sales@intentmarketresearch.com

+1 463-583-2713

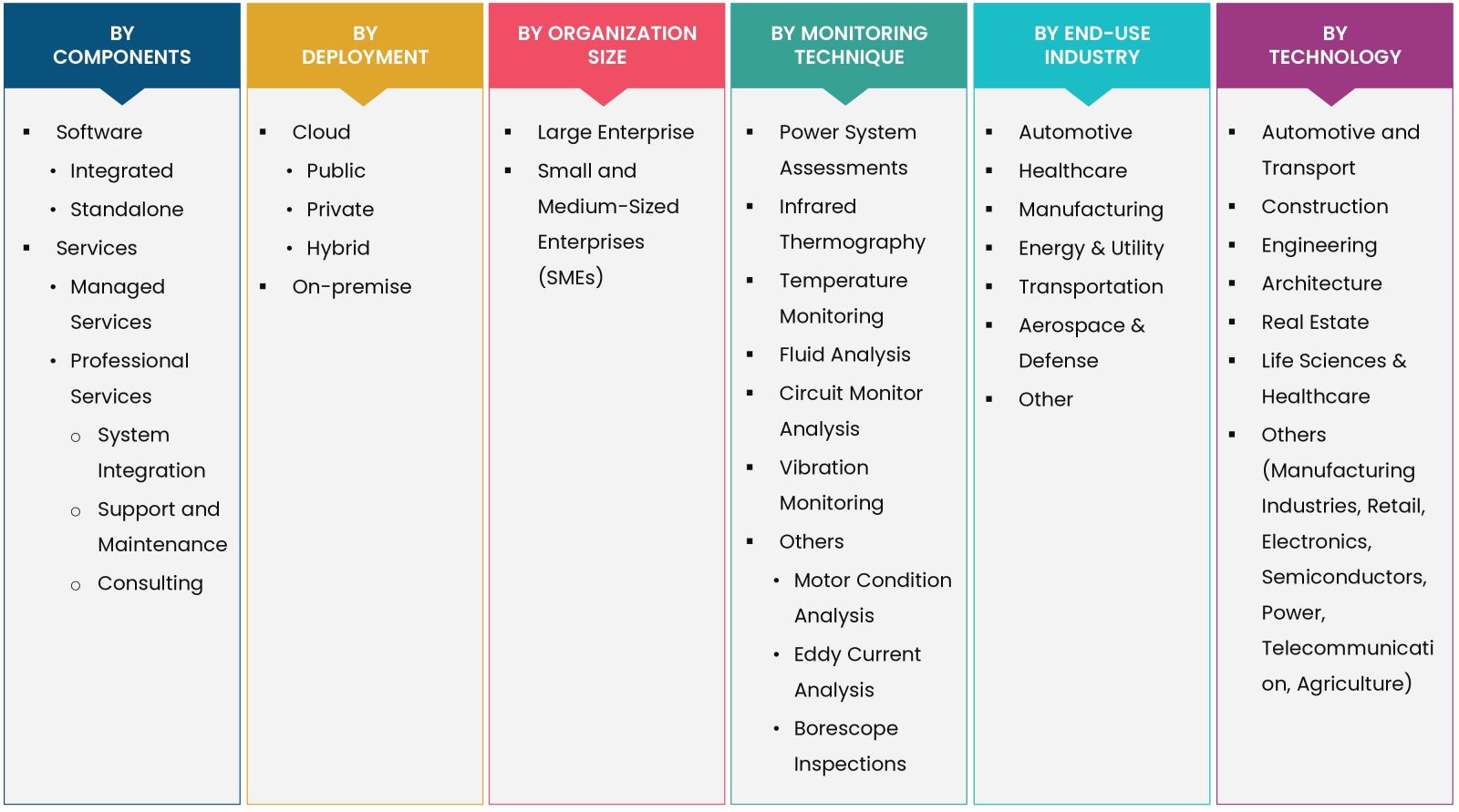

AI-Based Predictive Maintenance Market Size Analysis, By Components (Software {Integrate, Standalone}, Services (Managed Services, Professional Services {System Integration, Support & Maintenance, Consulting}, By Deployment {Cloud [Public, Private, Hybrid], On-premise, By Organization Size (Large Enterprise, Small and Medium-Sized Enterprises), By Monitoring Technique (Power System Assessments, Infrared Thermography, Temperature Monitoring, Fluid Analysis, Circuit Monitor Analysis, Vibration Monitoring), By End-use Industry (Automotive, Healthcare, Manufacturing, Energy & Utility, Transportation, Aerospace & Defense); Global Insights & Forecast (2024-2030)

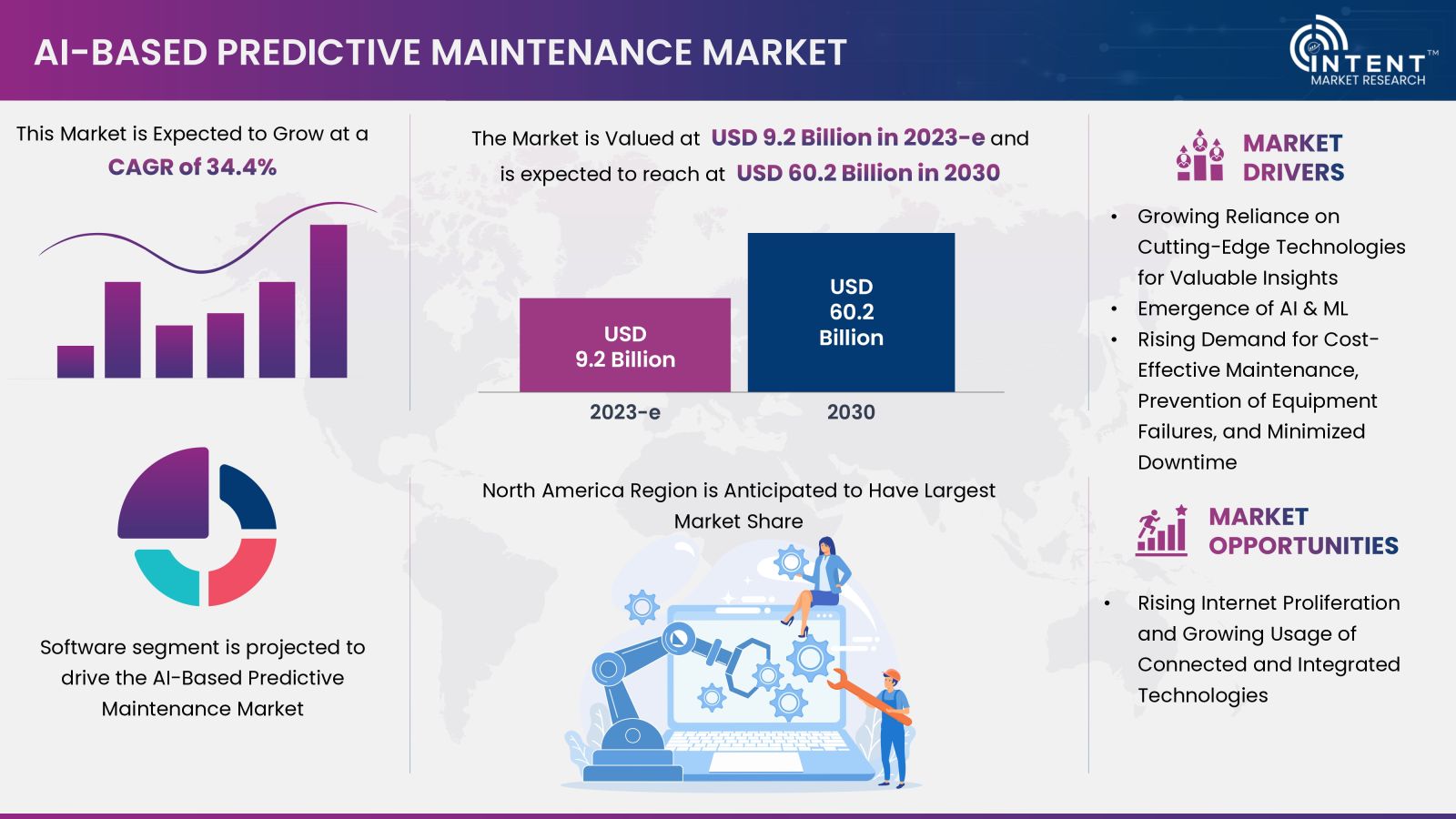

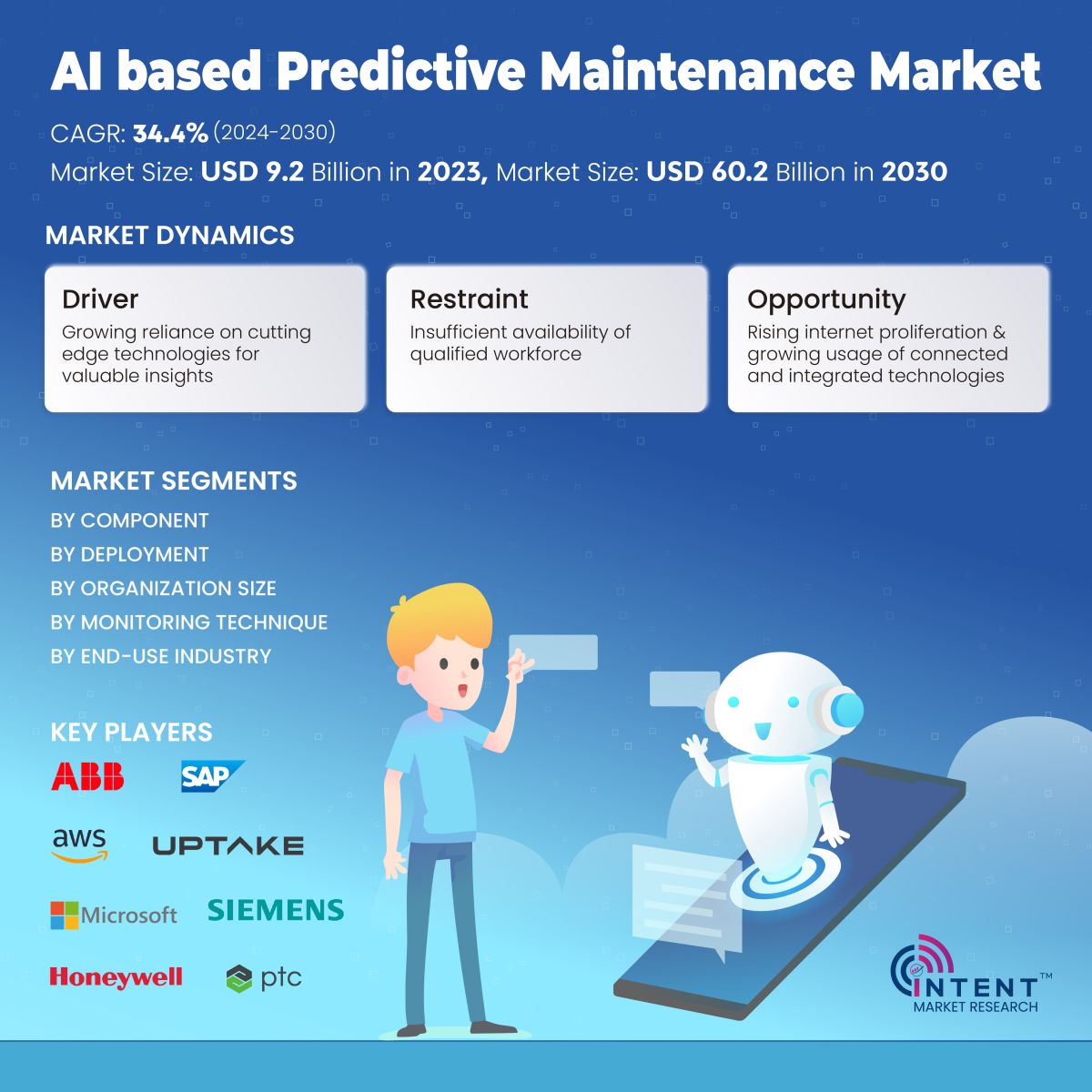

The AI-Based Predictive Maintenance Market is expected to grow from USD 9.2 billion in 2023-e to USD 60.2 billion by 2030, at a CAGR of 34.4% during the forecast period. The AI-based predictive maintenance market is a competitive market, the prominent players in the global market include ABB, AWS, C3.AI, Dingo, General Electric, Honeywell, IBM, Microsoft, PTC, SAP.

AI-based Predictive Maintenance (AI-PDM) represents a pivotal advancement in asset management, empowering businesses to predict equipment failures and reduce downtime. Leveraging AI and ML algorithms, AI-PDM analyzes extensive data from sensors integrated into equipment, revealing subtle patterns and anomalies that may signal potential failures. This foresight empowers maintenance teams to strategically plan proactive interventions, preventing costly disruptions and optimizing overall asset performance.

The significance of predictive maintenance in enhancing productivity within factories cannot be overstated. The widespread adoption of predictive maintenance solutions is rapidly gaining traction across both large enterprises and small to medium-sized enterprises. This surge in adoption can be attributed to a myriad of advantages, such as diminished downtime, prolonged equipment lifespan, heightened plant safety, optimized maintenance schedules, diminished maintenance costs, and an enhanced yield rate.

Certainly, as per McKinsey and Company, the implementation of AI-based predictive maintenance has the potential to increase availability by up to 20%, concurrently lowering inspection costs by 25% and annual maintenance fees by as much as 10%.

The Growth of Predictive Maintenance Solutions fueled by the Integration of IoT, Cloud Computing, and AI

The advancement of AI-PDM is propelled by the integration of technologies such as IoT, cloud computing, AI, and machine learning, aimed at optimizing the operational efficiency of machinery. The incorporation of IA into predictive maintenance tools enables the efficient collection and analysis of exte

nsive data, transforming it into meaningful insights and actionable data points, thereby preventing data overload.

The swift extraction of valuable information from extensive amounts of unstructured data is enabled by deploying data sensors and machine learning models in predictive maintenance solutions. Providers of predictive maintenance solutions are upgrading existing organizational maintenance systems by integrating advanced technologies to ensure optimal performance of in-service equipment.

AI-PDM Demand is Minimizing Maintenance Expenses by Reducing Downtime

The demand for predictive maintenance solutions is swiftly rising across diverse industrial sectors, including manufacturing, energy & utilities, transportation, healthcare, aerospace & defense. In the energy & utility domains, challenges arise for equipment manufacturers, operators, and plant owners in ensuring efficient operation of machinery and assets.

Predictive maintenance solutions prove invaluable by enabling plant owners to implement proactive maintenance programs, preempting the likelihood of failures. Similarly, within the manufacturing industry, early identification of causes for failures and potential faults are paramount. As a result, companies are increasingly adopting predictive maintenance solutions and services to enhance equipment uptime, proactively identifying potential issues in real-time without disrupting ongoing processes.

Market Segmentation

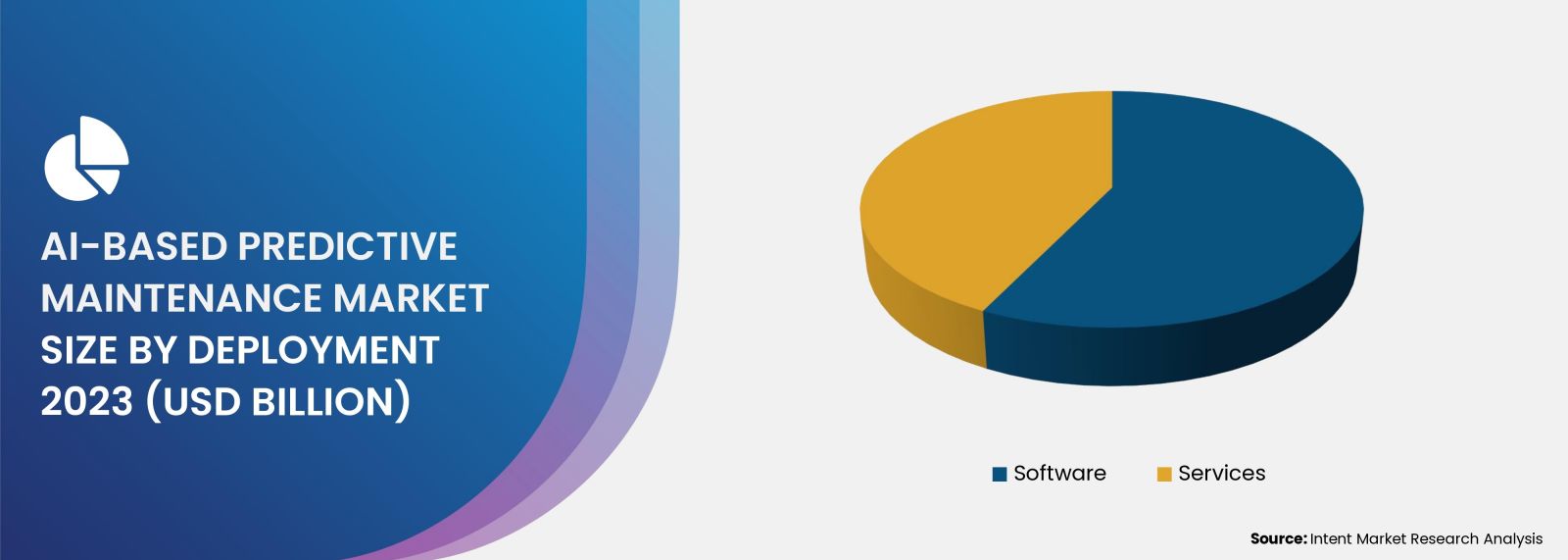

The AI-Based Predictive Maintenance Software is Anticipated to Witness Significant Market Growth

The AI-based predictive maintenance software holds the largest market share and is poised to sustain this trend. This is attributed to the escalating demand for IoT-based predictive maintenance solutions. Within the software segment, integrated solutions are expected to dominate, driven by a surge in demand for customized and application-specific solutions across diverse industry verticals.

The Vibration Monitoring Segment held the Predominant Market Share

The vibration monitoring segment held the largest share in the AI-based predictive maintenance market, owing to its ability to detect and diagnose problems and provide details regarding the life span and possible failure mode of the machine. This monitoring technique involves the use of sensors and devices to detect deviations from normal vibration patterns, enabling early identification of potential issues such as equipment malfunctions or structural weaknesses.

The AI-PDM Solutions are Widely Deployed On-Premise across Industries

On-premise deployment held the largest market share in 2023 and is expected to continue during the forecast period due to heightened data privacy concerns linked to cloud infrastructure. Organizations prioritize internal control over data by opting for on-premise servers and data centers to efficiently run both internal and external software solutions, thereby escalating the demand for on-premise solutions.

Large Enterprises Held Majority of the Market Share

Large enterprises presently hold a substantial market share in AI-based predictive maintenance. This is attributed to enterprises' growing inclination towards optimizing and automating operational maintenance processes through the adoption of predictive maintenance solutions. Furthermore, in large enterprises, the costs associated with downtime and assets are notably high, compelling a rapid increase in the demand for predictive maintenance solutions worldwide.

Manufacturing Sector held the Largest Market Share

The manufacturing segment emerged as the dominant force, securing the largest market share globally. This is attributed to the escalating demand for maintaining manufacturing equipment, including machinery, elevators, industrial robots, and pumps, to minimize overall downtimes. Manufacturers are leveraging advanced analytics, ML, and AI algorithms to enhance equipment reliability, reduce downtime, and optimize maintenance schedules. By harnessing the predictive capabilities of AI, manufacturing entities are proactively addressing equipment failures before they occur. This not only minimizes unplanned downtime but also enhances overall operational efficiency, translating into substantial cost savings and improved production output.

North America is Poised for Significant Market Growth in the Forecast Period

The region's dominance is attributed to the escalating adoption of predictive maintenance solutions leveraging advanced technologies such as IoT, cloud computing, machine learning, and artificial intelligence (AI). North American organizations utilize these solutions to optimize operational performance, improve maintenance practices, and ensure reliability.

The Acquisition of Smaller Players and Product Innovations by Major Players are Driving the Market Growth

AI-based predictive maintenance market is characterized by intense competition due to the presence of numerous international and domestic players. The market, in particular, is dominated by key players such as ABB, AWS, C3.AI, Dingo, General Electric, Honeywell, IBM, Microsoft, PTC, SAP. These industry leaders are primarily focused on acquiring smaller players and innovating their product lines to cater to the Ai-based predictive maintenance market.

- In June 2023, Accenture has completed the acquisition of Nextira, an Amazon web services (AWS) premier partner specializing in delivering cloud-native innovation, predictive analytics, and immersive experiences for its clients using AWS. This strategic acquisition enhances Accenture cloud first's already robust engineering capabilities, enabling clients to leverage a comprehensive spectrum of cloud tools and capabilities.

- In May 2023, NTT Ltd., and Cisco, have revealed a partnership aimed at creating and implementing collaborative solutions to actively advance the sustainability objectives of large enterprises. Drawing on NTT's Edge as a Service portfolio and Cisco's IoT expertise, the joint solutions are designed to provide real-time data insights, heightened security measures, informed decision-making, and cost reductions. These outcomes are achieved through predictive maintenance, asset tracking, and efficient supply chain management capabilities.

AI-Based Predictive Maintenance Market Coverage

The report provides key insights into the AI-based predictive maintenance market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyses key players and the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 9.2 billion |

|

Forecast Revenue (2030) |

USD 60.2 billion |

|

CAGR (2024-2030) |

34.4% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Components (Software {Integrate, Standalone}, Services (Managed Services, Professional Services {System Integration, Support & Maintenance, Consulting}, By Deployment {Cloud [Public, Private, Hybrid], On-premise, By Organization Size (Large Enterprise, Small and Medium-Sized Enterprises), By Monitoring Technique (Power System Assessments, Infrared Thermography, Temperature Monitoring, Fluid Analysis, Circuit Monitor Analysis, Vibration Monitoring, Others (Motor Condition Analysis, Eddy Current Analysis, Borescope Inspections), By End-use Industry (Automotive, Healthcare, Manufacturing, Energy & Utility, Transportation, Aerospace & Defense, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

ABB, AWS, C3.AI, Dingo, General Electric, Honeywell, IBM, Microsoft, PTC, SAP |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Growing Reliance on Cutting-Edge Technologies for Valuable Insights |

|

4.1.2.Emergence of AI & ML |

|

4.1.3.Rising Demand for Cost-Effective Maintenance, Prevention of Equipment Failures, and Minimized Downtime |

|

4.2.Market Growth Challenges |

|

4.2.1.Insufficient Availability of Qualified Workforce |

|

4.2.2.Apprehensions Regarding Data Security |

|

4.3. Market Growth Opportunities |

|

4.3.1.Rising Internet Proliferation and Growing Usage of Connected and Integrated Technologies |

|

4.4.Pestle Analysis |

|

4.5.Porter’s Five Forces Analysis |

|

5.Market Outlook |

|

5.1.Overview (Industry Snapshot) |

|

5.2.Technology Roadmap |

|

5.3.Value Chain Analysis |

|

5.4.Supply Chain Analysis |

|

5.5.Pricing Analysis |

|

5.6.Regulatory Landscape |

|

6.Market Segment Outlook (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

6.1.Segment Synopsis |

|

6.2.By Components |

|

6.2.1.Software |

|

6.2.1.1.Integrated |

|

6.2.1.2.Standalone |

|

6.2.2.Services |

|

6.2.2.1.Managed Services |

|

6.2.2.2.Professional Services |

|

6.2.2.2.1.System Integration |

|

6.2.2.2.2.Support and Maintenance |

|

6.2.2.2.3.Consulting |

|

6.3.By Deployment |

|

6.3.1. Cloud |

|

6.3.1.1.Public |

|

6.3.1.2.Private |

|

6.3.1.3.Hybrid |

|

6.3.2.On-premise |

|

6.4.By Organization Size |

|

6.4.1.Large Enterprise |

|

6.4.2.Small and Medium-Sized Enterprises (SMEs) |

|

6.5.By Monitoring Technique |

|

6.5.1.Power System Assessments |

|

6.5.2.Infrared Thermography |

|

6.5.3.Temperature Monitoring |

|

6.5.4.Fluid Analysis |

|

6.5.5.Circuit Monitor Analysis |

|

6.5.6.Vibration Monitoring |

|

6.5.7.Others |

|

6.6.By End-use Industry |

|

6.6.1.Automotive |

|

6.6.2.Healthcare |

|

6.6.3.Manufacturing |

|

6.6.4.Energy & Utility |

|

6.6.5.Transportation |

|

6.6.6.Aerospace & Defense |

|

6.6.7.Other |

|

7.Regional Outlook |

|

7.1.Global Market Synopsis |

|

7.2.North America (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.2.1.North America AI-based Predictive Maintenance Market Outlook |

|

7.2.1.1. US AI-based Predictive Maintenance Market, By Components |

|

7.2.1.2. US AI-based Predictive Maintenance Market, By Deployment |

|

7.2.1.3. US AI-based Predictive Maintenance Market, By Organization Size |

|

7.2.1.4. US AI-based Predictive Maintenance Market, By Monitoring Technique |

|

7.2.1.5. US AI-based Predictive Maintenance Market, By End-use Industry |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.2.Canada |

|

7.3.Europe (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.3.1.Europe AI-based Predictive Maintenance Market Outlook |

|

7.3.2.Germany |

|

7.3.3.UK |

|

7.3.4.France |

|

7.3.5.Spain |

|

7.3.6.Italy |

|

7.4.Asia-Pacific (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.4.1.Asia-Pacific AI-based Predictive Maintenance Market Outlook |

|

7.4.2.China |

|

7.4.3.India |

|

7.4.4.Japan |

|

7.4.5.South Korea |

|

7.4.6.Australia |

|

7.5.Latin America (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.5.1.Latin America AI-based Predictive Maintenance Market Outlook |

|

7.5.2.Mexico |

|

7.5.3.Brazil |

|

7.6.Middle East and Africa (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.6.1.Middle East and Africa AI-based Predictive Maintenance Market Outlook |

|

7.6.2.Saudi Arabia |

|

7.6.3.UAE |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Volume Output Analysis |

|

8.3.Company Strategy Analysis |

|

8.4.Competitive Matrix |

|

9.Company Profiles |

|

9.1.ABB |

|

9.1.1.Company Synopsis |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.Analyst Perception |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.2.AWS |

|

9.3.C3.AI |

|

9.4.Dingo |

|

9.5.General Electric |

|

9.6.Honeywell |

|

9.7.IBM |

|

9.8.Microsoft |

|

9.9.PTC |

|

9.10.SAP |

Let us connect with you TOC

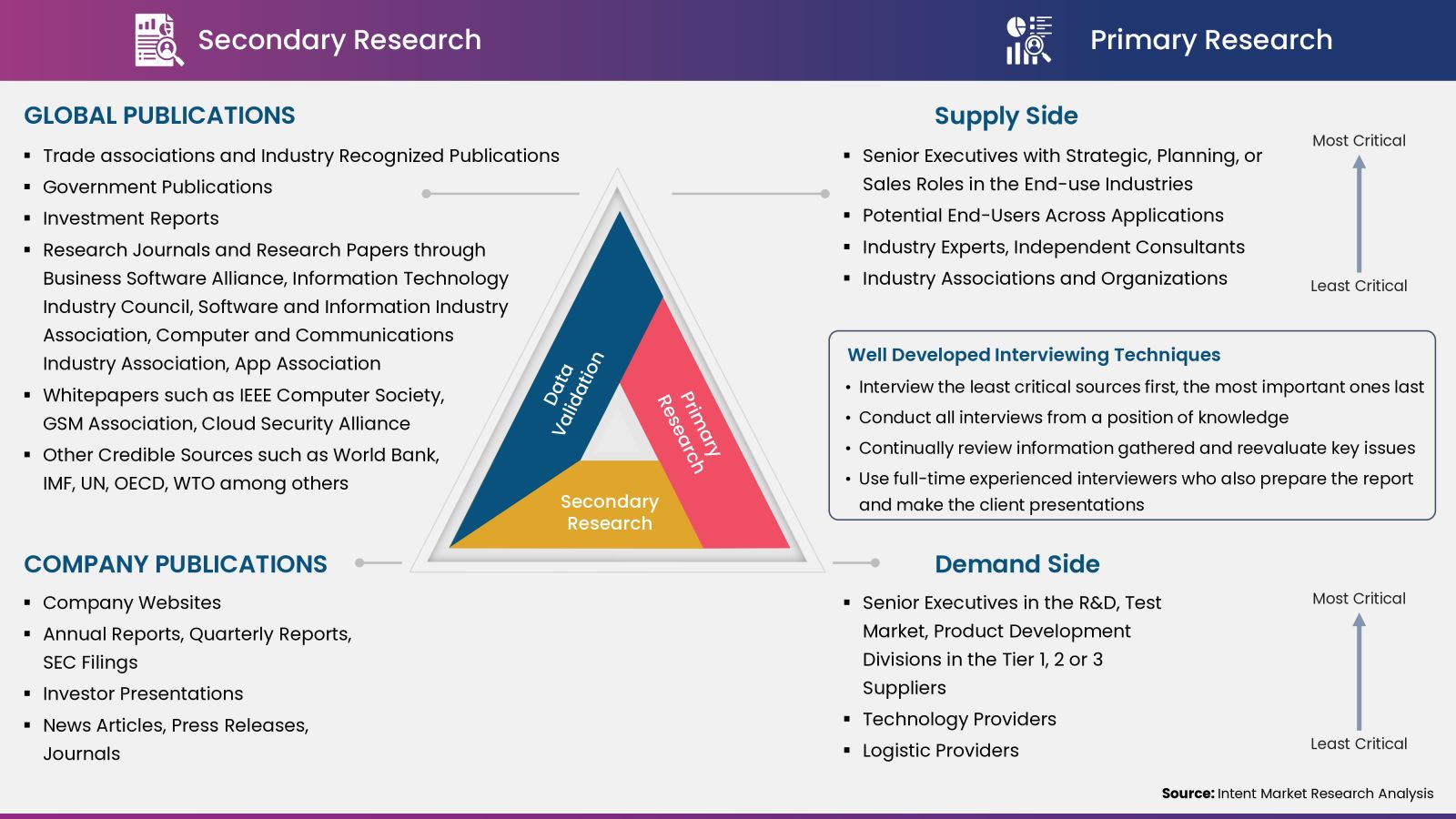

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

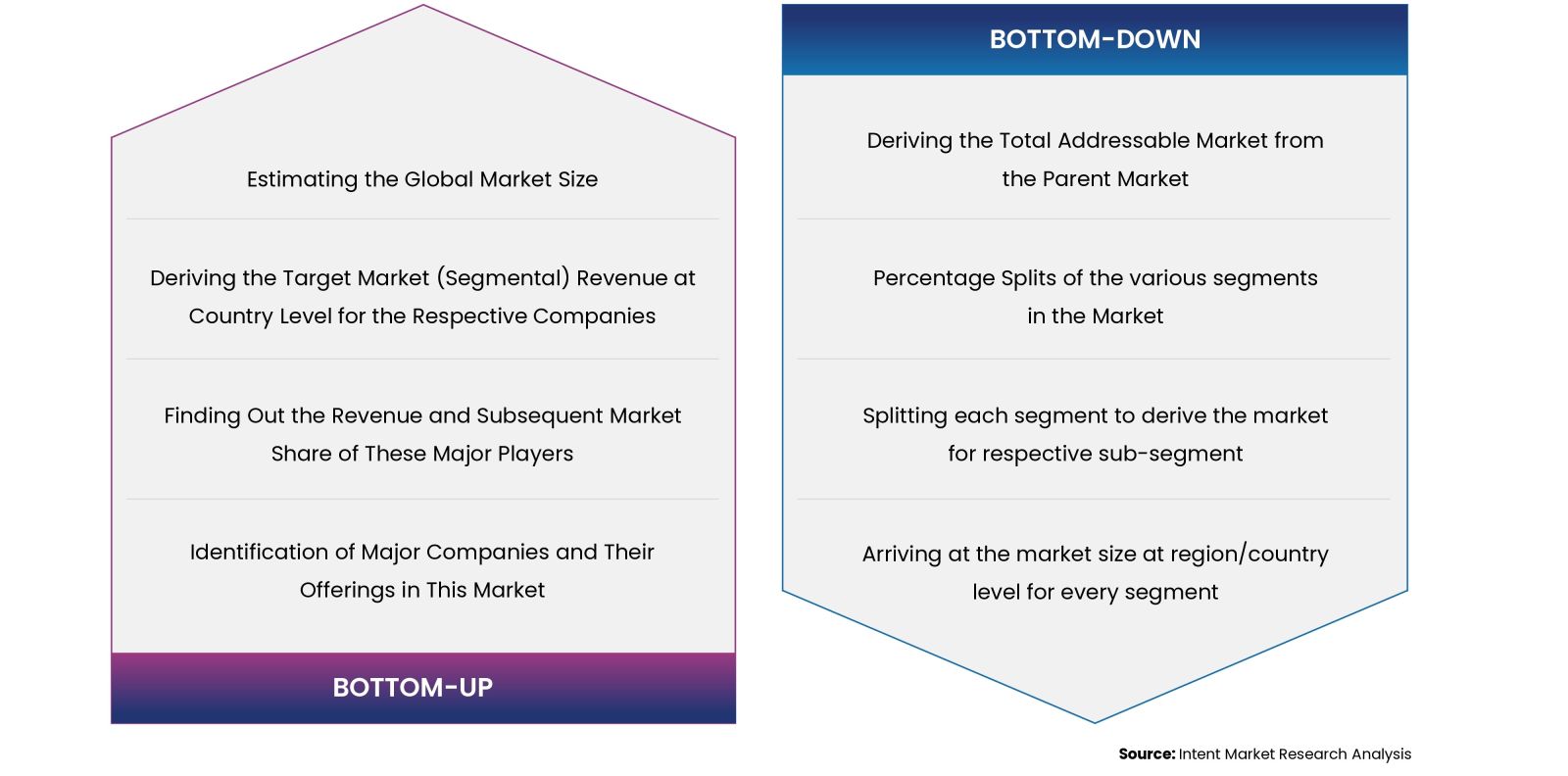

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

Available Formats