace |

|

8.4.2.3.4 Marine |

|

8.4.2.3.5 Medical |

|

8.4.2.3.6 Industrial |

|

8.4.2.3.8 Power |

|

8.4.2.3.8 Telecommunications |

|

8.4.3 France |

|

8.4.3.1 Type |

|

8.4.3.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

8.4.3.1.2 Lithium Cobalt Oxide |

|

8.4.3.1.3 Lithium Manganese Oxide |

|

8.4.3.1.4 Lithium Iron Phosphate |

|

8.4.3.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

8.4.3.1.6 Lithium Titanate Oxide |

|

8.4.3.2 Materials |

|

8.4.3.2.1 Cathode |

|

8.4.3.2.2 Anode |

|

8.4.3.2.3 Separator |

|

8.4.3.2.4 Electrolyte |

|

8.4.3.2.5 Others |

|

8.4.3.3 Application |

|

8.4.1.3.1 Automotive |

|

8.4.1.3.2 Consumer Electronics |

|

8.4.1.3.3 Aerospace |

|

8.4.1.3.4 Marine |

|

8.4.1.3.5 Medical |

|

8.4.1.3.6 Industrial |

|

8.4.1.3.8 Power |

|

8.4.1.3.8 Telecommunications |

|

8.4.4 Italy |

|

8.4.4.1 Type |

|

8.4.4.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

8.4.4.1.2 Lithium Cobalt Oxide |

|

8.4.4.1.3 Lithium Manganese Oxide |

|

8.4.4.1.4 Lithium Iron Phosphate |

|

8.4.4.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

8.4.4.1.6 Lithium Titanate Oxide |

|

8.4.4.2 Materials |

|

8.4.4.2.1 Cathode |

|

8.4.4.2.2 Anode |

|

8.4.4.2.3 Separator |

|

8.4.4.2.4 Electrolyte |

|

8.4.4.2.5 Others |

|

8.4.4.3 Application |

|

8.4.4.3.1 Automotive |

|

8.4.4.3.2 Consumer Electronics |

|

8.4.4.3.3 Aerospace |

|

8.4.4.3.4 Marine |

|

8.4.4.3.5 Medical |

|

8.4.4.3.6 Industrial |

|

8.4.4.3.8 Power |

|

8.4.4.3.8 Telecommunications |

|

9. Asia-Pacific Lithium-ion Battery Materials Market Segmentation (Market Size & Forecast: USD billion, 2023 – 2030) |

|

9.1 Type |

|

9.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

9.1.2 Lithium Cobalt Oxide |

|

9.1.3 Lithium Manganese Oxide |

|

9.1.4 Lithium Iron Phosphate |

|

9.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

9.1.9 Lithium Titanate Oxide |

|

9.2 Material |

|

9.2.1 Cathode |

|

9.2.2 Anode |

|

9.2.3 Separator |

|

9.2.4 Electrolyte |

|

9.2.5 Others |

|

9.3 Application |

|

9.3.1 Automotive |

|

9.3.2 Consumer Electronics |

|

9.3.3 Aerospace |

|

9.3.4 Marine |

|

9.3.5 Medical |

|

9.3.9 Industrial |

|

9.3.9 Power |

|

9.3.9 Telecommunications |

|

9.4 Country |

|

9.4.1 China |

|

9.4.1.1 Type |

|

9.4.1.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

9.4.1.1.2 Lithium Cobalt Oxide |

|

9.4.1.1.3 Lithium Manganese Oxide |

|

9.4.1.1.4 Lithium Iron Phosphate |

|

9.4.1.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

9.4.1.1.6 Lithium Titanate Oxide |

|

9.4.1.2 Materials |

|

9.4.1.2.1 Cathode |

|

9.4.1.2.2 Anode |

|

9.4.1.2.3 Separator |

|

9.4.1.2.4 Electrolyte |

|

9.4.1.2.5 Others |

|

9.4.1.3 Application |

|

9.4.1.3.1 Automotive |

|

9.4.1.3.2 Consumer Electronics |

|

9.4.1.3.3 Aerospace |

|

9.4.1.3.4 Marine |

|

9.4.1.3.5 Medical |

|

9.4.1.3.6 Industrial |

|

9.4.1.3.9 Power |

|

9.4.1.3.9 Telecommunications |

|

9.4.2 Japan |

|

9.4.2.1 Type |

|

9.4.2.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

9.4.2.1.2 Lithium Cobalt Oxide |

|

9.4.2.1.3 Lithium Manganese Oxide |

|

9.4.2.1.4 Lithium Iron Phosphate |

|

9.4.2.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

9.4.2.1.6 Lithium Titanate Oxide |

|

9.4.2.2 Materials |

|

9.4.2.2.1 Cathode |

|

9.4.2.2.2 Anode |

|

9.4.2.2.3 Separator |

|

9.4.2.2.4 Electrolyte |

|

9.4.2.2.5 Others |

|

9.4.2.3 Application |

|

9.4.2.3.1 Automotive |

|

9.4.2.3.2 Consumer Electronics |

|

9.4.2.3.3 Aerospace |

|

9.4.2.3.4 Marine |

|

9.4.2.3.5 Medical |

|

9.4.2.3.6 Industrial |

|

9.4.2.3.9 Power |

|

9.4.2.3.9 Telecommunications |

|

9.4.3 India |

|

9.4.3.1 Type |

|

9.4.3.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

9.4.3.1.2 Lithium Cobalt Oxide |

|

9.4.3.1.3 Lithium Manganese Oxide |

|

9.4.3.1.4 Lithium Iron Phosphate |

|

9.4.3.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

9.4.3.1.6 Lithium Titanate Oxide |

|

9.4.3.2 Materials |

|

9.4.3.2.1 Cathode |

|

9.4.3.2.2 Anode |

|

9.4.3.2.3 Separator |

|

9.4.3.2.4 Electrolyte |

|

9.4.3.2.5 Others |

|

9.4.3.3 Application |

|

9.4.1.3.1 Automotive |

|

9.4.1.3.2 Consumer Electronics |

|

9.4.1.3.3 Aerospace |

|

9.4.1.3.4 Marine |

|

9.4.1.3.5 Medical |

|

9.4.1.3.6 Industrial |

|

9.4.1.3.9 Power |

|

9.4.1.3.9 Telecommunications |

|

9.4.4 South Korea |

|

9.4.4.1 Type |

|

9.4.4.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

9.4.4.1.2 Lithium Cobalt Oxide |

|

9.4.4.1.3 Lithium Manganese Oxide |

|

9.4.4.1.4 Lithium Iron Phosphate |

|

9.4.4.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

9.4.4.1.6 Lithium Titanate Oxide |

|

9.4.4.2 Materials |

|

9.4.4.2.1 Cathode |

|

9.4.4.2.2 Anode |

|

9.4.4.2.3 Separator |

|

9.4.4.2.4 Electrolyte |

|

9.4.4.2.5 Others |

|

9.4.4.3 Application |

|

9.4.4.3.1 Automotive |

|

9.4.4.3.2 Consumer Electronics |

|

9.4.4.3.3 Aerospace |

|

9.4.4.3.4 Marine |

|

9.4.4.3.5 Medical |

|

9.4.4.3.6 Industrial |

|

9.4.4.3.9 Power |

|

9.4.4.3.9 Telecommunications |

|

10. Latin America Lithium-ion Battery Materials Market Segmentation (Market Size & Forecast: USD billion, 2023 – 2030) |

|

10.1 Type |

|

10.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

10.1.2 Lithium Cobalt Oxide |

|

10.1.3 Lithium Manganese Oxide |

|

10.1.4 Lithium Iron Phosphate |

|

10.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

10.1.10 Lithium Titanate Oxide |

|

10.2 Material |

|

10.2.1 Cathode |

|

10.2.2 Anode |

|

10.2.3 Separator |

|

10.2.4 Electrolyte |

|

10.2.5 Others |

|

10.3 Application |

|

10.3.1 Automotive |

|

10.3.2 Consumer Electronics |

|

10.3.3 Aerospace |

|

10.3.4 Marine |

|

10.3.5 Medical |

|

10.3.10 Industrial |

|

10.3.10 Power |

|

10.3.10 Telecommunications |

|

10.4 Country |

|

10.4.1 Brazil |

|

10.4.1.1 Type |

|

10.4.1.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

10.4.1.1.2 Lithium Cobalt Oxide |

|

10.4.1.1.3 Lithium Manganese Oxide |

|

10.4.1.1.4 Lithium Iron Phosphate |

|

10.4.1.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

10.4.1.1.6 Lithium Titanate Oxide |

|

10.4.1.2 Materials |

|

10.4.1.2.1 Cathode |

|

10.4.1.2.2 Anode |

|

10.4.1.2.3 Separator |

|

10.4.1.2.4 Electrolyte |

|

10.4.1.2.5 Others |

|

10.4.1.3 Application |

|

10.4.1.3.1 Automotive |

|

10.4.1.3.2 Consumer Electronics |

|

10.4.1.3.3 Aerospace |

|

10.4.1.3.4 Marine |

|

10.4.1.3.5 Medical |

|

10.4.1.3.6 Industrial |

|

10.4.1.3.10 Power |

|

10.4.1.3.10 Telecommunications |

|

10.4.2 Mexico |

|

10.4.2.1 Type |

|

10.4.2.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

10.4.2.1.2 Lithium Cobalt Oxide |

|

10.4.2.1.3 Lithium Manganese Oxide |

|

10.4.2.1.4 Lithium Iron Phosphate |

|

10.4.2.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

10.4.2.1.6 Lithium Titanate Oxide |

|

10.4.2.2 Materials |

|

10.4.2.2.1 Cathode |

|

10.4.2.2.2 Anode |

|

10.4.2.2.3 Separator |

|

10.4.2.2.4 Electrolyte |

|

10.4.2.2.5 Others |

|

10.4.2.3 Application |

|

10.4.2.3.1 Automotive |

|

10.4.2.3.2 Consumer Electronics |

|

10.4.2.3.3 Aerospace |

|

10.4.2.3.4 Marine |

|

10.4.2.3.5 Medical |

|

10.4.2.3.6 Industrial |

|

10.4.2.3.10 Power |

|

10.4.2.3.10 Telecommunications |

|

10.4.3 Argentina |

|

10.4.3.1 Type |

|

10.4.3.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

10.4.3.1.2 Lithium Cobalt Oxide |

|

10.4.3.1.3 Lithium Manganese Oxide |

|

10.4.3.1.4 Lithium Iron Phosphate |

|

10.4.3.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

10.4.3.1.6 Lithium Titanate Oxide |

|

10.4.3.2 Materials |

|

10.4.3.2.1 Cathode |

|

10.4.3.2.2 Anode |

|

10.4.3.2.3 Separator |

|

10.4.3.2.4 Electrolyte |

|

10.4.3.2.5 Others |

|

10.4.3.3 Application |

|

10.4.1.3.1 Automotive |

|

10.4.1.3.2 Consumer Electronics |

|

10.4.1.3.3 Aerospace |

|

10.4.1.3.4 Marine |

|

10.4.1.3.5 Medical |

|

10.4.1.3.6 Industrial |

|

10.4.1.3.10 Power |

|

10.4.1.3.10 Telecommunications |

|

11. Middle East & Africa Lithium-ion Battery Materials Market Segmentation (Market Size & Forecast: USD billion, 2023 – 2030) |

|

11.1 Type |

|

11.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

11.1.2 Lithium Cobalt Oxide |

|

11.1.3 Lithium Manganese Oxide |

|

11.1.4 Lithium Iron Phosphate |

|

11.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

11.1.11 Lithium Titanate Oxide |

|

11.2 Material |

|

11.2.1 Cathode |

|

11.2.2 Anode |

|

11.2.3 Separator |

|

11.2.4 Electrolyte |

|

11.2.5 Others |

|

11.3 Application |

|

11.3.1 Automotive |

|

11.3.2 Consumer Electronics |

|

11.3.3 Aerospace |

|

11.3.4 Marine |

|

11.3.5 Medical |

|

11.3.11 Industrial |

|

11.3.11 Power |

|

11.3.11 Telecommunications |

|

11.4 Country |

|

11.4.1 United Arab Emirates |

|

11.4.1.1 Type |

|

11.4.1.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

11.4.1.1.2 Lithium Cobalt Oxide |

|

11.4.1.1.3 Lithium Manganese Oxide |

|

11.4.1.1.4 Lithium Iron Phosphate |

|

11.4.1.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

11.4.1.1.6 Lithium Titanate Oxide |

|

11.4.1.2 Materials |

|

11.4.1.2.1 Cathode |

|

11.4.1.2.2 Anode |

|

11.4.1.2.3 Separator |

|

11.4.1.2.4 Electrolyte |

|

11.4.1.2.5 Others |

|

11.4.1.3 Application |

|

11.4.1.3.1 Automotive |

|

11.4.1.3.2 Consumer Electronics |

|

11.4.1.3.3 Aerospace |

|

11.4.1.3.4 Marine |

|

11.4.1.3.5 Medical |

|

11.4.1.3.6 Industrial |

|

11.4.1.3.11 Power |

|

11.4.1.3.11 Telecommunications |

|

11.4.2 South Africa |

|

11.4.2.1 Type |

|

11.4.2.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

11.4.2.1.2 Lithium Cobalt Oxide |

|

11.4.2.1.3 Lithium Manganese Oxide |

|

11.4.2.1.4 Lithium Iron Phosphate |

|

11.4.2.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

11.4.2.1.6 Lithium Titanate Oxide |

|

11.4.2.2 Materials |

|

11.4.2.2.1 Cathode |

|

11.4.2.2.2 Anode |

|

11.4.2.2.3 Separator |

|

11.4.2.2.4 Electrolyte |

|

11.4.2.2.5 Others |

|

11.4.2.3 Application |

|

11.4.2.3.1 Automotive |

|

11.4.2.3.2 Consumer Electronics |

|

11.4.2.3.3 Aerospace |

|

11.4.2.3.4 Marine |

|

11.4.2.3.5 Medical |

|

11.4.2.3.6 Industrial |

|

11.4.2.3.11 Power |

|

11.4.2.3.11 Telecommunications |

|

11.4.3 Saudi Arabia |

|

11.4.3.1 Type |

|

11.4.3.1.1 Lithium Nickel Manganese Cobalt Oxide |

|

11.4.3.1.2 Lithium Cobalt Oxide |

|

11.4.3.1.3 Lithium Manganese Oxide |

|

11.4.3.1.4 Lithium Iron Phosphate |

|

11.4.3.1.5 Lithium Nickel Cobalt Aluminum Oxide |

|

11.4.3.1.6 Lithium Titanate Oxide |

|

11.4.3.2 Materials |

|

11.4.3.2.1 Cathode |

|

11.4.3.2.2 Anode |

|

11.4.3.2.3 Separator |

|

11.4.3.2.4 Electrolyte |

|

11.4.3.2.5 Others |

|

11.4.3.3 Application |

|

11.4.3.3.1 Automotive |

|

11.4.3.3.2 Consumer Electronics |

|

11.4.3.3.3 Aerospace |

|

11.4.3.3.4 Marine |

|

11.4.3.3.5 Medical |

|

11.4.3.3.6 Industrial |

|

11.4.3.3.11 Power |

|

11.4.3.3.11 Telecommunications |

|

12. Competitive Landscape |

|

12.1 Company Market Share Analysis |

|

12.2 Competitive Matrix |

|

12.3 Product Benchmarking |

|

12.4 Company Profiles (Manufacturers of Lithium-ion Battery Materials Market) |

|

12.4.1 BASF |

|

12.4.1.1 Company Synopsis |

|

12.4.1.2 Company Financials |

|

12.4.1.3 Product/ Service Portfolio |

|

12.4.1.4 Recent Developments |

|

12.4.2 Resonac Holding Corporation |

|

12.4.3 UBE Corporation |

|

12.4.4 3M |

|

12.4.5 Tanaka Chemical Corporation |

|

12.4.6 SGL Carbon |

|

12.4.7 Umicore |

|

12.4.8 Sumitomo Metal Mining Co. |

|

12.4.9 KUREHA CORPORATION |

|

12.4.10 POSCO FUTURE |

|

12.4.11 Toda Kogyo Corp. |

|

12.4.12 LANDF CORP. |

|

12.4.13 JFE Chemical Corporation |

|

12.4.14 NEI Corporation |

|

12.4.15 BTR New Material Group Co. |

|

12.5 Company Profiles (Demand Side) |

|

12.5.1 Samsung Electronics |

|

12.5.1.1 Company Synopsis |

|

12.3.1.2 Company Financials |

|

12.3.1.3 Product/ Service Portfolio |

|

12.3.1.4 Recent Developments |

|

12.5.2 Sony Corporation |

|

12.5.3 LG Electronics |

|

12.5.4 Microsoft Corporation |

|

12.5.5 HP |

|

13. Analyst Recommendations |

Let us connect with you TOC

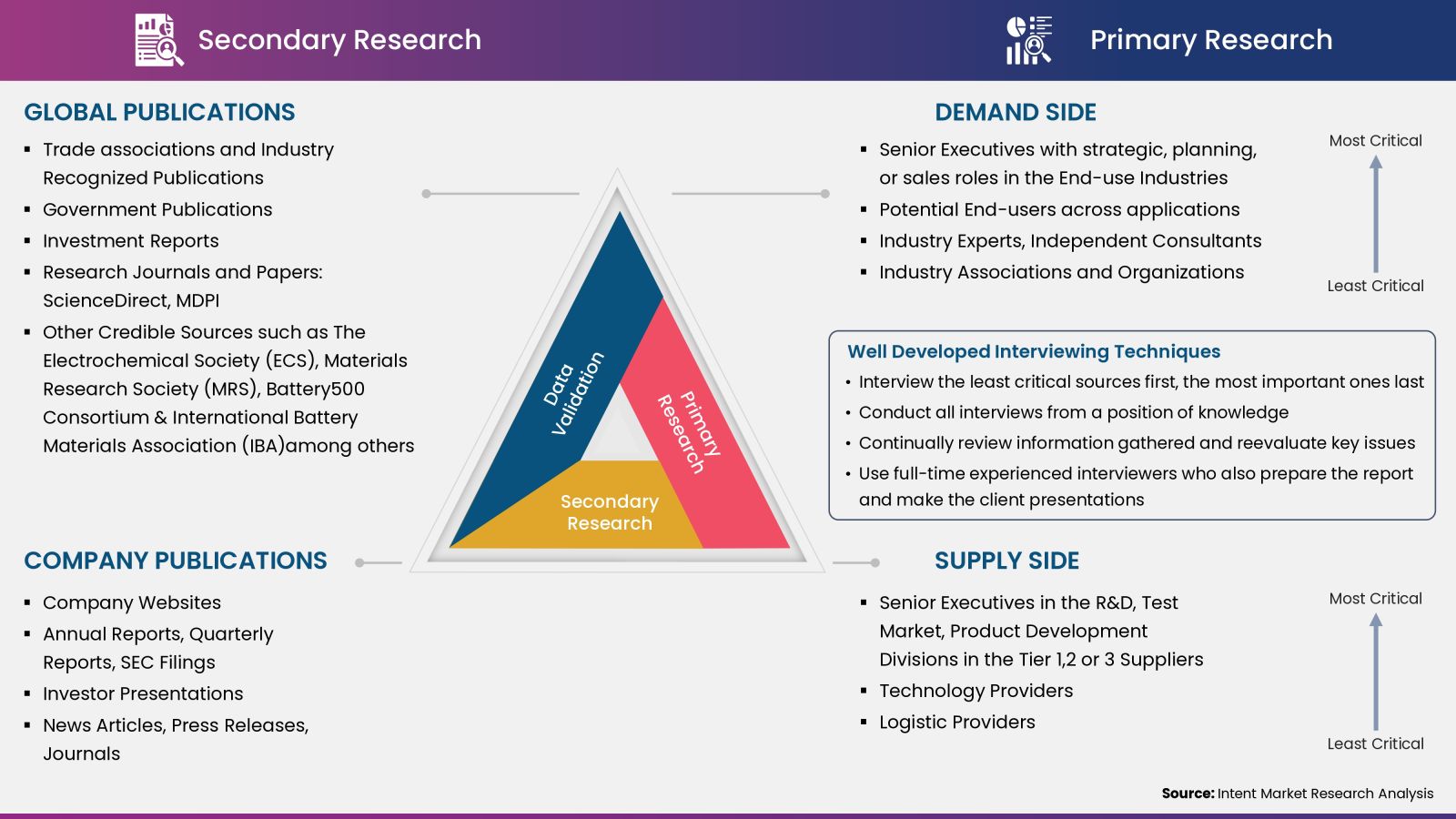

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

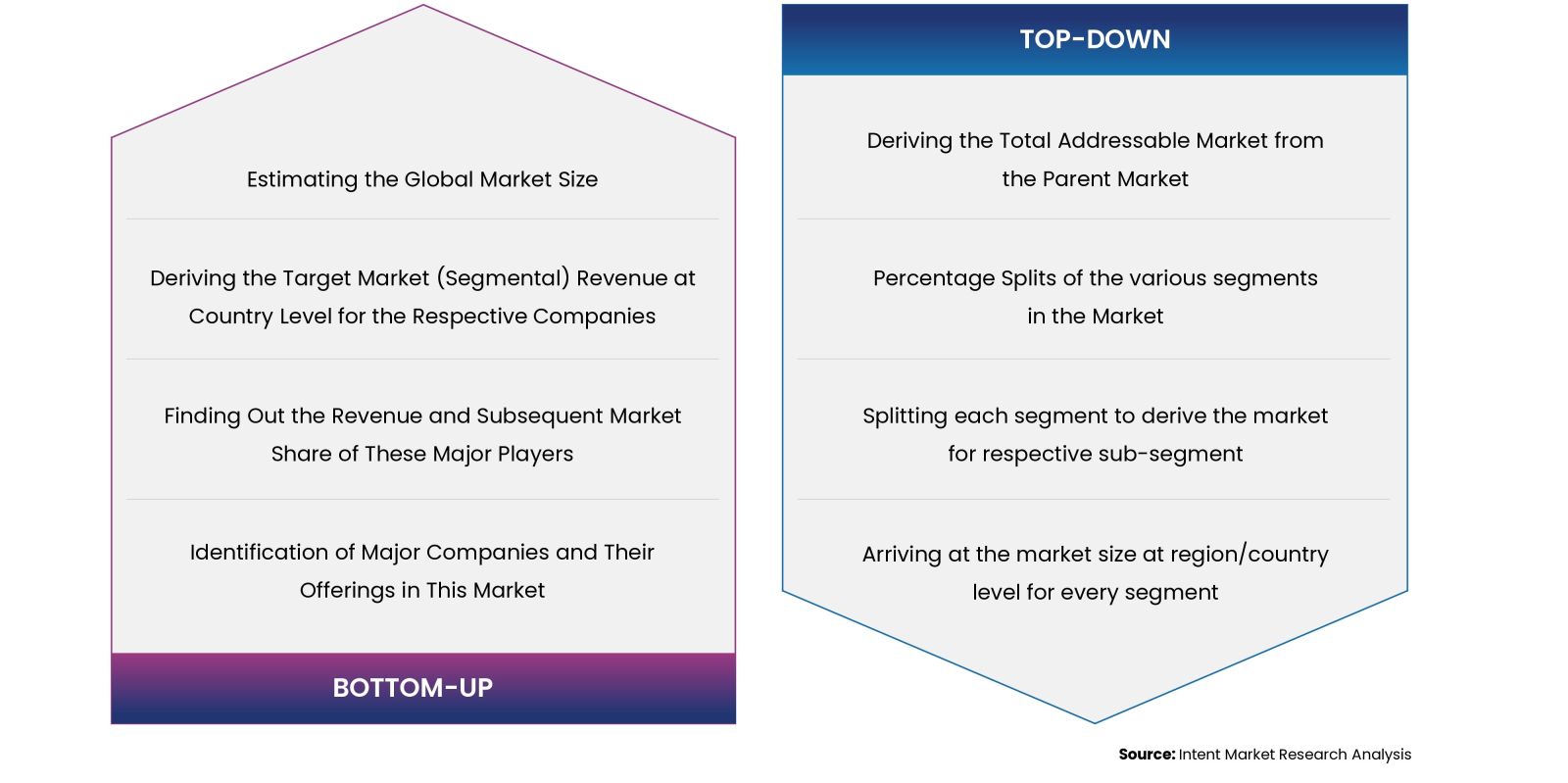

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats