sales@intentmarketresearch.com

+1 463-583-2713

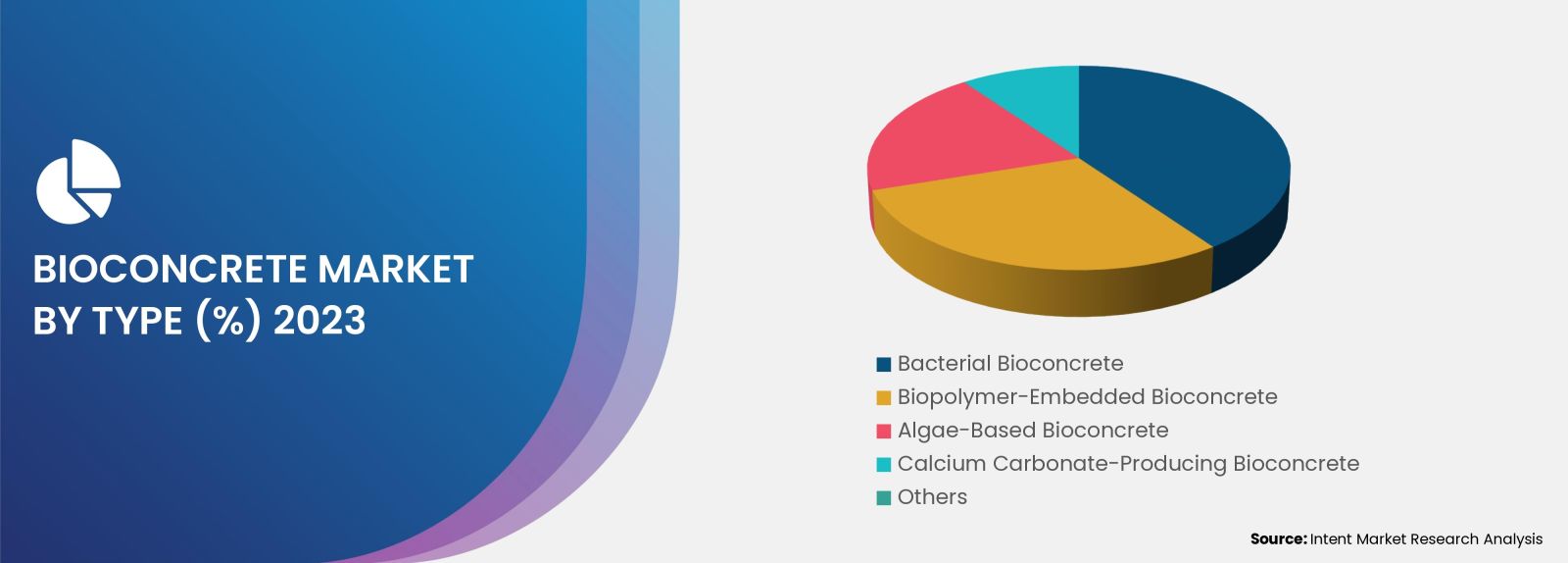

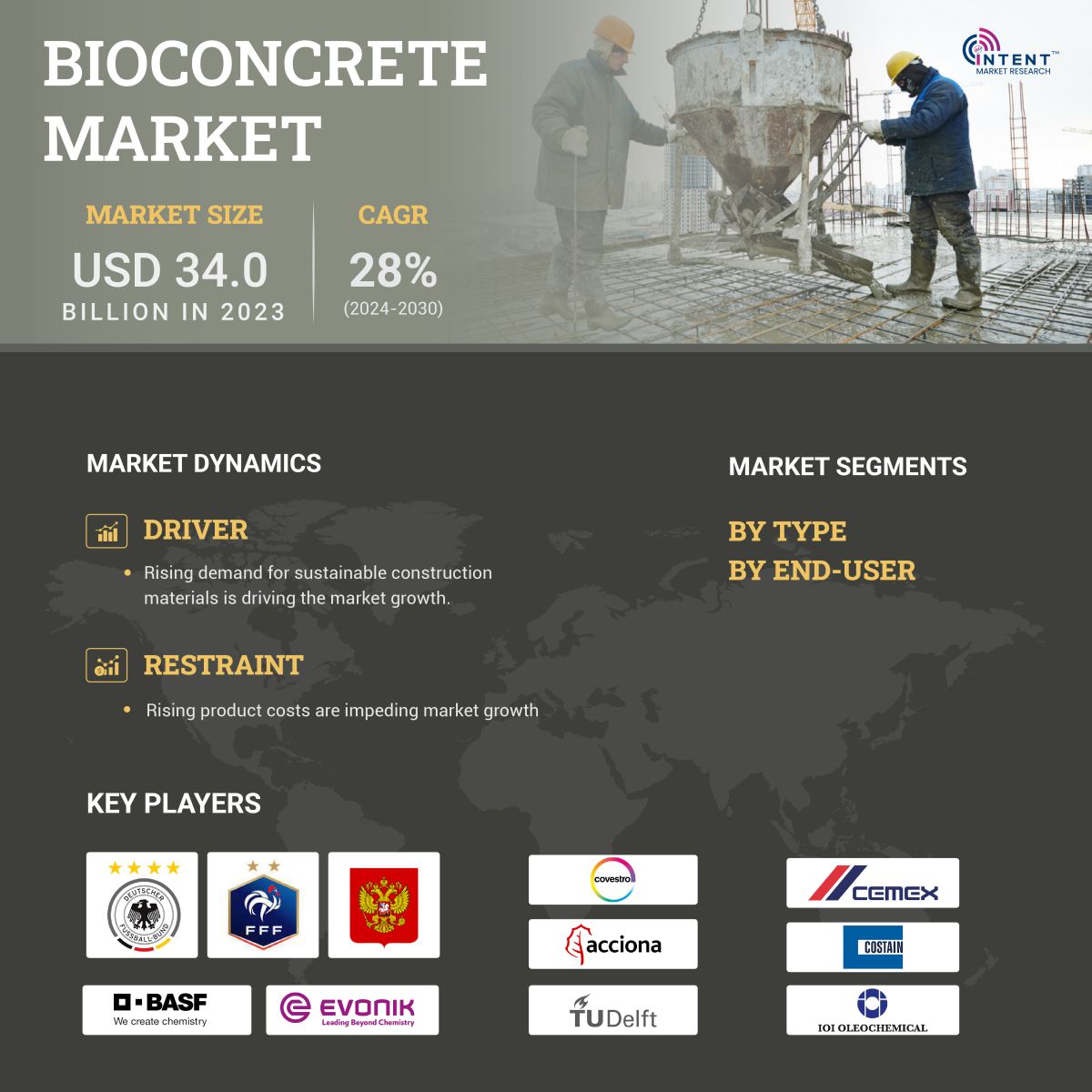

Bioconcrete Market By Type (Bacterial Bioconcrete, Biopolymer-Embedded Bioconcrete, Algae-Based Bioconcrete, Calcium Carbonate-Producing Bioconcrete), By End-Use (Commercial, Residential, Industrial & Infrastructure) and By Region; Global Insights & Forecast (2024 - 2030)

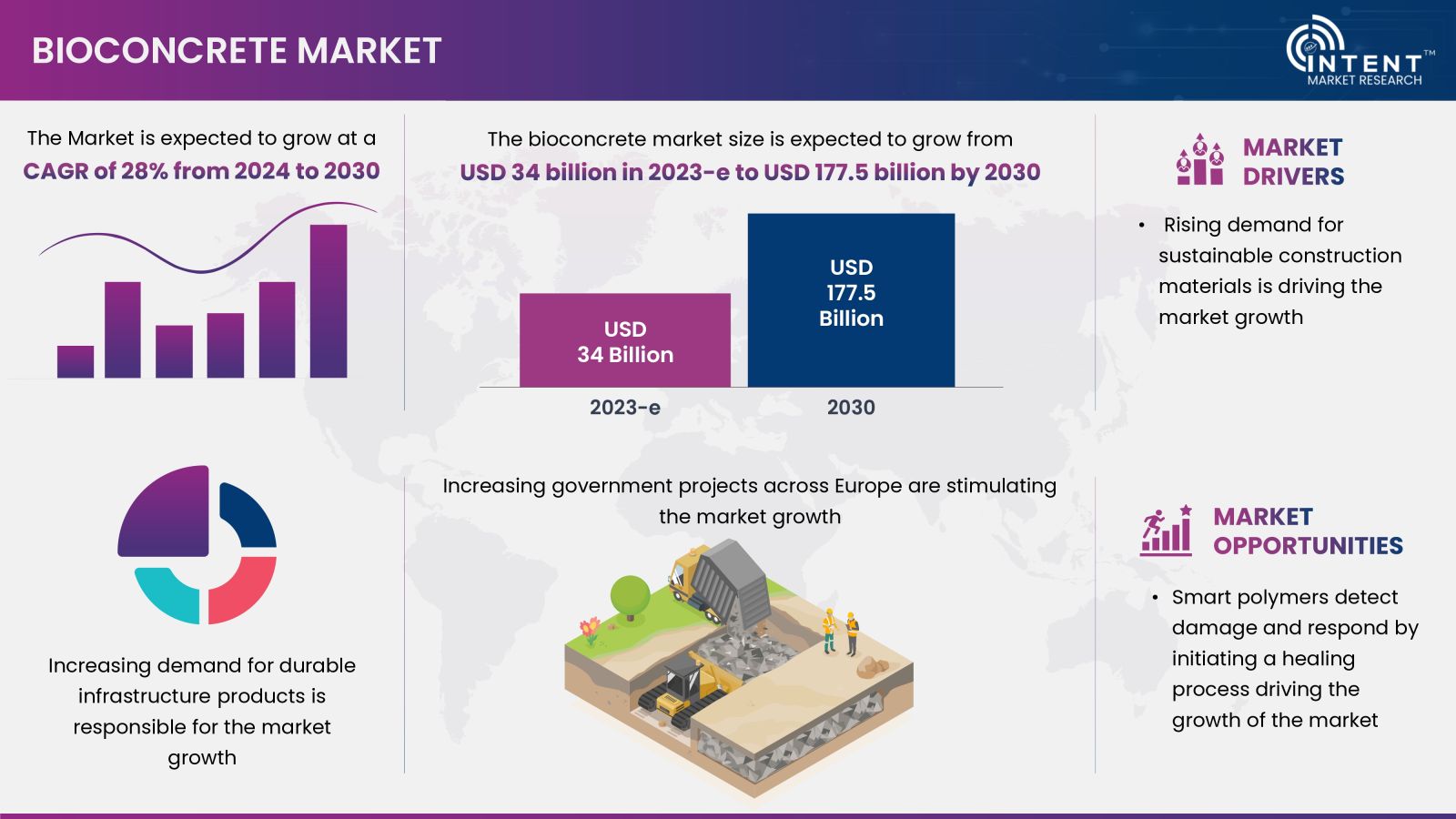

As per Intent Market Research, the Bioconcrete Market size is expected to grow from USD 34.0 billion in 2023-e to USD 177.5 billion by 2030, at a CAGR of 28% during the forecast period (2024-2030). The bioconcrete market is moderately competitive due to the limited presence of concrete manufacturers and less awareness about the product in the market. Some prominent players in the global bioconcrete market are Auro Gums, Aurochemicals, BASF, Berg + Schmidt, Cemex, Costain Group, Covestro, Evonik, Hallstar, IOI Oleochemicals, Koster Keunen, Saint-Gobain, & TU Delft. The synergy between materials science, nanotechnology, and artificial intelligence is shaping a future where buildings and infrastructure are capable of continuous adaptation and self-renewal.

Bioconcrete heal cracks and damage by itself, the way living organisms heal wounds. It is made up of a bacterium that creates limestone, which transforms into a gel to fill in spaces when exposed to water and air. The concrete fills in fractures to reduce the risk of corrosion and shield the steel framework from outside influences. This self-healing capability improves the lifespan of structures, reduces maintenance costs, and is more sustainable. Bioconcrete is revolutionizing the construction materials industry by incorporating bacteria that can autonomously repair cracks and create more durable and sustainable structures.

Bioconcrete Market Dynamics

Rising Demand for Sustainable Construction Materials is Driving the Market Growth

The rising demand for sustainable construction materials is a major driver for the

market. As the construction industry increasingly recognizes the environmental impact of traditional materials, there's a growing shift toward more eco-friendly and sustainable alternatives, including biodegradable plastics. Increased awareness of environmental issues and the desire to reduce the carbon footprint in construction projects have led to a demand for sustainable materials. Biodegradable plastics offer a greener alternative to traditional construction materials. Government regulations and initiatives promoting sustainable building practices and materials encourage the adoption of biodegradable plastics in construction.

Compliance with environmental standards becomes a key factor for construction projects. Sustainable construction often involves the use of materials that contribute to energy efficiency and reduced environmental impact. Biodegradable plastics, when sourced from renewable resources, fit well into the broader goal of creating energy-efficient and environmentally friendly buildings.

Advances in biodegradable polymer technology have led to the development of materials with improved strength, durability, and versatility. This makes them more suitable for various construction applications. Builders and developers pursuing Leadership in Energy and Environmental Design (LEED) certification are inclined to use sustainable materials, including biodegradable plastics, to meet the criteria for environmentally responsible construction.

Biodegradable plastics contribute to the reduction of construction waste. As these materials break down naturally, they have the potential to minimize the long-term environmental impact associated with construction and demolition. This trend is likely to continue as the construction sector strives to balance economic development with environmental responsibility.

Bioconcrete Market Segmental Insights

Rising Demand for Bacterial Bioconcrete in The Construction Sector Thriving the Market Growth

Bacterial bio concrete’s self-healing properties are projected to drive the bioconcrete market growth. This feature reduces repairs and enhances sustainability, making it valuable for infrastructure projects. Despite initial higher costs, the long-term savings make it an appealing option. The self-healing mechanism ensures that small cracks are swiftly sealed, preventing water and air infiltration, which can weaken the structural integrity of the concrete. This feature is particularly valuable in infrastructure projects such as bridges, tunnels, and roadways, where durability and reliability are of utmost importance.

Though the initial cost of bacterial bioconcrete is higher than traditional concrete, the long-term cost savings can be substantial. The cost savings make bacterial bioconcrete an appealing choice for projects where long-term financial considerations are crucial. Bacterial bioconcrete’s advancements and applications in real-world scenarios are driving the growth of the bioconcrete market. The combination of improved self-healing capabilities, increased durability, sustainability, and potential cost savings position bacterial bioconcrete as a promising solution for the construction industry.

Bioconcrete materials enhance the longevity, efficiency, resilience, and safety of structures in critical infrastructure projects

The infrastructure segment is set for significant growth, fueled by construction companies collaborating with product development firms to commercialize and expand the adoption of innovative solutions during the forecast period. This collaboration is expected to increase the demand for durable infrastructure products.

Industrial construction requires surfaces that can withstand harsh mechanical impacts, such as the carriage of heavy vehicles, operating heavy machinery, and heat treatments. As a result, bioconcrete is expected to gain popularity in industrial construction. Industrial structures need strong resistance to various physical and chemical factors to comply with technological requirements for a safe and convenient surface to carry out industrial operations.

Regional Insights

Increasing Government Projects across Europe are Stimulating Market Growth

The construction industry in Europe is expected to experience significant growth. This growth is fueled by positive indications in both private and public debt, which is expected to contribute favorably to market growth. Germany is a major contributor to the growth of the global construction industry in Western Europe. The government's various projects and initiatives have propelled market growth, and the country has taken superior supportive measures for its economy during the pandemic, resulting in positive growth as compared to the UK and France.

Competitive Landscape

The Acquisition and Product Innovations by Major Players are Key Strategies Adopted by Players to Sustain in the Competitive Environment

The bioconcrete market is moderately competitive due to the limited presence of concrete manufacturers and less awareness about the product in the market. Some prominent players in the global bioconcrete market are Auro Gums, Aurochemicals, BASF, Berg + Schmidt, Cemex, Costain, Covestro, Evonik, Hallstar, IOI Oleochemicals, Koster Keunen, Saint-Gobain, & TU Delft.

The market growth is driven by rising mergers & acquisitions along with novel product innovations such as researchers at the University of South Australia using bioconcrete with microcapsules to repair sewage pipes, potentially saving USD 1.4 billion in maintenance costs. In December 2021, GCP Applied Technologies was acquired by Saint-Gobain for USD 2.30 billion, and in July 2021, JP Concrete signed an agreement with Basilisk to operate its new Sensicrete compound. All these developments are driving the market growth.

Bioconcrete Market Coverage

The report provides key insights into the Bioconcrete market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The analysis centres on market drivers, restraints, opportunities, and examines key players and the competitive landscape within the bioconcrete market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 34.0 billion |

|

Forecast Revenue (2030) |

USD 177.5 billion |

|

CAGR (2024-2030) |

28% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Type (Bacterial Bioconcrete, Biopolymer-Embedded Bioconcrete, Algae-Based Bioconcrete, Calcium Carbonate-Producing Bioconcrete, and Others) and By End-use (Commercial, Residential, Industrial & Infrastructure) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

Auro Gums, Aurochemicals, BASF, Berg+Schmidt, Cemex, Costain, Covestro, Evonik, Hallstar, IOI Oleochemicals, Koster Keunen, Saint-Gobain, & TU Delft. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1. Introduction |

|

1. 1. Study Assumptions and Bioconcrete Market Definition |

|

1.2. Scope of the Study |

|

2. Research Methodology |

|

3. Executive Summary |

|

4. Bioconcrete Market Dynamics |

|

4.1. Market Growth Drivers |

|

4.2 Market Growth Challenges |

|

5. Bioconcrete Market Outlook |

|

5.1. Regulatory landscape |

|

5.2 Value Chain Analysis |

|

5.3. Manufacturing Overview |

|

5.4 Opportunity Analysis |

|

5.5. Reimbursement & Investment Analysis |

|

5.6 Porters Five Forces |

|

5.7 Pestle Analysis |

|

5.8 Patent Analysis |

|

5.9 Production process overview |

|

5.10 Pricing analysis |

|

6. Global Bioconcrete Market Segmentation (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

6.1 Type |

|

6.1.1 Bacterial Bioconcrete |

|

6.1.2 Biopolymer-Embedded Bioconcrete |

|

6.1.3 Algae-Based Bioconcrete |

|

6.1.4 Calcium Carbonate-Producing Bioconcrete |

|

6.1.5 Others |

|

6.2 End-Use |

|

6.2.1 Commercial |

|

6.2.2 Residential |

|

6.2.3 Industrial |

|

6.2.4 Infrastructure |

|

6.4 Region |

|

6.4.1 North America |

|

6.4.2 Europe |

|

6.4.3 Asia-Pacific |

|

6.4.4 Latin America |

|

6.4.5 Middle East and Africa |

|

7. North America Bioconcrete Market Segmentation (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.1 Type |

|

7.1.1 Bacterial Bioconcrete |

|

7.1.2 Biopolymer-Embedded Bioconcrete |

|

7.1.3 Algae-Based Bioconcrete |

|

7.1.4 Calcium Carbonate-Producing Bioconcrete |

|

7.1.5 Others |

|

7.2 End-Use |

|

7.2.1 Commercial |

|

7.2.2 Residential |

|

7.2.3 Industrial |

|

7.2.4 Infrastructure |

|

7.4 Country |

|

7.4.1 United States |

|

7.4.1.1 Type |

|

7.4.1.1.1 Bacterial Bioconcrete |

|

7.4.1.1.2 Biopolymer-Embedded Bioconcrete |

|

7.4.1.1.3 Algae-Based Bioconcrete |

|

7.4.1.1.4 Calcium Carbonate-Producing Bioconcrete |

|

7.4.1.1.5 Others |

|

7.4.1.2 End-Use Industry |

|

7.4.1.2.1 Commercial |

|

7.4.1.2.2 Residential |

|

7.4.1.2.3 Industrial |

|

7.4.1.2.4 Infrastructure |

|

7.4.2 Canada |

|

7.4.2.1 Type |

|

7.4.2.1.1 Bacterial Bioconcrete |

|

7.4.2.1.2 Biopolymer-Embedded Bioconcrete |

|

7.4.2.1.3 Algae-Based Bioconcrete |

|

7.4.2.1.4 Calcium Carbonate-Producing Bioconcrete |

|

7.4.2.1.5 Others |

|

7.4.2.2 End-Use Industry |

|

7.4.2.2.1 Commercial |

|

7.4.2.2.2 Residential |

|

7.4.2.2.3 Industrial |

|

7.4.2.2.4 Infrastructure |

|

8. Europe Market Bioconcrete Segmentation (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

8.1 Type |

|

8.1.1 Bacterial Bioconcrete |

|

8.1.2 Biopolymer-Embedded Bioconcrete |

|

8.1.3 Algae-Based Bioconcrete |

|

8.1.4 Calcium Carbonate-Producing Bioconcrete |

|

8.1.5 Others |

|

8.2 End-Use |

|

8.2.1 Commercial |

|

8.2.2 Residential |

|

8.2.3 Industrial |

|

8.2.4 Infrastructure |

|

8.4 Country |

|

8.4.1 United Kingdom |

|

8.4.1.1 Type |

|

8.4.1.1.1 Bacterial Bioconcrete |

|

8.4.1.1.2 Biopolymer-Embedded Bioconcrete |

|

8.4.1.1.3 Algae-Based Bioconcrete |

|

8.4.1.1.4 Calcium Carbonate-Producing Bioconcrete |

|

8.4.1.1.5 Others |

|

8.4.1.2 End-Use |

|

8.4.1.2.1 Commercial |

|

8.4.1.2.2 Residential |

|

8.4.1.2.3 Industrial |

|

8.4.1.2.4 Infrastructure |

|

8.4.2 France |

|

8.4.2.1 Type |

|

8.4.2.1.1 Bacterial Bioconcrete |

|

8.4.2.1.2 Biopolymer-Embedded Bioconcrete |

|

8.4.2.1.3 Algae-Based Bioconcrete |

|

8.4.2.1.4 Calcium Carbonate-Producing Bioconcrete |

|

8.4.2.1.5 Others |

|

8.4.2.2 End-Use |

|

8.4.2.2.1 Commercial |

|

8.4.2.2.2 Residential |

|

8.4.2.2.3 Industrial |

|

8.4.2.2.4 Infrastructure |

|

8.4.3 Germany |

|

8.4.3.1 Type |

|

8.4.3.1.1 Bacterial Bioconcrete |

|

8.4.3.1.2 Biopolymer-Embedded Bioconcrete |

|

8.4.3.1.3 Algae-Based Bioconcrete |

|

8.4.3.1.4 Calcium Carbonate-Producing Bioconcrete |

|

8.4.3.1.5 Others |

|

8.4.3.2 End-Use |

|

8.4.3.2.1 Commercial |

|

8.4.3.2.2 Residential |

|

8.4.3.2.3 Industrial |

|

8.4.3.2.4 Infrastructure |

|

8.4.4 Italy |

|

8.4.4.1 Type |

|

8.4.4.1.1 Bacterial Bioconcrete |

|

8.4.4.1.2 Biopolymer-Embedded Bioconcrete |

|

8.4.4.1.3 Algae-Based Bioconcrete |

|

8.4.4.1.4 Calcium Carbonate-Producing Bioconcrete |

|

8.4.4.1.5 Others |

|

8.4.4.2 End-Use |

|

8.4.4.2.1 Commercial |

|

8.4.4.2.2 Residential |

|

8.4.4.2.3 Industrial |

|

8.4.4.2.4 Infrastructure |

|

9. Asia Pacific Bioconcrete Market Segmentation (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

9.1 Type |

|

9.1.1 Bacterial Bioconcrete |

|

9.1.2 Biopolymer-Embedded Bioconcrete |

|

9.1.3 Algae-Based Bioconcrete |

|

9.1.4 Calcium Carbonate-Producing Bioconcrete |

|

9.1.5 Others |

|

9.2 End-Use |

|

9.2.1 Commercial |

|

9.2.2 Residential |

|

9.2.3 Industrial |

|

9.2.4 Infrastructure |

|

9.4 Country |

|

9.4.1 China |

|

9.4.1.1 Type |

|

9.4.1.1.1 Bacterial Bioconcrete |

|

9.4.1.1.2 Biopolymer-Embedded Bioconcrete |

|

9.4.1.1.3 Algae-Based Bioconcrete |

|

9.4.1.1.4 Calcium Carbonate-Producing Bioconcrete |

|

9.4.1.1.5 Others |

|

9.4.1.2 End-Use |

|

9.4.1.2.1 Commercial |

|

9.4.1.2.2 Residential |

|

9.4.1.2.3 Industrial |

|

9.4.1.2.4 Infrastructure |

|

9.4.2 Japan |

|

9.4.2.1 Type |

|

9.4.2.1.1 Bacterial Bioconcrete |

|

9.4.2.1.2 Biopolymer-Embedded Bioconcrete |

|

9.4.2.1.3 Algae-Based Bioconcrete |

|

9.4.2.1.4 Calcium Carbonate-Producing Bioconcrete |

|

9.4.2.1.5 Others |

|

9.4.2.2 End-Use |

|

9.4.2.2.1 Commercial |

|

9.4.2.2.2 Residential |

|

9.4.2.2.3 Industrial |

|

9.4.2.2.4 Infrastructure |

|

9.4.3 India |

|

9.4.3.1 Type |

|

9.4.3.1.1 Bacterial Bioconcrete |

|

9.4.3.1.2 Biopolymer-Embedded Bioconcrete |

|

9.4.3.1.3 Algae-Based Bioconcrete |

|

9.4.3.1.4 Calcium Carbonate-Producing Bioconcrete |

|

9.4.3.1.5 Others |

|

9.4.3.2 End-Use |

|

9.4.3.2.1 Commercial |

|

9.4.3.2.2 Residential |

|

9.4.3.2.3 Industrial |

|

9.4.3.2.4 Infrastructure |

|

9.4.4 South Korea |

|

9.4.4.1 Type |

|

9.4.4.1.1 Bacterial Bioconcrete |

|

9.4.4.1.2 Biopolymer-Embedded Bioconcrete |

|

9.4.4.1.3 Algae-Based Bioconcrete |

|

9.4.4.1.4 Calcium Carbonate-Producing Bioconcrete |

|

9.4.4.1.5 Others |

|

9.4.4.2 End-Use |

|

9.4.4.2.1 Commercial |

|

9.4.4.2.2 Residential |

|

9.4.4.2.3 Industrial |

|

9.4.4.2.4 Infrastructure |

|

10. Latin America Bioconcrete Market Segmentation (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

10.1 Type |

|

10.1.1 Bacterial Bioconcrete |

|

10.1.2 Biopolymer-Embedded Bioconcrete |

|

10.1.3 Algae-Based Bioconcrete |

|

10.1.4 Calcium Carbonate-Producing Bioconcrete |

|

10.1.5 Others |

|

10.2 End-Use |

|

10.2.1 Commercial |

|

10.2.2 Residential |

|

10.2.3 Industrial |

|

10.2.4 Infrastructure |

|

10.4 Country |

|

10.4.1 Brazil |

|

10.4.1.1 Type |

|

10.4.1.1.1 Bacterial Bioconcrete |

|

10.4.1.1.2 Biopolymer-Embedded Bioconcrete |

|

10.4.1.1.3 Algae-Based Bioconcrete |

|

10.4.1.1.4 Calcium Carbonate-Producing Bioconcrete |

|

10.4.1.1.5 Others |

|

10.4.1.2 End-Use |

|

10.4.1.2.1 Commercial |

|

10.4.1.2.2 Residential |

|

10.4.1.2.3 Industrial |

|

10.4.1.2.4 Infrastructure |

|

10.4.2 Mexico |

|

10.4.2.1 Type |

|

10.4.2.1.1 Bacterial Bioconcrete |

|

10.4.2.1.2 Biopolymer-Embedded Bioconcrete |

|

10.4.2.1.3 Algae-Based Bioconcrete |

|

10.4.2.1.4 Calcium Carbonate-Producing Bioconcrete |

|

10.4.2.1.5 Others |

|

10.4.2.2 End-Use |

|

10.4.2.2.1 Commercial |

|

10.4.2.2.2 Residential |

|

10.4.2.2.3 Industrial |

|

10.4.2.2.4 Infrastructure |

|

10.4.3 Argentina |

|

10.4.3.1 Type |

|

10.4.3.1.1 Bacterial Bioconcrete |

|

10.4.3.1.2 Biopolymer-Embedded Bioconcrete |

|

10.4.3.1.3 Algae-Based Bioconcrete |

|

10.4.3.1.4 Calcium Carbonate-Producing Bioconcrete |

|

10.4.3.1.5 Others |

|

10.4.3.2 End-Use |

|

10.4.3.2.1 Commercial |

|

10.4.3.2.2 Residential |

|

10.4.3.2.3 Industrial |

|

10.4.3.2.4 Infrastructure |

|

11. Middle East & Africa Bioconcrete Market Segmentation (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

11.1 Type |

|

11.1.1 Bacterial Bioconcrete |

|

11.1.2 Biopolymer-Embedded Bioconcrete |

|

11.1.3 Algae-Based Bioconcrete |

|

11.1.4 Calcium Carbonate-Producing Bioconcrete |

|

11.1.5 Others |

|

11.2 End-Use |

|

11.2.1 Commercial |

|

11.2.2 Residential |

|

11.2.3 Industrial |

|

11.2.4 Infrastructure |

|

11.4 Country |

|

11.4.1 United Arab Emirates |

|

11.4.1.1 Type |

|

11.4.1.1.1 Bacterial Bioconcrete |

|

11.4.1.1.2 Biopolymer-Embedded Bioconcrete |

|

11.4.1.1.3 Algae-Based Bioconcrete |

|

11.4.1.1.4 Calcium Carbonate-Producing Bioconcrete |

|

11.4.1.1.5 Others |

|

11.4.1.2 End-Use |

|

11.4.1.2.1 Commercial |

|

11.4.1.2.2 Residential |

|

11.4.1.2.3 Industrial |

|

11.4.1.2.4 Infrastructure |

|

11.4.2 Saudi Arabia |

|

11.4.2.1 Type |

|

11.4.2.1.1 Bacterial Bioconcrete |

|

11.4.2.1.2 Biopolymer-Embedded Bioconcrete |

|

11.4.2.1.3 Algae-Based Bioconcrete |

|

11.4.2.1.4 Calcium Carbonate-Producing Bioconcrete |

|

11.4.2.1.5 Others |

|

11.4.2.2 End-Use |

|

11.4.2.2.1 Commercial |

|

11.4.2.2.2 Residential |

|

11.4.2.2.3 Industrial |

|

11.4.2.2.4 Infrastructure |

|

11.4.3 South Africa |

|

11.4.3.1 Type |

|

11.4.3.1.1 Bacterial Bioconcrete |

|

11.4.3.1.2 Biopolymer-Embedded Bioconcrete |

|

11.4.3.1.3 Algae-Based Bioconcrete |

|

11.4.3.1.4 Calcium Carbonate-Producing Bioconcrete |

|

11.4.3.1.5 Others |

|

11.4.3.2 End-Use |

|

11.4.3.2.1 Commercial |

|

11.4.3.2.2 Residential |

|

11.4.3.2.3 Industrial |

|

11.4.3.2.4 Infrastructure |

|

12. Competitive Landscape |

|

12.1 Company Market Share Analysis |

|

12.2 Competitive Matrix |

|

12.2 Product Benchmarking |

|

12.3 Company Profiles (Manufacturers of Bioconcrete) |

|

12.3.1 Cemex |

|

12.3.1.1 Company Synopsis |

|

12.3.1.2 Company Financials |

|

12.3.1.3 Product/ Service Portfolio |

|

12.3.1.4 Recent Developments |

|

12.3.2 Covestro |

|

12.3.3 Evonik |

|

12.3.4 BASF |

|

12.3.5 Saint-Gobain |

|

12.3.6 Costain Group |

|

12.3.7 TU Delft |

|

12.3.8 IOI Oleochemicals |

|

12.3.9 Koster Keunen |

|

12.3.10 Aurochemicals |

|

12.3.11 Berg + Schmidt |

|

12.3.12 Hallstar |

|

12.4 Company Profiles (Demand Side) |

|

12.4.1 GCP Applied Technologies Inc. |

|

12.4.1.1 Company Synopsis |

|

12.3.1.2 Company Financials |

|

12.3.1.3 Product/ Service Portfolio |

|

12.3.1.4 Recent Developments |

|

12.4.2 Turner Construction |

|

12.4.3 Skanska |

|

12.4.4 Fluor Corporation |

|

12.4.5 Kiewit Corporation |

|

13. Analyst Recommendations |

Let us connect with you TOC

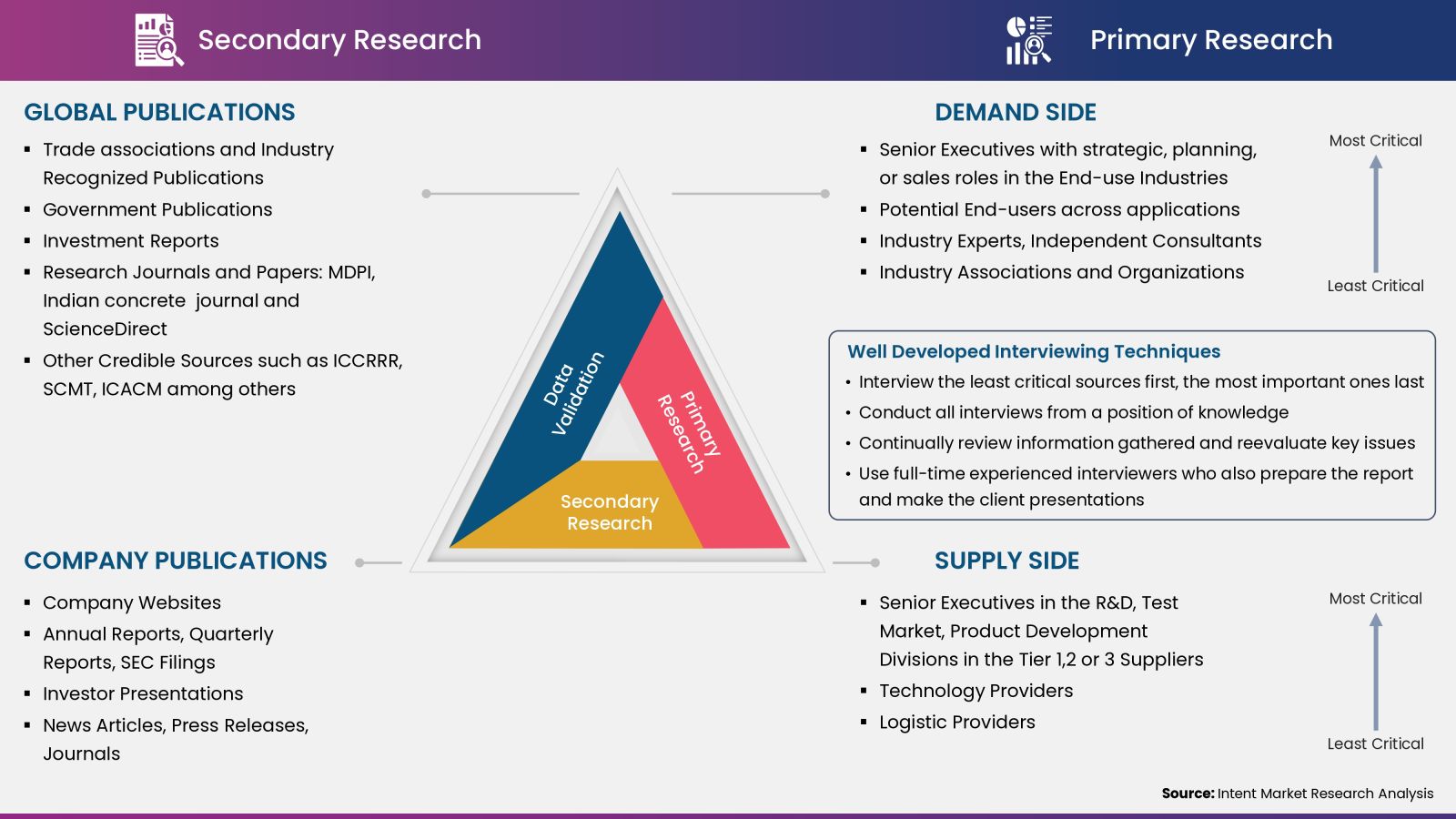

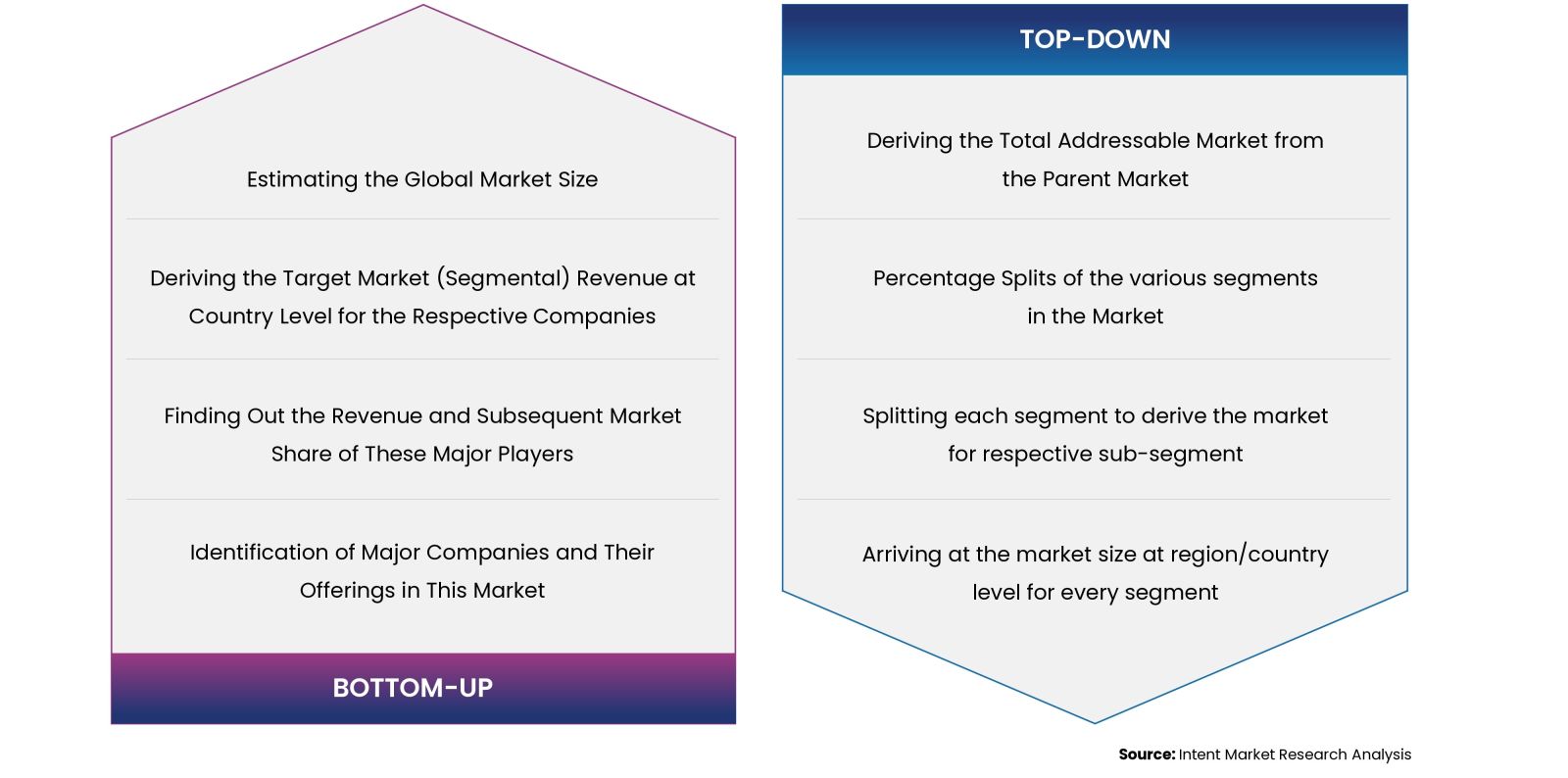

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats