Hydrogen Rocket Engine Market Research Report By Cycle (Expander, Gas-generator, Staged Combustion, Combustion Tap-off), By Application (Upper Stage, Lower Stage, Booster), By Flight Plan (Low Earth Orbit, Medium Earth Orbit, Geostationary, Earth Escape), By Vehicle Type (Unmanned and Manned), By End Use (Commercial, Military & Government) and By Region | Market Forecast (2024-2030)

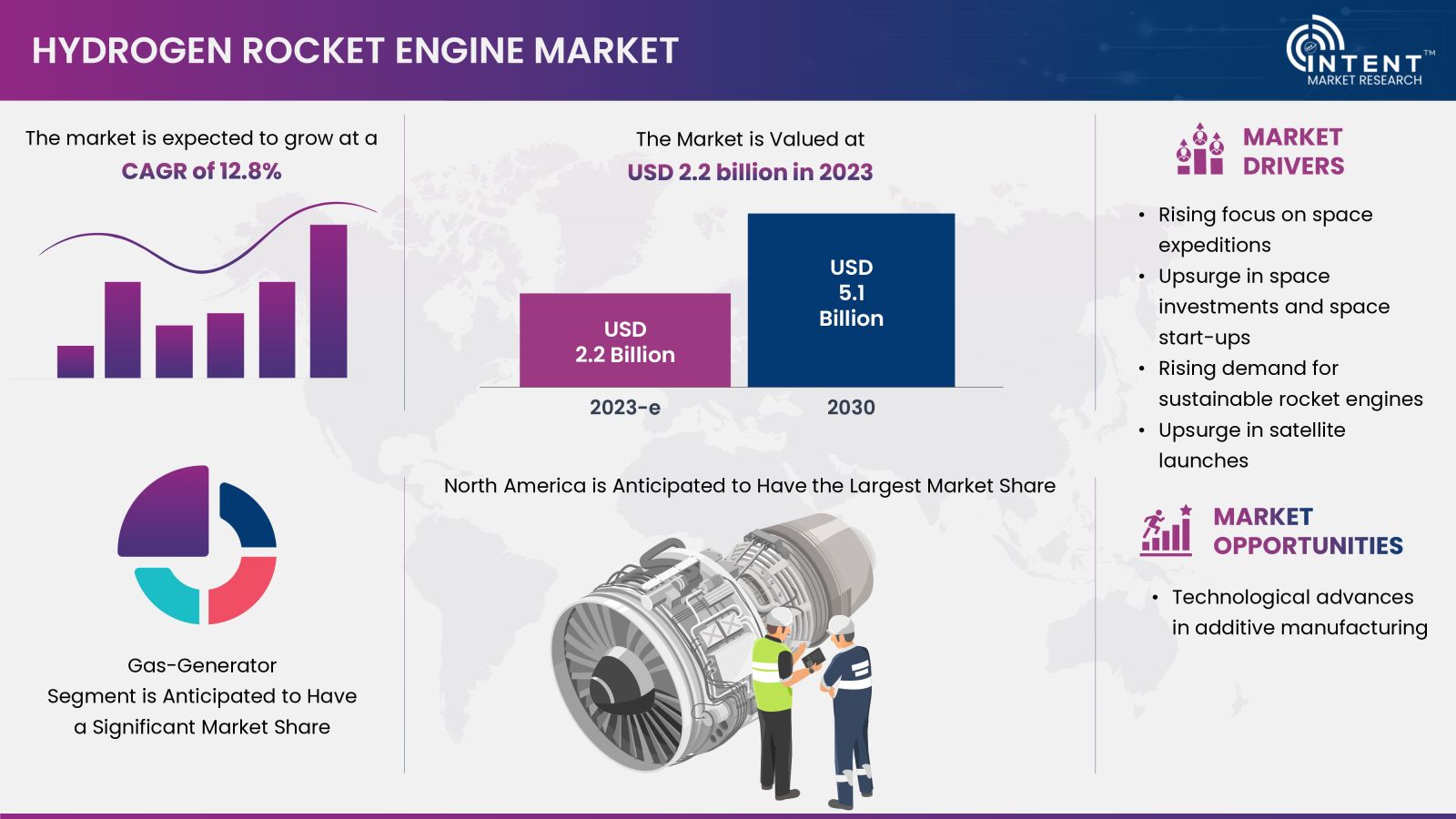

The Hydrogen Rocket Engine Market is expected to grow from USD 2.2 billion in 2023-e to USD 5.1 billion by 2030, at a CAGR of 12.8% during the forecast period. The hydrogen rocket engine market is a competitive market, the prominent players in the global market include Aerojet Rocketdyne (L3Harris Technologies), Blue Origin, Boeing, China Academy of Launch Vehicle Technology (CALT), Hindustan Aeronautics Limited (HAL), Mitsubishi Heavy Industries, Pulsar, Safran Aircraft Engines, ArianeGroup, and IHI Corporation.

Hydrogen Rocket Engine Market Snapshot

Hydrogen rocket engines are cryogenic engines in which liquid hydrogen (LH2) is used as a propellant along with liquid oxygen (LOX) for combustion. LH2 fuel offers several advantages such as high specific impulse and higher efficiency making it a popular choice for rocket engines. The high specific impulse of a hydrogen engine offers significant advantage as it produces more thrust for a longer time.

Upsurge in Satellite Launches is Driving the Market Growth

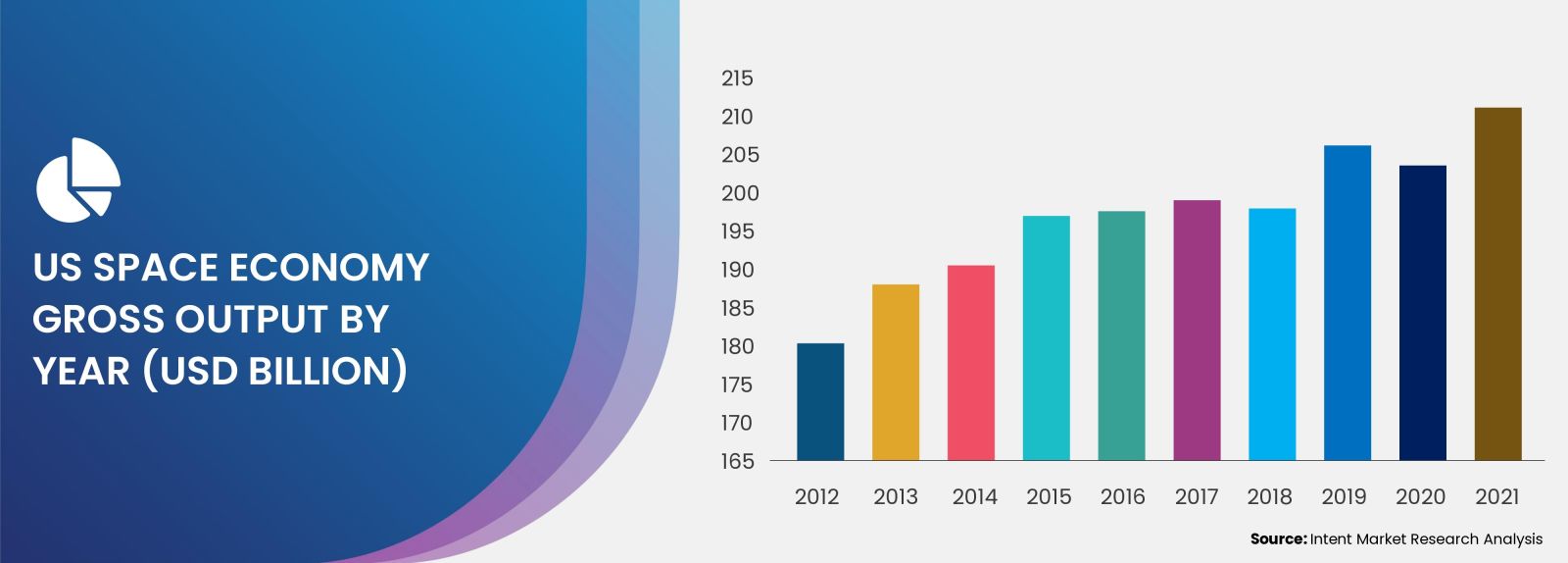

The hydrogen rocket engine market is driven by the upsurge in satellite launches. The satellites are used for GPS, communications, and remote sensing. As of June 2023, the United Nations Office for Outer Space Affairs (UNOOSA) reported that 11,330 individual satellites were orbiting the Earth. This marked a notable increase of 37.94% since January 2022.

Satellite internet has become a viable substitute for broadband services and communication in recent years. There have been significant investments made by private companies to establish satellite internet networks. For instance, Amazon teamed up with Blue Origin, Arianespace, and United Launch Alliance (ULA) in April 2022 to launch up to 83 broadband satellites as part of its Project Kuiper initiative. Thus, growing infrastructure investments globally are driving the Hydrogen Rocket Engine market.

High Specific Impulse offered by Gas-generator Cycle Drives the Market Growth

The gas-generator cycle also called an open cycle is among the most widely used power cycles in bipropellant liquid rocket engines. The gas-generator cycle has several advantages, including simple design, high efficiency, and thrust-to-weight ratio. It provides a higher specific impulse (ISP) than solid-propellant fuel, making it advantageous. This has led to increasing number of developments by companies into hydrogen gas-generator cycle engines to capitalize on these benefits. Due to the advantages that gas-generator cycle offers, there’s an increase in adoption of it by the companies thereby driving the gas-generator cycle segment growth. Some of the engines that use gas-generator cycles include RS-68 (Aerojet Rocketdyne), VULCAIN 2.1 (ArianeGroup), CE-20 (HAL), and YF-73 (CALT).

Growing Interest in Space Exploration is Fueling the Demand for Upper-Stage Rocket Engines

The upper stages provide the in-space propulsion to set the spacecraft on a precise trajectory once the spacecraft is in orbit. Liquid hydrogen and liquid oxygen propellants are ideal for upper stages owing to the high-energy combination. The hydrogen engine in the upper stage presents various advantages, such as high exhaust jet velocity, increased efficiency at higher altitudes, and zero pollution.

The growing interest in space exploration is fueling the demand for upper-stage rocket engines. There are several space explorations planned in coming years such as Peregrine Mission 1, Intuitive Machines 1, Bepi-Colombo, Martian Moon eXploration (MMX), Europa Clipper, and more. Due to the advantages of hydrogen rockets in the upper stages and the rising number of rocket launches for space exploration, the upper stage segment is expected to maintain a substantial market share in the hydrogen rocket engine market.

Increasing Applications of Low Earth Orbit (LEO) Satellites for Communication, Weather Forecasting, Navigation, and Imaging is Driving the Segment Growth

There has been a significant rise in LEO satellite launches in recent years. These LEO satellites are often SmallSats and CubeSats which are utilized for several applications including communication, weather forecasting, navigation, and imaging, among others. The significant increase in satellite launches can be attributed to factors such as the growing adoption of reusable launch vehicles, the rise in computing power, and the privatization of the space industry.

According to NASA, there was an average of about 140 SmallSats launched per year from 2013 to 2017. In contrast, there were around 1700 SmallSats per year from 2017 to 2021. As a result, the LEO segment is expected to experience significant growth in the hydrogen rocket engine market.

Rising Demand for Earth Observatory Satellites is Augmenting the Unmanned Spacecraft Segment Growth

Unmanned spacecraft are space probes that are unpiloted devices with a set of scientific instruments and tools sent to explore space and gather scientific information. Rising demand for Earth observatory satellites in growing economies is driving the demand for unmanned spacecraft. The ability to launch manned spacecraft is currently restricted to only a handful of countries.

The growing space industry in emerging economies is particularly focused on deploying numerous satellites to improve their navigation, security, and communication systems. As a result, the unmanned spacecraft segment is expected to maintain a substantial market share in the hydrogen rocket engine market.

Growing Number of Commercial Satellite Launches is Driving the Hydrogen Rocket Engine Market

In recent years, there has been tremendous growth in commercial satellite launches. The growing number of private companies entering the space exploration market is one of the key drivers for the growth of the hydrogen rocket engine market. Companies such as Blue Origin have actively deployed hydrogen rocket engines and are strongly focused on commercial space expeditions.

The market is growing due to a rising demand for satellite internet and an increasing number of commercial satellite launches. Furthermore, the notable increase in space tourism is expected to contribute to the demand for commercial end-use. This is anticipated to lead to significant growth in the commercial segment of the hydrogen rocket engine market.

Robust Government Initiatives Has Resulted for Asia-Pacific to be the Fastest-Growing Region in the Hydrogen Rocket Engine Market

Asia-Pacific has emerged as a strong region in the space sector with China, India, and Japan leading the space industry. These countries have comprehensive end-to-end space capabilities and possess a complete space infrastructure including space technology, satellite manufacturing, rockets, and spaceports. The market in the region is driven by a growing emphasis on space exploration and robust government initiatives.

Furthermore, countries such as South Korea, Taiwan, Philippines, Thailand, and New Zealand, are actively developing and expanding their indigenous space capabilities. In June 2022, South Korea launched its Nuri rocket, placing six satellites into orbit. The South Korean government revealed intentions to allocate USD 674 million in its 2023 budget, representing a substantial 19.5% increase from the 2022 budget and the largest budget allocated for space programs in the country. Consequently, the Asia-Pacific region is expected to be the fastest-growing region in the hydrogen rocket engine market.

Competitive Analysis

Companies operating within the hydrogen rocket engine market are primarily rocket engine manufacturers responsible for producing components utilized in hydrogen engines. These companies not only manufacture engines for their space vehicles but frequently engage in long-term contracts with governmental bodies worldwide.

The companies are actively expanding their portfolios with the growing space industry. The hydrogen rocket engine market is dominated by a few key global market players having a significant market share. The market is also highly competitive with an increasing number of startups coming in the market. Some of the key companies in the market are Aerojet Rocketdyne (L3Harris Technologies), Blue Origin, Boeing, China Academy of Launch Vehicle Technology (CALT), Hindustan Aeronautics Limited (HAL), Mitsubishi Heavy Industries, Pulsar, Safran Aircraft Engines, ArianeGroup, and IHI Corporation.

Following are the key developments in the hydrogen rocket engine market:

- In July 2023, China Aerospace Science and Technology Corporation (CASC) tested its advanced hydrogen-oxygen rocket engine for the space program

- In December 2022, GKN Aerospace signed a contract with ArianeGroup to supply the next phase of Ariane 6 turbines and Vulcain nozzles.

Hydrogen Rocket Engine Market Coverage

The report provides key insights into the hydrogen rocket engine market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 2.2 Billion |

|

Forecast Revenue (2030) |

USD 5.1 Billion |

|

CAGR (2024-2030) |

12.8% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments, Company Profiles, Segment Analysis, Regional Outlook |

|

Segments Covered |

Hydrogen Rocket Engine Market Research Report By Cycle (Expander, Gas-generator, Staged Combustion, and Combustion Tap-off), By Application (Upper Stage, Lower Stage, and Booster), By Flight Plan (LEO, Medium Earth Orbit, Geostationary, and Earth Escape), By Vehicle Type (Unmanned and Manned), By End Use (Commercial, Military and Government) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, UK, France, Italy), Asia-Pacific (China, India, Japan, South Korea), Rest of the World (Latin America, Middle East, and Africa) |

|

Key Companies |

Aerojet Rocketdyne (L3Harris Technologies), ArianeGroup, Blue Origin, Boeing, China Academy of Launch Vehicle Technology (CALT), Hindustan Aeronautics Limited (HAL), IHI Corporation, Mitsubishi Heavy Industries, Pulsar, and Safran Aircraft Engines |

|

Customization Scope |

Customization at the segment level or region/country level can be provided. |

|

Purchase Options |

Opt for Single User License, Multi-User License (Up to 5 Users), or Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1. Study Assumptions and Market Definition |

|

1.2. Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1. Market Drivers |

|

4.1.1. Rising focus on space expeditions |

|

4.1.2. Upsurge in space investments and space startups |

|

4.1.3. Rising demand for sustainable rocket engines |

|

4.1.4. Upsurge in satellite launches |

|

4.2. Market Restraints |

|

4.2.1. High capital investments |

|

4.2.2. Regulatory challenges |

|

4.3. Market Growth Opportunities |

|

4.3.1. Technology advances in additive manufacturing |

|

4.4. Porter’s Five Forces |

|

4.5. PESTLE Analysis |

|

5.Market Outlook |

|

5.1. Supply Chain Analysis |

|

5.2. Regulatory Framework |

|

5.3. Technology Analysis |

|

5.4. Patent Analysis |

|

5.5. Impact of COVID-19 |

|

5.6. Impact of Russia-Ukraine War |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

6.1. Segment Synopsis |

|

6.2. By Cycle |

|

6.2.1. Gas-generator |

|

6.2.2. Expander |

|

6.2.3. Staged Combustion |

|

6.2.4. Combustion Tap-off |

|

6.3. By Application |

|

6.3.1. Upper Stage |

|

6.3.2. Lower Stage |

|

6.3.3. Booster |

|

6.4. By Flight Plan |

|

6.4.1. Low Earth Orbit (LEO) |

|

6.4.2. Medium Earth Orbit (MEO) |

|

6.4.3. Geostationary Earth Orbit (GEO) |

|

6.4.4. Beyond Geosynchronous Orbit |

|

6.5. By Vehicle Type |

|

6.5.1. Unmanned |

|

6.5.2. Manned |

|

6.6. By End Use |

|

6.6.1. Commercial |

|

6.6.2. Military & Government |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2023 – 2030) |

|

7.1. Global Market Synopsis |

|

7.2. North America |

|

7.2.1. North America Hydrogen Rocket Engine Market Outlook |

|

7.2.2. US |

|

7.2.2.1.US Hydrogen Rocket Engine Market, By Cycle |

|

7.2.2.2.US Hydrogen Rocket Engine Market, By Application |

|

7.2.2.3.US Hydrogen Rocket Engine Market, By Flight Plan |

|

7.2.2.4.US Hydrogen Rocket Engine Market, By Vehicle Type |

|

7.2.2.5.US Hydrogen Rocket Engine Market, By End Use |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3. Canada |

|

7.3. Europe |

|

7.3.1. Europe Hydrogen Rocket Engine Market Outlook |

|

7.3.2. Germany |

|

7.3.3. UK |

|

7.3.4. France |

|

7.3.5. Italy |

|

7.4. Asia-Pacific |

|

7.4.1. Asia-Pacific Hydrogen Rocket Engine Market Outlook |

|

7.4.2. China |

|

7.4.3. India |

|

7.4.4. Japan |

|

7.4.5. South Korea |

|

7.5. Rest of the World |

|

7.5.1. Rest of the World Hydrogen Engine Market Outlook |

|

7.5.2. Latin America |

|

7.5.3. Middle East |

|

7.5.4. Africa |

|

8.Competitive Landscape |

|

8.1. Market Share Analysis |

|

8.2. Company Strategy Analysis |

|

8.3. Competitive Matrix |

|

9.Company Profiles |

|

9.1. Aerojet Rocketdyne (L3Harris Technologies) |

|

9.1.1. Company Synopsis |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.2. ArianeGroup |

|

9.3. Blue Origin |

|

9.4. Boeing |

|

9.5. China Academy of Launch Vehicle Technology (CALT) |

|

9.6. Hindustan Aeronautics Limited (HAL) |

|

9.7. IHI Corporation |

|

9.8. Mitsubishi Heavy Industries |

|

9.9. Pulsar |

|

9.10. Safran Aircraft Engines |

Let us connect with you TOC

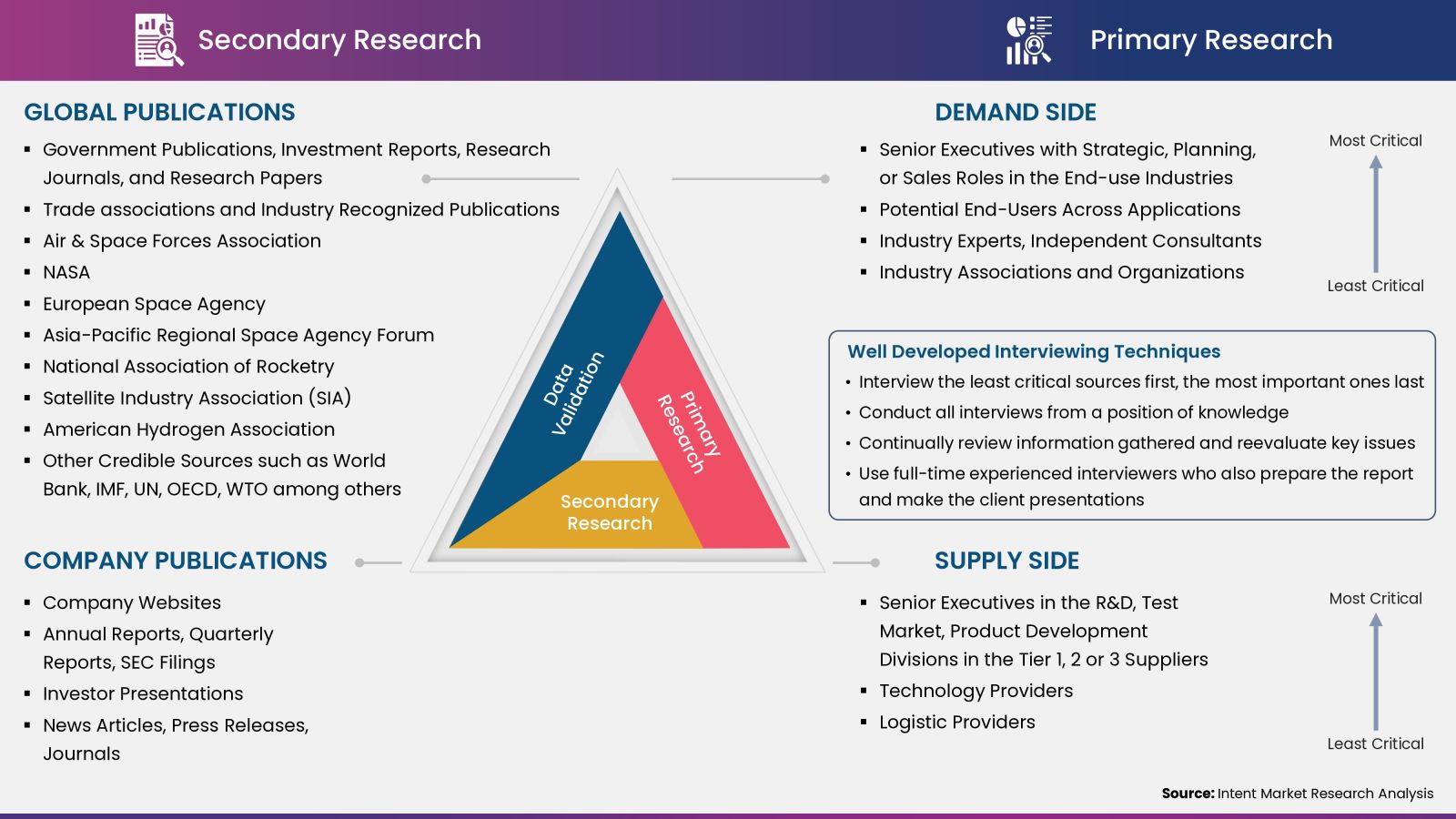

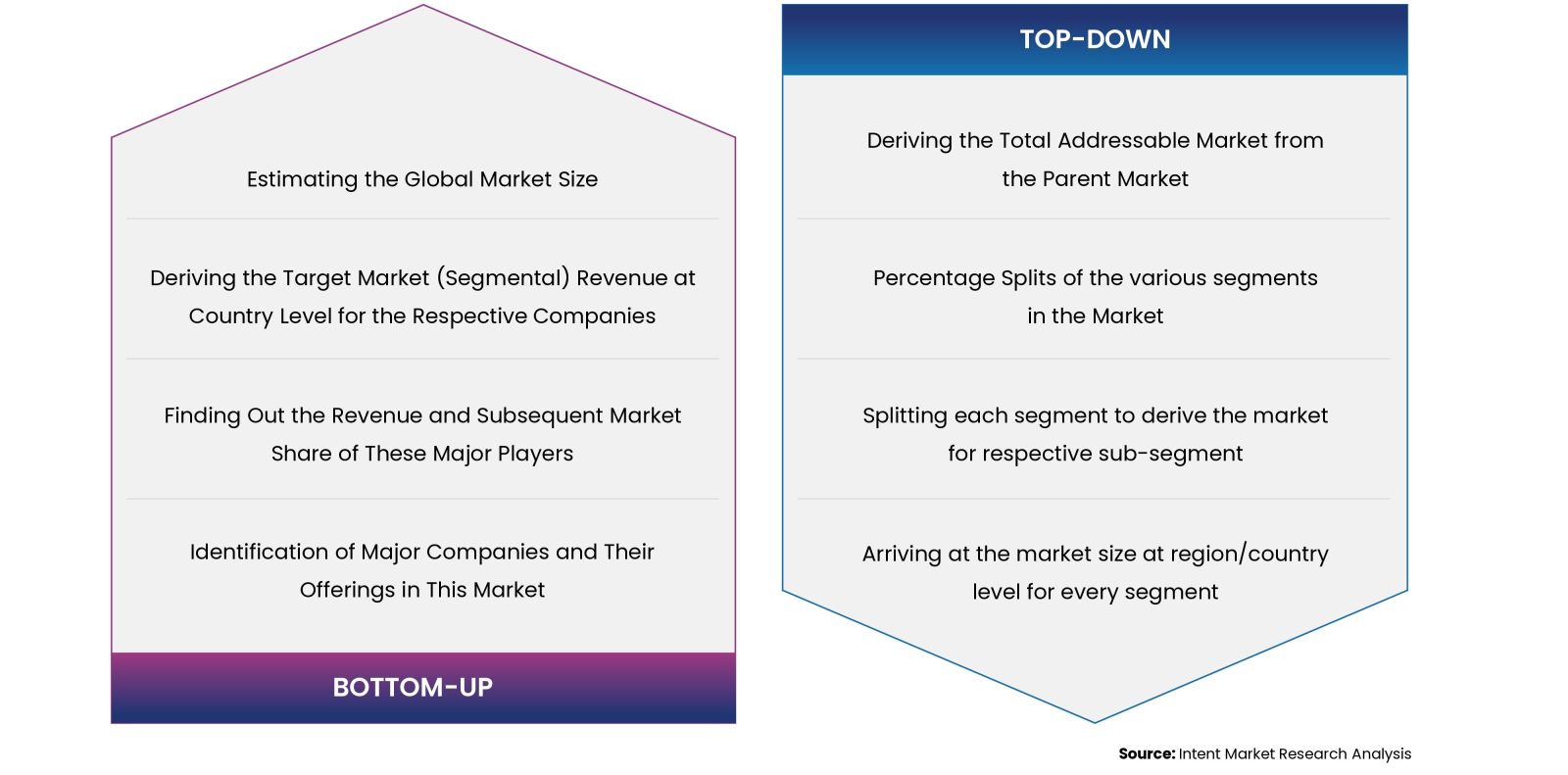

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats